A new study finds that cryptocurrency markets in the U.S. and Europe are still doing well, even though they face a lot of questions and uncertainty in the U.S.

The study by Coalition Greenwich and Amberdata shows that asset managers and hedge funds are feeling positive and excited about cryptocurrency. They’re not just hopeful about its potential to grow; they’re also looking for ways to make money from it.

These financial experts see cryptocurrency as a good way to make their portfolios bigger and more diverse. They’re not just watching from the sidelines; they’re getting involved to take advantage of the opportunities in the cryptocurrency world.

Source: greenwich

Increasing Adoption of Cryptocurrency

A recent research project by Coalition Greenwich, a well-known company in the financial services sector, along with Amberdata, a leading blockchain and crypto data firm, uncovered a noteworthy trend. It turns out that a significant 48% of asset management institutions are actively managing cryptocurrency assets for their clients.

What’s surprising is that these institutions remain positive and hopeful about cryptocurrencies, even when the overall market sentiment is not so good.

The study, titled “Digital Assets: Managers Fuel Data Infrastructure Needs,” looked into how these institutions are adding digital asset services to what they offer, like how they work with clients, their investment products, and the technology they use, all to meet their clients’ needs.

The study found that 24% of asset management companies already have a plan for digital assets, and another 13% plan to have one in the next two years.

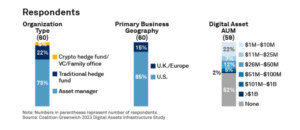

They also surveyed 60 companies in three different places, and 25% of them currently have managers and teams for digital assets. It’s expected that this number will go up by about a third in the next year as more companies want to do more in this area.

Expanding Interest in Digital Assets Across Countries

The crypto market is strong and has support from different places like Dubai, Singapore, Switzerland, the US, and the United Kingdom. Financial institutions are looking into tokenizing assets, and having secure storage for these assets is very important.

The competition is changing, and it’s more about data, analytics, and tools for professionals who want to make more money. In the next 6-12 months, there will be more investments in crypto data and portfolio management, which shows that the industry is ready for what’s coming next.

About 52% of institutions that don’t offer crypto services say it’s because of the rules. They point to things like how cryptocurrencies are different, confusing tax rules, worries about safety, and issues with knowing who the customer is.

Asset managers think the market will grow in the next five years, which is the same as what people who work with digital assets have said before. About 85% of people who work for institutions think that the US Securities and Exchange Commission will change how they do things and make it easier to do business in the next few years.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News