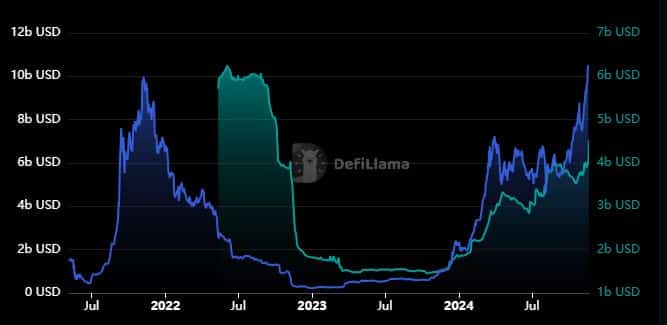

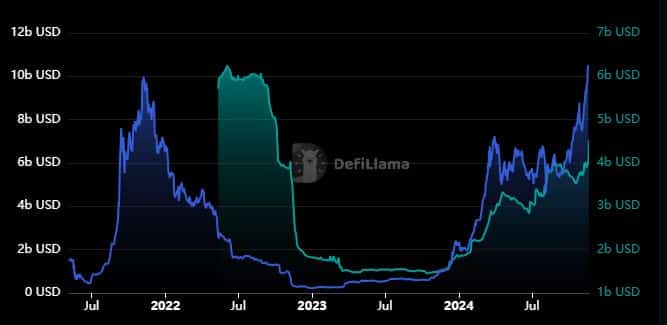

- Solana’s total value locked (TVL) reached a new all-time high of $10.57 billion on November 19, driven by increased DeFi activity.

- Crypto analysts predict further gains for SOL, with potential rallies to $400 during this cycle and long-term targets reaching $4,000 or higher.

After resting under $240 levels for a while, the Solana price has pricked the upward trajectory once again gaining 3.42% and moving to $247 at press time with a market cap of $117 billion. The daily trading volumes have also surged by a staggering 21.4% to $7.97 billion.

After a spectacular rally of 340% since the beginning of 2024 so far, the SOL price has been resting at the crucial resistance zone of $240-$250. Crossing this will put Solana on the trajectory to a new all-time high and eventually surge past $300. Besides, on-chain metrics also support this development as the Solana blockchain is seeing roaring DeFi activity.

Notably, its total value locked (TVL) has not only rebounded to 2021 levels but also reached a new all-time high of $10.57 billion on November 19. The growth trajectory is likely to persist with the recent integration of Sky Protocol’s USDS stablecoin into the Solana ecosystem, a move expected to enhance network liquidity and drive increased DeFi activity, per the CNF report.

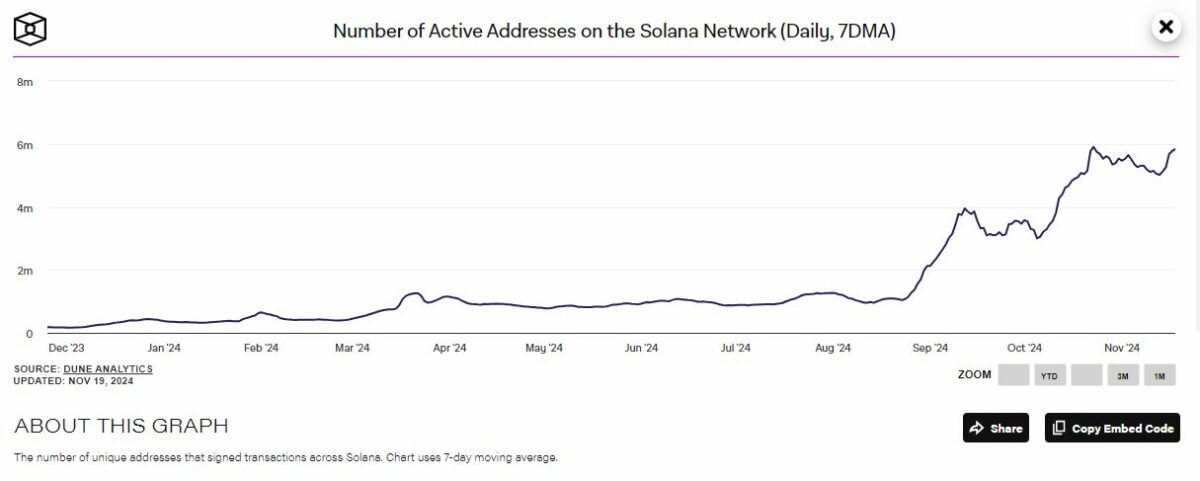

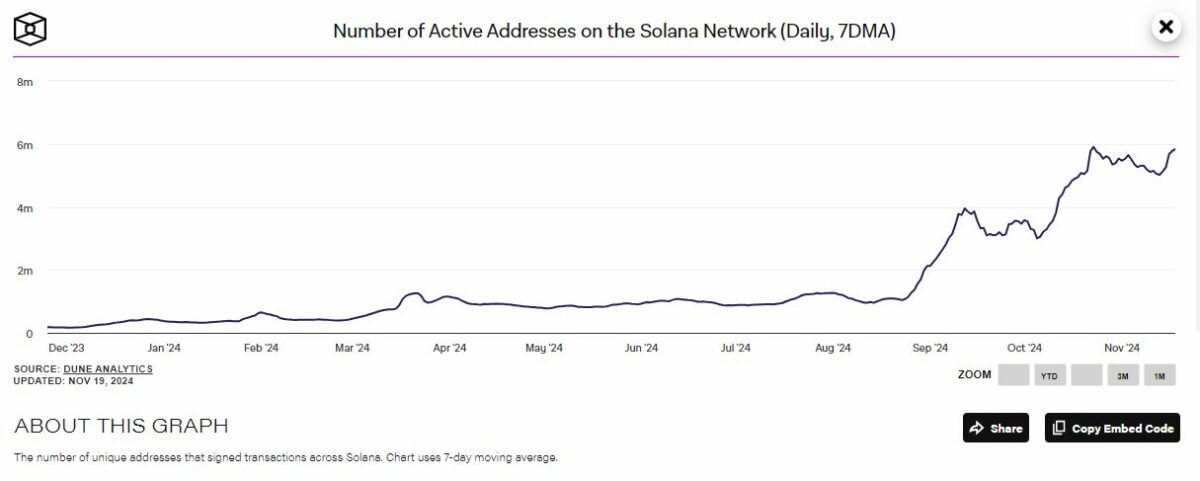

Solana Address Activity on the Rise

The Solana address activity has been on the rise in the last three months along with the SOL price surge which is a healthy sign. During its slowest days in August, the network had less than 1 million daily active addresses.

Solana’s daily active addresses have surged past 5.7 million, highlighting the growing organic demand for SOL. This trend is a positive signal for both retail and institutional investors, potentially driving further demand for the cryptocurrency in the months ahead.

Solana has climbed to the 4th position among the largest cryptocurrencies by market cap, recently overtaking the BNB Chain. Its market cap reached a peak of $117.15 billion on Monday, and if the current growth momentum continues, Solana could challenge USDT to secure a spot in the top three.

Considering its strong performance and underlying factors driving growth, SOL appears well-positioned to potentially rally beyond $400 during this market cycle’s peak.

However, as per the CNF report, Solana’s transfer volume hit a staggering $318 billion which is nearly thrice its market cap. Upon further investigation, it turned out that most of it was contributed by the bot activity.

SOL Price Eyes Mega Rally to $4,000

Crypto analyst CryptoRus shared a bullish outlook for Solana (SOL), projecting a price of $4,000 by the end of the current market cycle.

Highlighting Solana’s recent breakout from a significant “Cup & Handle” pattern, CryptoRus noted that the depth of the cup indicates a potential price target of approximately $5,000. This technical analysis reinforces optimism for Solana’s long-term growth trajectory.

I’ve been saying this for the past year; By the end of this cycle, we could see a $4,000 $SOL

With Solana breaking out of its massive Cup & Handle, cup depth has a price target of around $5,000 👀

Chart: TATrader_Alan pic.twitter.com/Ib99bQKqQl

— CryptosRus (@CryptosR_Us) November 20, 2024