In the last few months, Bitcoin (BTC) has been trading within the $56,000 to $70,000 range. According to a new report from 10x Research, rising liquidity inflows position the coin to sustain its uptrend.

As of this writing, Bitcoin (BTC) trades at $63,632, reflecting a 9% increase over the past seven days.

Bitcoin May Be Poised For Rally

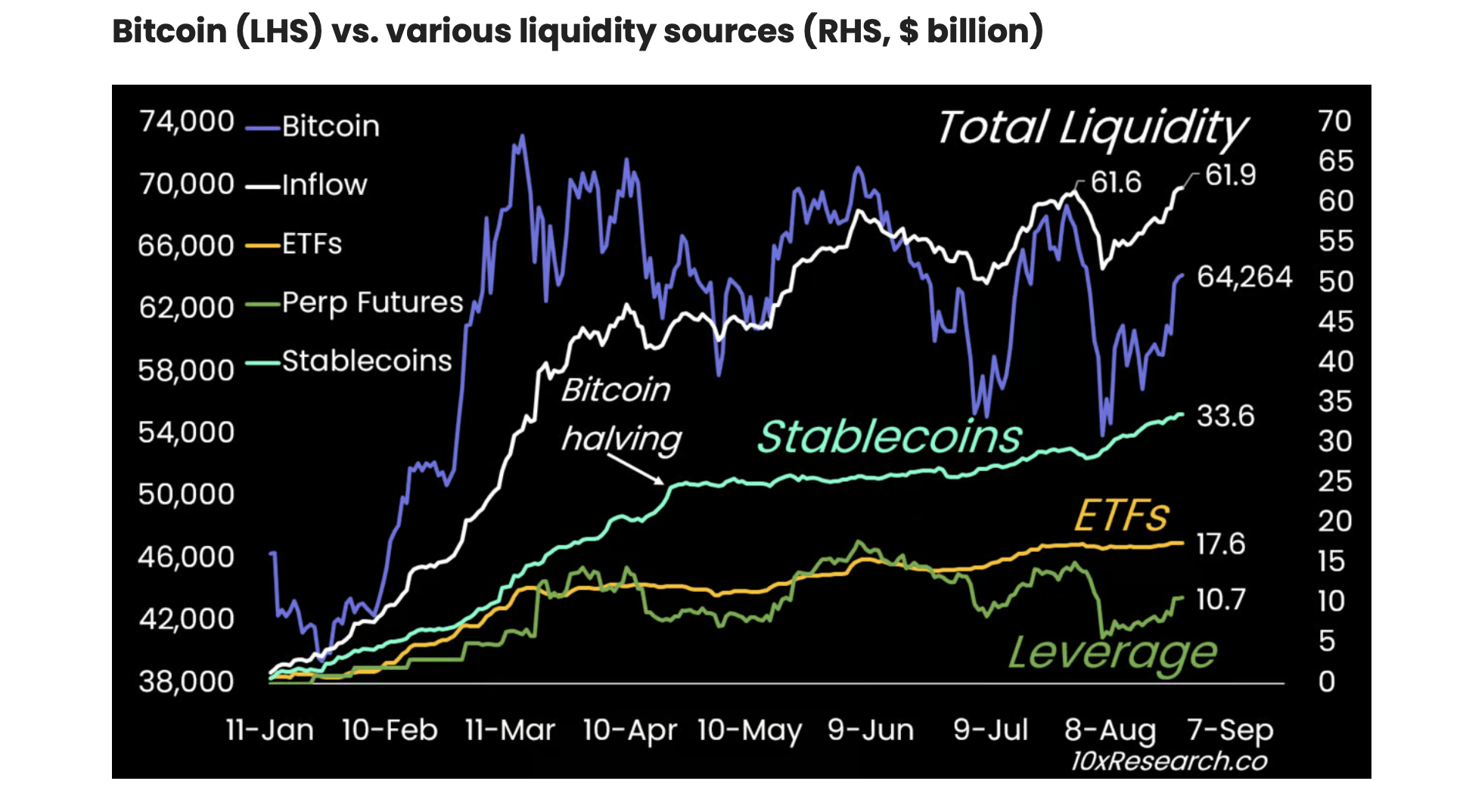

In its new report, 10x Research found that the BTC market has become flush with liquidity in the past few weeks. According to it, total liquidity inflows have reached a year-to-date high of $61.9 billion, surpassing the previous peak in July

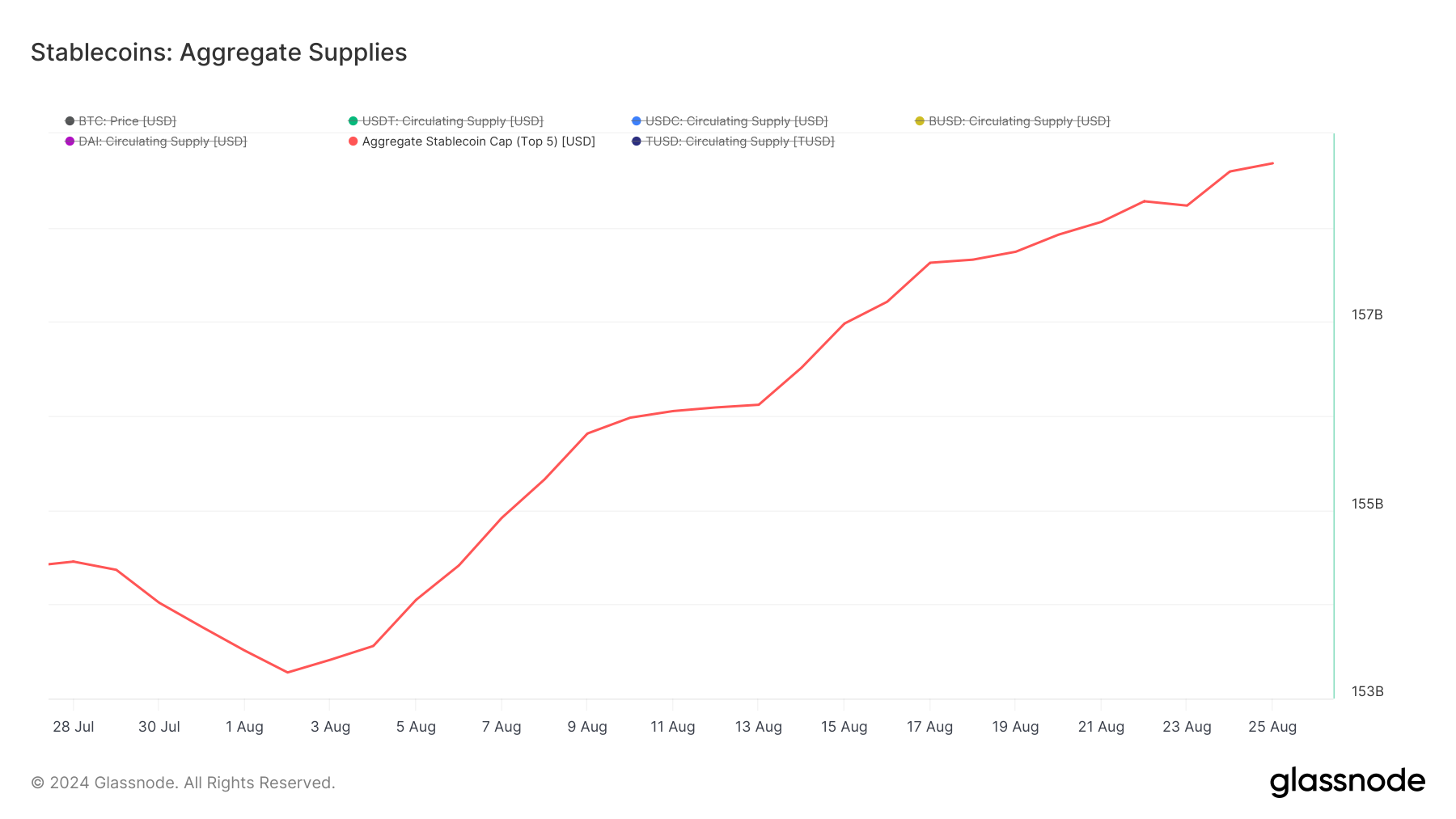

This surge in liquidity has been partly driven by an increase in stablecoin minting. According to Glassnode, the combined supply of the top five stablecoins — Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI), and TrueUSD (TUSD) — has increased by 3% over the past month.

Read more: What Is a Bitcoin ETF?

The rise in stablecoin minting is a bullish signal because it indicates a growing demand for cryptocurrencies. As more people convert fiat currency into stablecoins, they effectively buy crypto.

While noting that the 7-day minting impulse has decreased from $2.7 billion to $1.0 billion, 10x Research stated that “it remains strong.”

Additionally, the derivatives market has witnessed a rise in leverage through Bitcoin’s perpetual futures, contributing to its recent price momentum. This leverage and ongoing liquidity inflows can help drive the coin’s price toward $70,000.

Weakening Dollar Equals Price Hike For Bitcoin

Further, 10x Research observed a significant macroeconomic shift in early July which may aid BTC’s price. According to the report, the US Dollar peaked in the first few days of July, and 10-year Treasury bond yields declined.

Oil prices, a key indicator of economic strength, also dropped by 10% after reaching their peak in early July. Furthermore, the ISM Manufacturing Index, which has remained below 50 for the third consecutive month, suggests a potential slowdown in the US economy.

When analyzing these macroeconomic trends in relation to BTC’s historical performance, the research firm noted that a weaker US Dollar and lower bond yields have traditionally been favorable for the leading cryptocurrency.

“Fed Chair Powell’s speech, combined with the weakness in the ISM Manufacturing Index and the decline in the US Dollar, has set the stage for expectations of increased market liquidity, which could stimulate risk assets like stocks and Bitcoin,” 10x Research said.

On August 23, Bitcoin broke above the resistance at $61,000 and has since trended upward. However, 10x Research notes that its bullish target of $70,000 will only materialize “if the broader economy doesn’t falter.”

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

If the macro trend stays favorable and Bitcoin maintains its uptrend, the next price target is $64,442. If this level holds and the rally continues, BTC could reclaim the critical $68,000 support before pushing toward $70,000.

Conversely, if selling pressure intensifies, BTC’s price may drop to $61,509, invalidating the bullish projection.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.