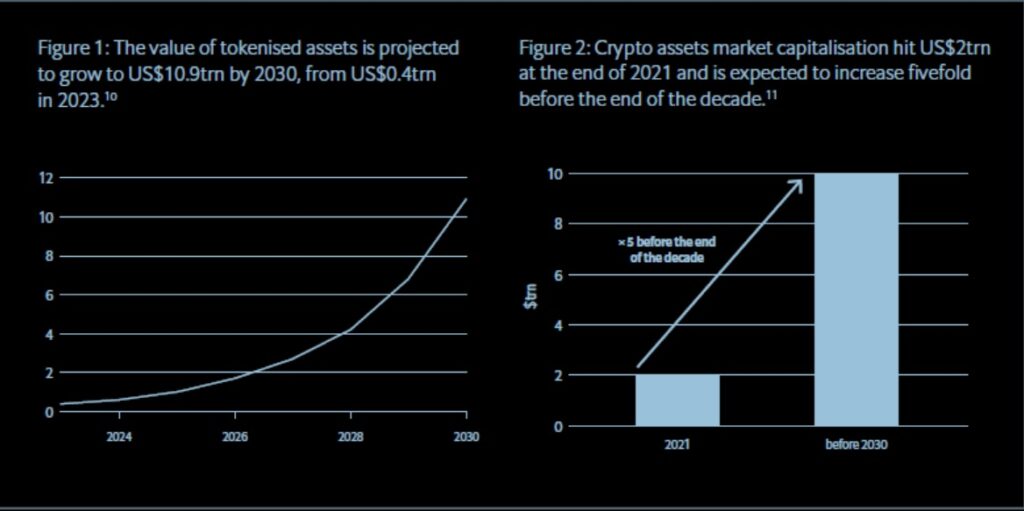

As digital assets rapidly gain traction, they are no longer the domain of retail investors and crypto enthusiasts alone. A new research brief commissioned by OKX and authored by Economist Impact highlights a significant shift in institutional sentiment towards digital assets, positioning them as a promising addition to institutional portfolios. This trend marks a new era for digital assets, underscored by the growing integration of cryptocurrencies, non-fungible tokens (NFTs), and tokenized real-world assets into institutional investment strategies.

Institutional Interest in Digital Assets on the Rise

The research brief reveals that institutional investors are increasingly recognizing digital assets as an inevitable component of their portfolios. With advancements in blockchain technology, enhanced security infrastructure, and a gradual move towards global regulatory clarity, digital assets are becoming a staple in institutional investment strategies.

A key finding from the research is that institutional investors currently allocate between 1% to 5% of their portfolios to digital assets, a figure expected to rise to 7.2% by 2027. This increase reflects a broader acceptance of digital assets as a diversified investment class, particularly as traditional and crypto hedge funds, asset managers, and financial institutions begin to ramp up their exposure.

Key Considerations for Institutional Investors

The report identifies four crucial areas that institutional investors need to focus on when considering digital assets:

- Asset Allocation:

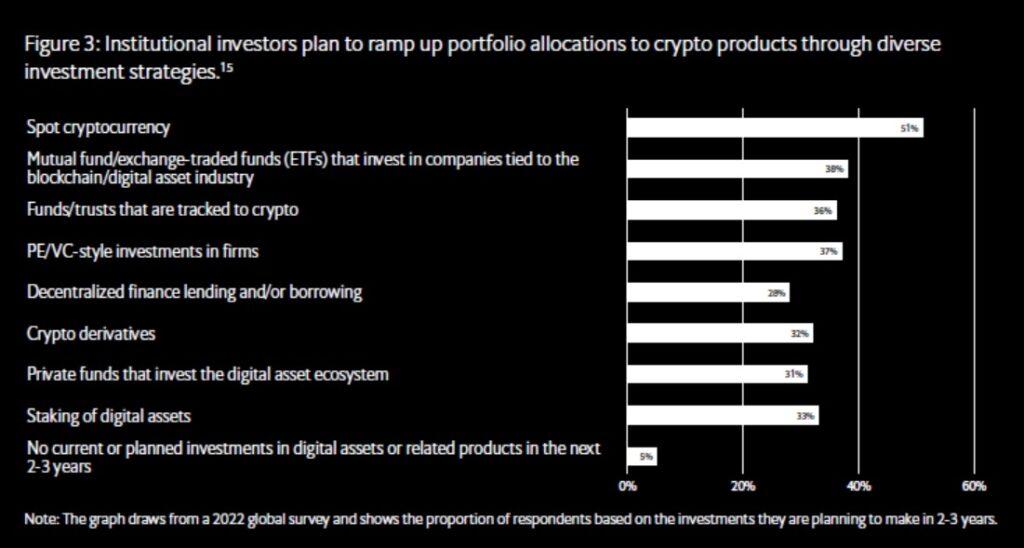

Digital assets are increasingly viewed as valuable additions to diversified portfolios due to their low correlation with traditional asset classes like equities and fixed income. This makes them an attractive hedge against market volatility and inflation. Notably, 69% of institutional investors surveyed anticipate increasing their allocations to digital assets over the next two to three years. Investment strategies range from spot crypto allocations and staking of digital assets to crypto derivatives.

- Custody Solutions:

As digital assets reside exclusively in the online realm, they are subject to various risks, including cyberattacks and technological failures. The rise of institutional-grade custodians is crucial in mitigating these risks. The digital asset custody market is projected to grow at a compound annual growth rate of over 23% through 2028, with 80% of traditional and crypto hedge funds utilizing third-party digital asset custodians. This trend underscores the importance of robust custody solutions tailored to the unique needs of institutional investors.

- Regulatory Development:

The evolving regulatory landscape is pivotal to the broader adoption of digital assets. Regulatory frameworks such as Europe’s Markets in Crypto-Assets (MiCA) regulation are creating pathways for digital asset adoption across borders. Exchanges and custodians must remain adaptable to local regulatory requirements while maintaining market integrity. The brief highlights that stablecoin regulation is a key area of focus, with some jurisdictions already establishing regulatory sandboxes to explore the potential of these assets.

- Risk Management:

Effective risk management is essential for integrating digital assets into institutional portfolios. The adoption of technologies like proof-of-reserves and independent third-party audits can significantly enhance trust among institutional investors. Moreover, traditional financial risk management strategies, such as value-at-risk models and scenario analysis, are being adapted to address the unique risks associated with digital assets. These measures are critical for safeguarding institutional investments in this rapidly evolving market.

A Growing Institutional Opportunity

The research underscores that digital assets are on the cusp of becoming a mainstream component of institutional portfolios. The expanding ecosystem of market participants, including custodians, exchanges, and regulators, is unlocking new opportunities for institutional investors. As these players continue to refine their offerings and build trust within the market, digital assets are set to play a more prominent role in the global financial landscape.

OKX’s Chief Commercial Officer, Lennix Lai, emphasized the significance of this trend, stating, “This initiative to engage with the world’s leading institutional investors demonstrates how digital assets are rapidly being adopted in investment portfolios. This trend will only intensify if we see advancements in blockchain technology, enhanced regulatory clarity, and uptake of innovative digital solutions like tokenized real-world assets.”

The convergence of traditional finance and digital assets is ushering in a new era of investment opportunities. As institutional investors continue to explore the potential of digital assets, their focus on asset allocation, custody, regulation, and risk management will be crucial in navigating this dynamic market. The findings from the OKX-commissioned research brief provide valuable insights for institutions looking to capitalize on the growing digital asset market while effectively managing the associated risks.