Ripple is actively promoting the XRP Ledger (XRPL) as the ideal blockchain for tokenizing real-world assets (RWA) on an institutional scale. Ripple emphasizes security, scalability, and interoperability, positioning itself as a dependable platform for decentralized finance (DeFi) and managing tokenized assets.

In a recent exclusive interview with BeInCrypto, Ross Edwards, Senior Director for Solutions and Delivery at Ripple, offers insights into why the XRPL is uniquely positioned to bridge traditional finance with DeFi.

Instant Settlement, Stability, and Lower Risk: Why XRPL is Suitable for Financial Institutions

When discussing the XRPL’s role in transforming institutional finance, Ross Edwards was unequivocal about its foundational advantages. He pointed out the unique benefits that make the blockchain stand out for institutions looking to tokenize RWAs.

For Edwards, the key to XRPL’s success lies in its design. For instance, he highlighted that the XRPL’s transaction speed—settling in just 3 to 5 seconds at minimal cost—addresses the high costs and delays often associated with traditional financial systems.

“The XRP Ledger enables instant settlement of value, together with transparency and auditability that can really change the risk profile of transactions,” he explained.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

He also elaborated that the XRPL employs a strong governance mechanism. This allows the community to introduce amendments to meet its needs, including those of financial institutions.

Moreover, it eliminates the need for custom writing, deploying, and managing smart contracts, as well as the associated audits. These functionalities ultimately will reduce risks, which is crucial for financial institutions.

“It was built for creating value and assets on-chain, for holding those securely, for trading and transferring those assets. So, it’s natively built for this. The XRP Ledger is a proven technology. It’s been running for 11 to 12 years. It’s extremely stable. […] You simply have to call the APIs of the XRP Ledger to enable those use cases,” Edwards argues.

Additionally, the Automated Market Maker (AMM) is one of Ripple’s core innovations on the XRPL. This feature, integrated directly into the protocol, allows institutions to engage with DeFi securely without the need for potentially unreliable third-party smart contracts.

What sets the XRPL’s AMM apart is its ability to aggregate liquidity across the protocol. Ripple’s liquidity strategy is specifically designed to meet the needs of institutional users.

By incorporating the AMM into the XRPL’s decentralized exchange (DEX), the process for institutions to participate in DeFi is simplified. Such a mechanism ensures both security and efficiency for large-scale operations.

The XRPL’s AMM is also capable of consolidating liquidity from across the protocol. This system ensures that institutions have access to substantial liquidity pools and can execute transactions at the most favorable prices. Moreover, it effectively minimizes slippage—a significant concern for institutions executing large transactions—and guarantees continuous liquidity for trading purposes.

Additionally, the introduction of the Multi-Purpose Token (MPT) standard will allow institutions to create complex token structures representing various asset classes. Set for release in Q3, MPT will provide greater flexibility for institutions looking to tokenize and manage diverse portfolios of assets on the XRPL.

Ripple is also looking to expand the use of the XRPL for institutional DeFi with the upcoming launch of Ripple USD (RLUSD), a fully-backed stablecoin pegged to the US dollar. Edwards sees this stablecoin as a significant step toward improving liquidity and cross-border transactions for institutions using the XRPL.

“If you’re going to work in the real-world asset tokenization space, stablecoins are a must-have. It’s going to continue to grow in importance, not just importance in the crypto world but actually importance in the financial world. And that’s why Ripple believes that issuing Ripple USD will add to the existing stablecoins out there. They will suit specific institutions and specific use cases and really help fuel or continue the growth of tokenization overall,” he said.

Leveraging DIDs and Strategic Partnerships for Growing Impact in Tokenized Assets

Besides solid infrastructure and technologies, security and compliance are paramount for institutions, especially in tokenized assets. In a prior conversation with BeInCrypto, Ripple’s Markus Infanger, Senior Vice President of RippleX, highlighted how the XRPL leverages Decentralized Identifiers (DID) to address these concerns effectively.

By integrating DIDs, the XRPL enables institutions to securely and verifiably manage user identities, facilitating compliance with Know Your Client (KYC) and Anti-Money Laundering (AML) standards. This integration helps minimize the risks of fraudulent transactions by streamlining KYC/AML processes. As a result, it enhances both security and regulatory adherence for tokenized asset transactions.

“The combination of these features, as well as others proposed to support institutional DeFi on the XRPL, such as a native Lending Protocol and Oracles, are making it easier to integrate tokenized real-world assets into on-chain financial infrastructure. Ultimately, DeFi provides new financial rails for actions such as trading, collateralizing, investing, and borrowing. Bringing real-world assets on-chain and exposing them to these rails opens up new opportunities—which is the real value of tokenizing real-world assets,” Infanger elaborated.

The increasing use of the XRPL in institutional finance stands out through its partnerships with key industry players. For example, Ripple’s partnership with OpenEden led to the introduction of tokenized US treasury bills (T-bills) on the XRPL.

Similarly, Ripple has partnered with Archax, the UK’s first regulated digital asset exchange, broker, and custodian. Archax plans to bring hundreds of millions of dollars in tokenized RWAs onto the XRPL in the coming year.

Balancing Short-Term Gains and Long-Term Growth in Tokenization

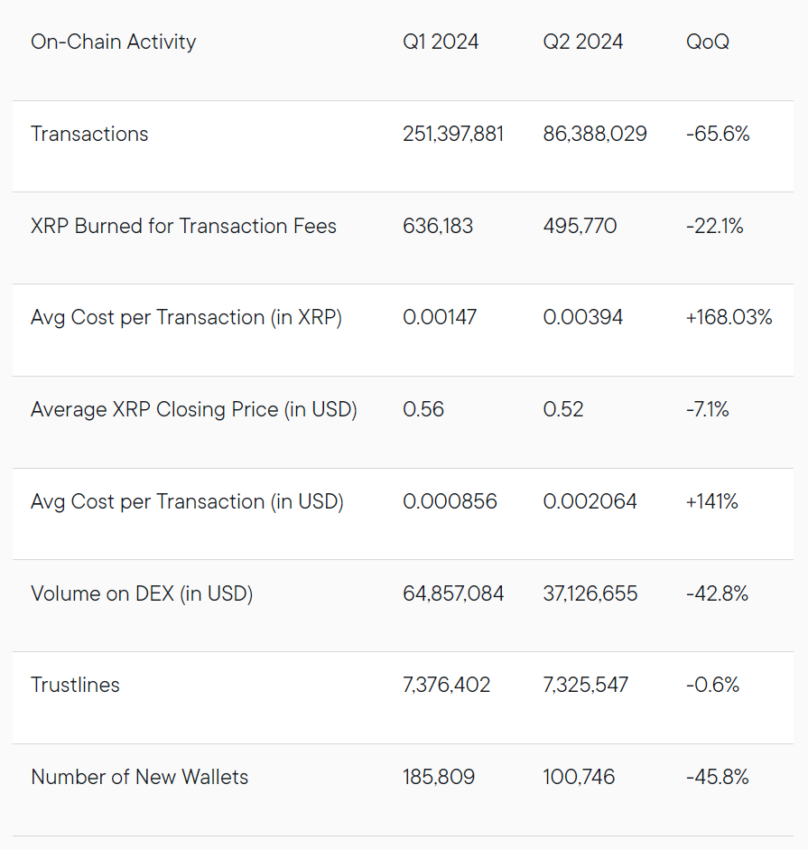

Despite the XRP Ledger’s strong foundation for institutional adoption, it has faced some challenges, particularly in on-chain activity. A recent report revealed that in the second quarter of 2024, the number of transactions on the XRPL fell by over 65% compared to the first quarter. This decrease is also seen in transaction volumes and overall DEX engagement, where trading volume fell by nearly 43%.

The average transaction cost on the XRPL also increased substantially. In Q2, the cost of transactions more than doubled compared to Q1, rising by 168%, which could contribute to the drop in activity. Additionally, fewer new wallets were created on the network, with wallet growth decreasing by 45.8%.

Furthermore, Edwards remarked that the challenges of tokenization are beyond the XRPL itself. He acknowledged that one of the biggest challenges in tokenization is its long-term nature. According to him, this requires patience and gradual ecosystem building.

“Tokenization is not something that can be done instantly. It’s not dependent on someone’s decision or ability to take an asset, write a piece of code, and store it somewhere, even if it’s a blockchain or whatever. That’s actually a very simple process. It’s about building the ecosystem and connecting together these value chains,” he said.

Edwards emphasized that financial institutions need immediate, tangible returns. This means each step in the tokenization process must deliver short-term value while setting the foundation for long-term growth.

He also noted that this requirement is a delicate balancing act that Ripple and the broader industry must navigate carefully. Furthermore, Edwards highlighted that financial institutions must play a key role in getting this balance right, as their participation is critical for the success of the tokenization ecosystem.

Read more: RWA Tokenization: A Look at Security and Trust

However, in the near term, Edwards believes that increasing demand and understanding the drivers behind tokenization will be essential. As the utilization of tokenized assets grows—moving beyond just purchasing and holding to broader use cases—the market will start to expand swiftly.

“We’re going to see, once that happens and unlocks, once there’s more utilization of these tokenized assets, rather than just purchase and hold, we’re going to start to see this area ramp up considerably. And it’s going to become critical to the future of the financial system,” he concluded.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.