Many consumer rights protection firms, cybersecurity firms, blockchain analysis firms, and other such firms have helped global regulators identify and dismantle fraudulent schemes and bogus crypto-based companies.

According to recent information, the founder of IcomTech, a fraudulent “Ponzi,” has been jailed for 10 years by the court. IcomTech was founded by David Carmona, who is facing conspiracy charges for committing wire fraud.

In a statement, Damian Willams, the U.S. attorney, said, “David Carmona mastermind behind the IcomTech cryptocurrency Ponzi scheme, which preyed upon working-class people by promising them complete financial freedom in exchange for parting with their hard-earned money.”

The attorney argued that in reality, IcomTech was not doing such a thing and was lying to its investors, and when the scheme came crashing down the victims were left with nothing.

With 10 years in prison, he was also sentenced to 3 years of supervised release.

Other Crypto Market News Updates

Earlier on September 28, 2024, it was reported that the CEO of Zort, a crypto-based platform, Adam Iza, was arrested over charges of extortion, conspiracy, and tax evasion.

On August 21, 2024, it was reported that the ex-CEO of the failed Heartland Tri-State Bank was sentenced to over 24 years in prison for embezzling more than $47 million in a fraudulent crypto scheme.

The Wall Street Journal reported in July 2024 that U.S. authorities have filed criminal and civil charges against BitClout founder Nader Al-Naji, alleging he defrauded investors.

BitClout was portrayed as a cryptocurrency trading and social-media platform; however, its founder was later detained and presented in front of a magistrate judge in California.

In April 2024, the founder and former CEO of Binance, Changpeng Zhao, was arrested by the Department of Justice for violating the Bank Secrecy Act. Bloomberg wrote citing a spokesperson for the Bureau of Prisons on September 27, 2024, that CZ was released from a correctional facility in California.

Crypto Market Price Updates

At the time of writing, the cryptocurrency market capitalization was $2.16 trillion, with a surge of 1.90% in the past 24 hours; at the same time, the fear and greed index was at 41, determining neutrality in the market.

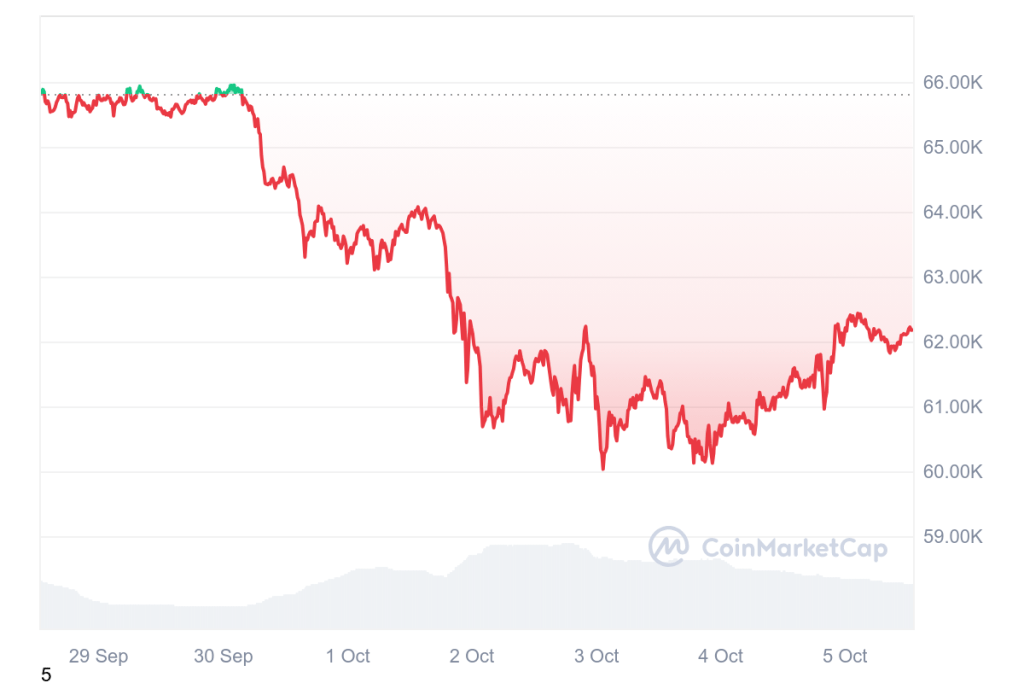

Until publishing, Bitcoin was trading at $62,320, adding 1.74% intraday despite a surge in price; its trading volume fell over 20%, reaching $27,289,469,033. It is speculated that the announcement of the nearing election result in the U.S. fuels the positivity in the trading price of the leading cryptocurrencies.

However, the exact date hasn’t been disclosed, but the results are expected in the next month. The Ethereum trading price crossed the mark of $2,300; as of writing, it was trading at $2,425, surging 2.13% in the past 24 hours.

Memecoin remains one of the most traded in the market; the intraday gainers’ list has been ruled by Popcat (POPCAT), surging 23.45%, reaching $1.23, followed by Bittensor (TAO) trading at $588.25, Wormhole (W) at $0.3515 growing 11.74% and Dogwifhat (WIF) at $2.37 growing 10.28%.

FTT token native of FTX lost 9.00% in the past 24 hours, reaching $2.35, making it the leader of intraday losers, followed by Stacks, Tron, EigenLabs, and Kaspa.