Ethereum’s largest scaling solution, Polygon, announced that the long-awaited migration of its MATIC token to POL will take place on September 4.

On the same day, user activity on the Layer-2 (L2) network plummeted to multi-month lows.

Polygon Users Observe from the Sidelines

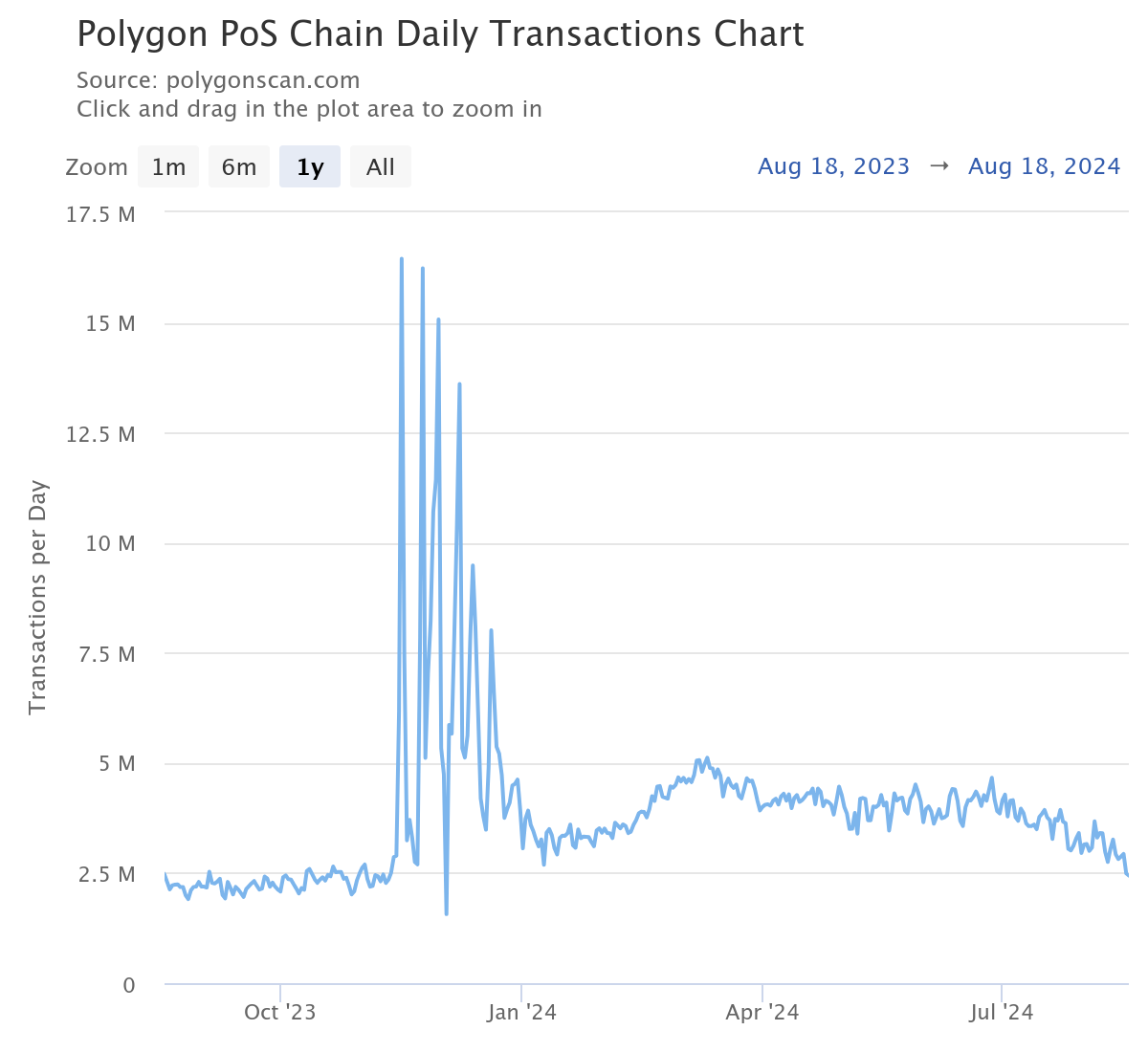

Polygonscan’s data show that on Sunday, the total number of transactions recorded on the Polygon Proof-of-Stake (PoS) chain was 2.44 million, representing the L2’s lowest since December 2023.

When a network sees a decline in transaction count, it suggests fewer users are active. In Polygon’s case, uncertainty surrounding MATIC’s upcoming migration to POL may be causing users to delay transactions until the transition is complete.

MATIC’s muted price performance reflects the network’s recent drop in activity, with the altcoin trading at $0.41, up just 3% in the last 24 hours. Despite a 27% increase in trading volume, totaling $142 million, uncertainty surrounding MATIC’s transition to POL has contributed to the slowdown.

However, Polygon’s DeFi sector remains resilient. On Sunday, both the network’s total value locked (TVL) and trading volume on decentralized exchanges (DEXes) saw a notable spike, signaling continued interest despite the broader dip in transaction activity.

Read more: 15 Best Polygon (MATIC) Wallets in 2024

According to Artemis’ data, its TVL rose 5% to $859 million that day. Also, daily trading volume on the DEXes housed within the L2 increased by 21%. As of this writing, Polygon’s daily DEX trading volume is $69 million.

MATIC Price Prediction: Demand Trickles in

Although MATIC has failed to record any considerable surge in value post-Polygon announcement, there has been a notable spike in buying activity on its 12-hour chart. As of this writing, the token’s Relative Strength Index (RSI) is in an uptrend and is poised to cross above the 50-neutral line.

This attempt to cross the center line indicates that buying pressure is increasing. It signals that MATIC is transitioning from a slightly bearish to a more neutral or somewhat bullish momentum.

Read more: Polygon (MATIC) Price Prediction 2024/2025/2030

If this buying pressure gains momentum, the token’s price may rise to a 30-day high of $0.55. However, it may fall to $0.33 if the market trend shifts from positive to negative and selling activity skyrockets.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.