In the last day, Hedera Hashgraph (HBAR) had a wild ride due to confusion and too much optimism. Yesterday, it shot up by over 105% in trading but then quickly dropped by more than 20%. This morning, it continued to fall, losing over 26% of its value. This rollercoaster could give critics more reasons to doubt cryptocurrencies.

Today, Hedera’s price started higher than yesterday’s opening, at $0.156441 compared to $0.090412. However, it quickly fell from its peak of $0.18025 earlier in the day to $0.132002 at the time of writing, marking a steep decline of over 26% in just a short period. But what caused this sudden drop?

Confusion Surrounds Hedera’s Announcement on BlackRock MMF Tokenization

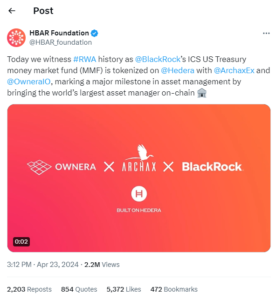

The HBAR Foundation sparked widespread interest on social media when it posted about BlackRock’s ICS US Treasury money market being tokenized on Hedera.

This announcement, hailed as a significant milestone in asset management, garnered over 2 million views within hours. However, some misinterpreted the message, believing that BlackRock had chosen to tokenize its money market fund directly on the Hedera blockchain.

In reality, BlackRock was not directly involved in tokenizing its MMF on Hedera. Instead, the Twitter post referred to the availability of BlackRock MMF shares as tokenized assets on platforms like Archax and Ownera, in addition to Hedera.

Archax clarified this aspect in a blog post the same day, stating that they were expanding their offerings to include the BlackRock ICS US Treasury money market fund as a tokenized asset available on their platform and connected networks.

Social Media Reacts to HBAR Foundation’s Ambiguous Announcement

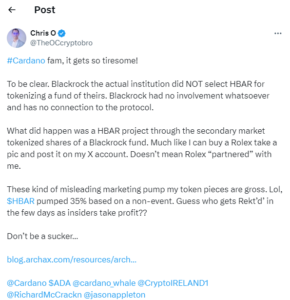

The HBAR Foundation’s announcement regarding the tokenization of BlackRock’s ICS US Treasury money market fund on Hedera sparked criticism and confusion on social media platforms. Many users, like Chris O (TheOCCryptobro), clarified that BlackRock itself was not directly involved in the tokenization process and had no affiliation with the Hedera protocol.

Chris O explained that the tokenization of the BlackRock fund on Hedera was initiated by a project within the HBAR community, similar to an individual purchasing a Rolex and sharing a photo on social media without implying a partnership with the luxury brand.

Hedera’s Volatility Fuels Anti-Crypto Sentiment

The recent rollercoaster ride experienced by Hedera Hashgraph (HBAR) has provided ammunition to anti-cryptocurrency voices, including prominent figures like Jamie Dimon, regulators, and Federal Reserve presidents. The sharp fluctuations in HBAR’s price, driven by misleading information and non-events, exemplify the type of instability that critics often associate with blockchain technology and cryptocurrencies.

Hedera’s rapid surge, followed by a steep decline within a short timeframe, underscores the perception of volatility without a solid foundation. This episode feeds into the narrative propagated by detractors, who argue that cryptocurrencies and decentralized finance (DeFi) lack stability and reliability, making them unsuitable for widespread adoption.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News