Institutional Buying Boosts GBTC Amid Hopes for BlackRock’s U.S. Bitcoin Spot ETF

On June 17, data from monitoring resource CoinGlass revealed that the Grayscale Bitcoin Trust (GBTC) came close to reaching new highs for the year 2023. The GBTC, a prominent investment vehicle for Bitcoin, demonstrated significant upward momentum in its price, reflecting growing interest and potential optimism in the market.

The price of Bitcoin (BTC) witnessed a decrease of $26,527 as BlackRock’s plans emerged, but the news seemed to ignite a rally in the original institutional Bitcoin investment vehicle. The BTC ticker experienced a dip in its value, reflecting the market’s initial response. However, the announcement of BlackRock’s involvement sparked renewed interest and enthusiasm among institutional investors, leading to a resurgence in the Bitcoin market. The “OG” institutional BTC investment vehicle, commonly referred to as the Grayscale Bitcoin Trust (GBTC), benefited from this renewed buying activity and witnessed a positive upward trend.

GBTC “Premium” Plunges Below -37%

The Bitcoin market sentiment experienced a slight boost towards the end of last week, driven by the news of BlackRock, the world’s largest asset manager, filing for the launch of a Bitcoin spot price exchange-traded fund (ETF). The announcement generated optimism among investors and contributed to a modest improvement in the overall sentiment surrounding Bitcoin.

Also Read: BlackRock’s Bitcoin ETF Filing: A Game-Changer for the Crypto Industry

Although not yet permitted in the United States, experts believe that a spot ETF backed by a reputable entity like BlackRock has a stronger likelihood of overcoming the existing legal hurdles. Meanwhile, positive indications beyond mere sentiment are emerging, as the Grayscale Bitcoin Trust (GBTC) continues to trade at a significant discount compared to the BTC spot price, which is steadily rising.

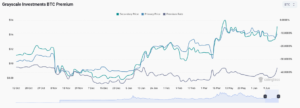

Based on CoinGlass data, the negative “premium” that has typically been associated with GBTC share prices currently stands at -36.6%. Despite still being significantly discounted, GBTC is now trading closer to zero than it has been for most of this year. Just a few days ago, on June 13, the discount was even more pronounced, nearing -44%.

GBTC premium vs. asset holdings vs. BTC/USD chart (screenshot). Source: CoinGlass

Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, expressed his belief on Twitter that if the BlackRock ETF receives approval, the ultimate beneficiary will be GBTC. Cochran highlighted that BlackRock’s approval would pave the way for conversion and lead to the resolution of GBTC’s significant discount of over 40%, alongside the growth of the industry as a whole.

Cochran expressed his optimism regarding the regulatory approval chances of BlackRock’s offering, noting that it has a “good odds” due to its distinct structure and the involvement of a formidable entity. He highlighted the unique features of the offering, such as being a ’30 act redeemable trust with redemptions (unlike GBTC), along with a proposed rule change filing. Cochran emphasized that BlackRock is actively engaging and prepared for the competitive landscape.

ARK Holding Out as Latest Buyers Emerge

The BlackRock move has generated its own share of controversy, as market commentators engage in debates over its classification as an ETF. Opinions diverge, with some arguing that it will resemble a Trust similar to GBTC, while others, like Cochran, take a more nuanced perspective on the matter. The discussions highlight varying interpretations and viewpoints surrounding the nature of BlackRock’s offering.

I’m a skeptic and a pessimist and even I think the Blackrock ETF filing has good odds.

Very different structure than other efforts by a behemoth who doesn’t lose.

‘30 act redeemable trust w/ redemptions (unlike GBTC) + proposed rule change filing.

They came to play.

— Adam Cochran (adamscochran.eth) (@adamscochran) June 16, 2023

Cory Klippsten, CEO of Bitcoin financial services firm Swan, simplifies the debate by stating, “IT’S OK TO CALL IT AN ETF GUYS.” Klippsten highlights that the filing under Form S-1, rather than Form N-1A, sets it apart from the majority of stock ETFs. He emphasizes that it will trade on an exchange and offer redemption to the issuer, making it a superior option compared to GBTC. The focus now shifts to the SEC’s decision on approving BlackRock’s spot Bitcoin ETF.

Amidst the developments, investor interest in GBTC is on the rise. Notably, hedge fund North Rock Digital has been actively accumulating more of the Grayscale trusts in recent weeks. Following BlackRock’s announcement, the hedge fund expressed its optimism, stating that the risk-reward ratio appears highly favorable at current levels. They anticipate a 50% upside potential if Grayscale emerges victorious, while the downside risk remains minimal in case of a loss. North Rock Digital views the BlackRock filing as a potential catalyst that could drive the GBTC premium to converge towards more rational levels.

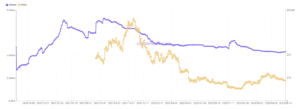

ARK Invest, a major holder, has not yet increased its exposure, maintaining a steady holding of approximately 5.37 million GBTC shares. Data from Cathie’s ARK, a tracking website dedicated to ARK Invest CEO Cathie Wood, confirms a gradual decline in their GBTC holdings throughout 2023. Despite the evolving landscape, ARK Invest has not made significant adjustments to its GBTC position.

ARK Invest GBTC holdings chart (screenshot). Source: Cathie’s ARK

Also Read: Valkyrie Bitcoin Futures ETF Inspired by TradFi Memes

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.

Follow Cryptos Headlines on Google News

Join Cryptos Headlines Community