The price of Ethereum has surged to $2,270, marking its highest point since May 2022. This significant climb is drawing attention from institutional investors who are placing their bets on the cryptocurrency reaching $3,000 by the end of the year.

The renewed interest and investment from institutional players are contributing to Ethereum’s bullish momentum, signaling positive sentiment in the market. Investors are closely watching these developments, anticipating further gains in the coming weeks.

Investors are showing satisfaction with the current performance of major cryptocurrencies, with a focus on leading assets such as Bitcoin and Ethereum. However, this positive sentiment extends beyond these primary tokens to include other top altcoins like Solana, Cardano, Chainlink, Avalanche, Polygon, and several others. The broader cryptocurrency market is witnessing active participation and interest from investors, encompassing a diverse range of digital assets. This collective attention indicates a robust and dynamic environment within the crypto space.

Ethereum Price Rally: Factors and Positive Momentum

Ethereum’s price rally continued over the weekend, extending from the previous week and gaining 3.3% on Monday to reach $2,229. The past 30 days have seen remarkable bullish momentum for the leading smart contracts token, achieving a cumulative ascent of 21%.

Multiple factors contribute to the ongoing rally in Ethereum’s price, with one significant driver being the fear of missing out (FOMO). This sentiment is linked to the anticipated approval of spot Bitcoin exchange-traded funds (ETFs) in the United States.

The crucial ability of Ethereum to maintain higher support levels, starting at $2,000, holds immense importance. This stability not only assures traders of the longevity of the current uptrend but also raises the potential for Ethereum’s price to surge to $3,000 before the close of the year. Investors and market participants are closely monitoring these factors, shaping the positive momentum in Ethereum’s value.

Robust Inflows into Crypto AUM Products Signal Growing Investor Appetite

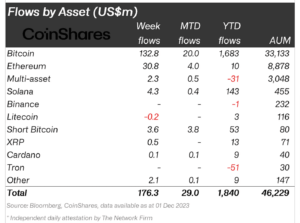

In the past week, weekly inflows into assets under management (AUM) products reached an impressive total of $176 million, as reported by CoinShares. This highlights the increasing risk appetite among investors, marking a 10-week cumulative sum of $1.76 billion—a level not seen since October 2021, coinciding with the launch of Bitcoin futures ETFs in the United States.

Ethereum experienced notable inflows, securing at least $31 million, while Bitcoin led the way with weekly inflows amounting to $133 million. Additionally, investors directed funds into Solana products, contributing to $4.3 million in weekly inflows.

Source: CoinShares

This bullish trend is poised to persist, with more investors directing their attention to the potential impact of Bitcoin spot ETF approval, anticipated possibly in January. The overall positive trajectory of the crypto market further fuels this optimistic outlook, as investors continue to navigate the dynamic landscape of digital assets.

Ethereum’s Uptrend Supported by Strong Technicals and Consolidation

Ethereum maintains its position above a newly established support level at $2,200, consolidating gains from the weekend surge. The Moving Average Convergence Divergence (MACD) indicator has generated a buy signal, reinforcing the current uptrend as momentum behind the token strengthens.

In the event of a correction, robust support is anticipated at $2,100 and $2,000, providing a safety net. However, unless significant developments alter the technical structure, any downturns are expected to be brief, presenting opportunities to accumulate liquidity for potential upcoming breakouts.

Crucial milestones on the horizon include breaking resistance at $2,300 and overcoming the subsequent hurdle at $2,500. The potential for FOMO (Fear of Missing Out) to take hold could propel the price to $3,000, setting the stage for Ethereum to reclaim its all-time highs. Investors and market participants are closely monitoring these key levels as Ethereum navigates its path in the current market conditions.

Ethereum price prediction chart: Source TradingView

Ethereum Maintains Bullish Stance Above Key Moving Averages

Ethereum continues to demonstrate its bullish momentum, securing a position above all three crucial bull market indicators: the 20 Exponential Moving Average (EMA) in blue, the 50-day EMA in red, and the 200-day EMA in purple. This alignment further reinforces the prevailing bullish sentiment in the market.

The Relative Strength Index (RSI) has entered the overbought region, signaling a robust and sustained uptrend. While this suggests a strong market scenario unlikely to experience an immediate reversal, traders are advised to stay vigilant for potential sudden pullbacks. These retracements could be identified if the RSI retreats back into the neutral zone, prompting traders to exercise caution and adjust their strategies accordingly.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News