- 1INCH bulls show signs of life after retesting a major support level.

- Will low network usage dampen sentiments and affect hopes of a major rally?

1inch [1INCH] extended the gap from its recent lows in the last 24 hours. This was courtesy of the new found excitement related to Trump winning the U.S elections. But will this extended recovery be short-lived or is it the start of bullish times ahead?

1INCH has been struggling to escape its bottom range since August and had given up most of the gains achieved in the last 12 months. However, the bulls attempted another take-over attempt, which yielded a 15% rally from its latest bottom range.

Most of the top cryptocurrencies registered a significant upside in the last 24 hours, courtesy of the hype around Donald Trump winning the U.S elections. It is worth noting that the rally commenced after 1INCH retested a major support line at the $0.22 price level.

The latest bounce back validated the same support system but real question is whether this time it will finally achieve a major rally. Note that 1INCH has ever rallied by over 200% after bouncing off the same support line in September 2023.

It had also demonstrated some consolidation back then.

1INCH on-chain data may not be as convincing

While the token may be demonstrating signs of a potential rally, the 1Inch DeFi platform may not paint a very convincing image in terms of performance. It was once one of the top DeFi platforms but a lot has changed in the last 3 years.

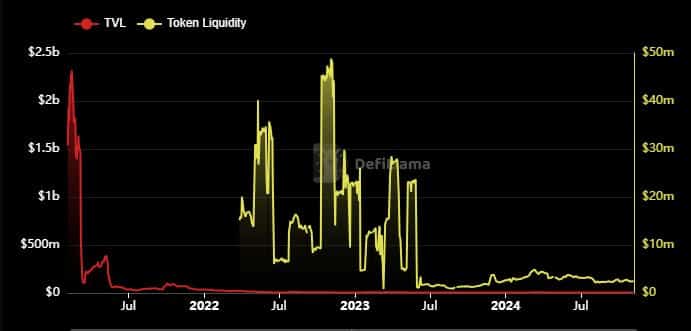

For example, its TVL which was one above $2 billion experienced heavy outflows in 2021 and has never recovered. To put things into perspective, 1inch had a $4.5 million TVL at the time of writing. Token liquidity also took a heavy hit in 2023.

Token liquidity peaked at $48.79 million in November 2022 but has since then dropped to less than $5 million.

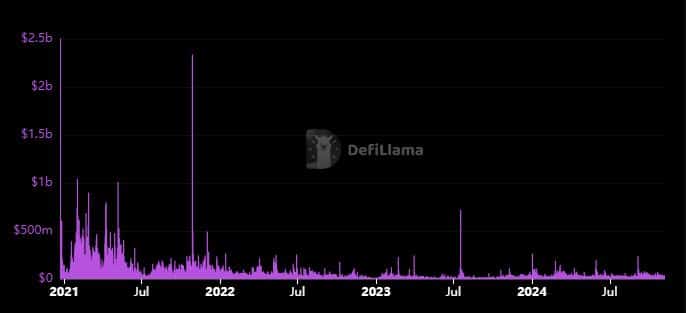

1Inch’s on-chain volume has also struggled to make a comeback. For context, the network averaged well over $100 million in daily on-chain volume between January and May 2021. Achieving such figures has been a tall order since then.

Read 1inch’s [1INCH]Price Prediction 2024–2025

There were isolated incidents where on-chain volume soared above $100 million this year. Even as recent as September. This may indicate that the network could experience a demand resurgence in case the market enters a major rally.

Nevertheless, the data confirms that 1inch has been operating at a fraction of its peak performance. A major reason for this could be the due to growing completion from newer and more efficient DeFi platforms.