- A bullish falling wedge pattern appeared on NOT’s price chart

- Technical indicators hinted at an upcoming consolidation phase for the altcoin

Notcoin’s [NOT] performance over the last 24 hours has been impressive, with its value surging by double digits on the charts. Now, although this massive hike can be attributed to bullish market conditions, it has also opened an opportunity for NOT to recover its previous losses.

Notcoin caught investors off guard

CoinMarketCap’s data revealed that Notcoin registered gains of over 10% last week. That’s not all though as the token’s price surged by nearly 15% in the last 24 hours alone. At the time of writing, NOT was trading at $0.007155 with a market capitalization of over $733 million.

Despite the price hike, however, only 479k NOT addresses were in profit, which accounted for 17% of the total number of NOT addresses, as per IntoTheBlock. That being said, the trend can change soon.

Consider this – The altcoin’s meteoric rise pushed its value to a key level. World Of Charts, a popular crypto analyst, also recently shared a tweet highlighting a bullish falling wedge pattern on NOT’s price chart.

This pattern first appeared in June. Since then, NOT has been consolidating inside it. At press time, Notcoin was consolidating in a tight zone and was about to test the resistance of the pattern. In case of a breakout, investors can expect NOT to recover from its previous losses.

Will NOT finally break out?

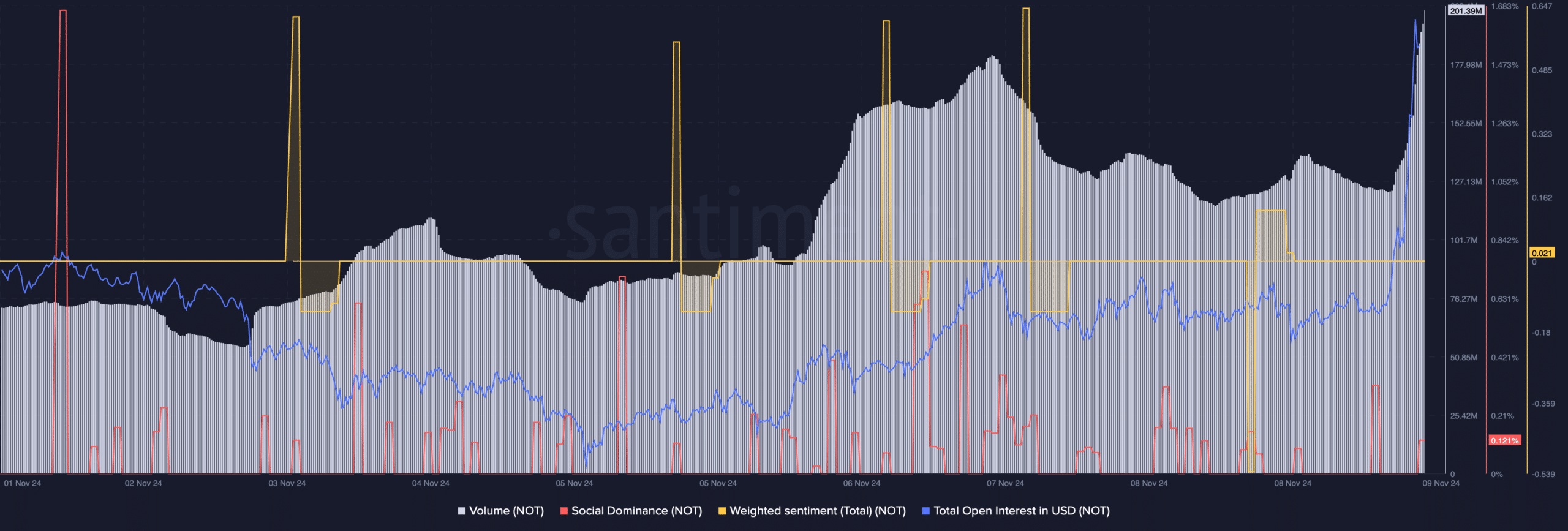

Since the altcoin was about to test a crucial resistance level, AMBCrypto then checked its on-chain data to find out the odds of Notcoin breaking above the pattern. As per our analysis of Santiment’s data, NOT’s social volume dropped significantly last week – A sign of a drop in popularity.

Its weighted sentiment also followed a similar route. This highlighted the dominance of bearish sentiment in the market.

Additionally, we also found that Notcoin’s long/short ratio dropped. This meant that there were more short positions than long positions in the market – A bearish sign.

Nonetheless, not everything was against NOT.

For instance, its trading volume rose along with its price, acting as a foundation for the bull rally. Moreover, its Open Interest also climbed. Whenever the metric rises, it means that the chances of the ongoing price trend continuing are high.

Read Notcoin’s [NOT] Price Prediction 2024–2025

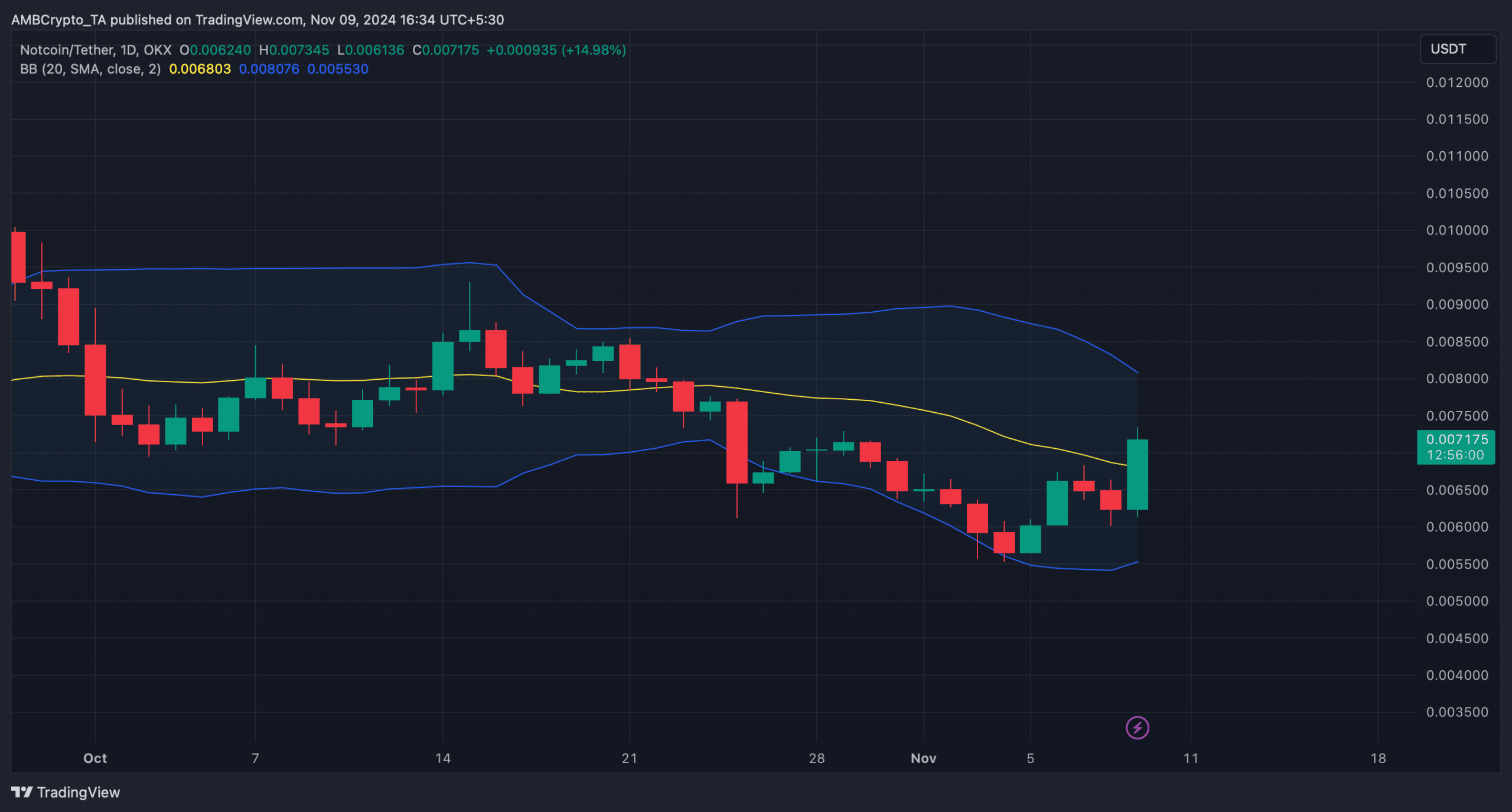

AMBCrypto then checked NOT’s daily chart to better understand which way it was heading in the near term.

We found that NOT managed to go above its 20-day SMA. but the Bollinger Bands pointed to a few upcoming days of consolidation. Therefore, investors should remain patient to see NOT breaking out of the pattern, before recovering its past losses.