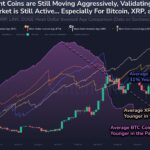

- Bitcoin faces selling pressure as long-term holders realise significant profits.

- Bitcoin’s resilience grows, driven by institutional demand and ETF adoption.

Bitcoin’s recent price activity has been a rollercoaster. The cryptocurrency traded at $97,431 just six days after a record-breaking all-time high (ATH) of $104,088. Despite a 0.59% daily surge, Bitcoin’s trading volume has dipped by 15%, raising questions about the sustainability of its current trajectory.

Bitcoin has surged by 20% in the past month, driven by robust institutional demand and retail optimism. However, a significant factor shaping the market now is holders’ behavior. Their strategic selling, influenced by macroeconomic uncertainties such as potential interest rate hikes, has introduced selling pressure into the market. Yet, Bitcoin’s resilience in absorbing this supply is noteworthy.

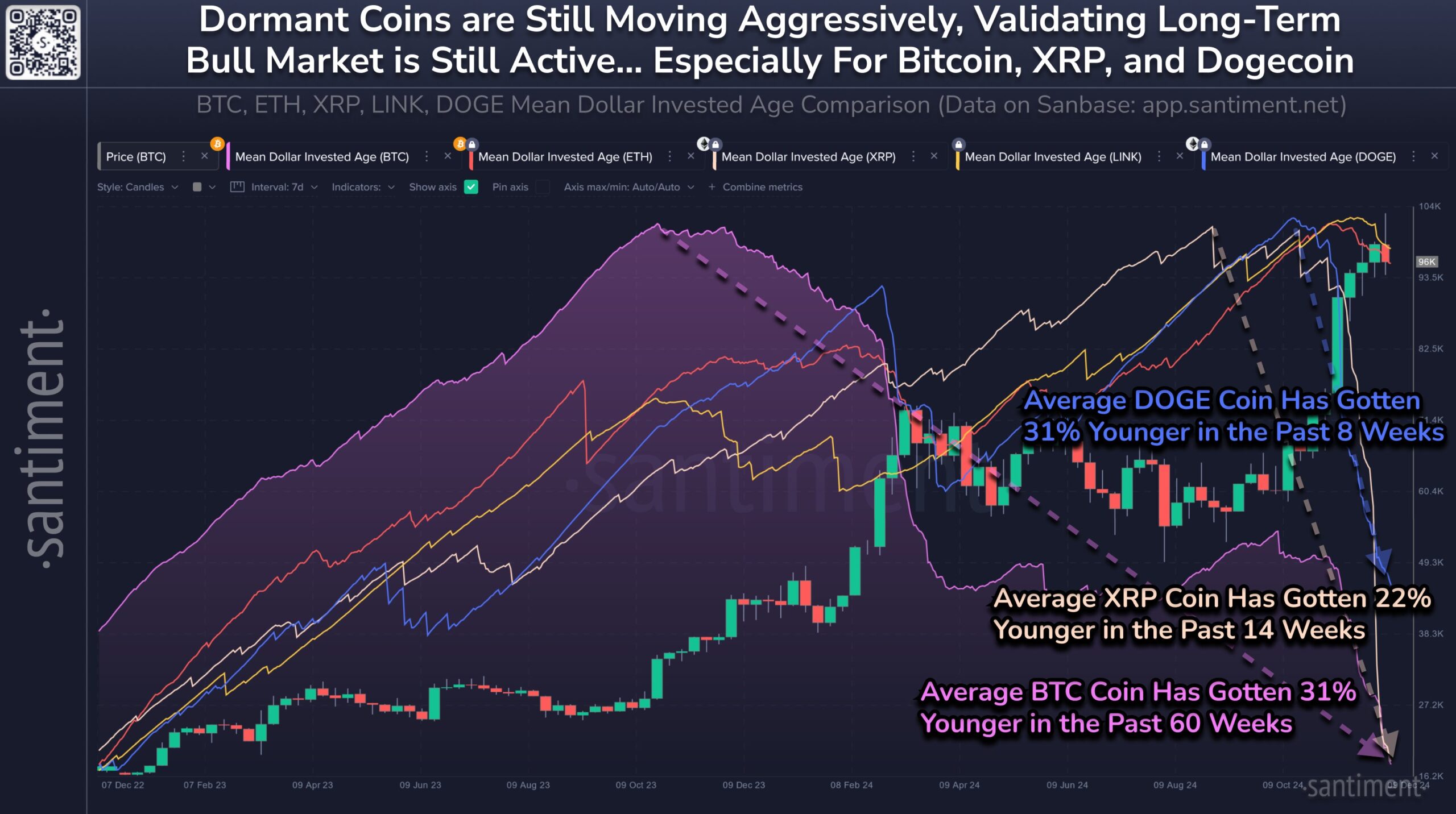

Moreover, the influx of new investors, spurred by institutional-grade financial instruments like Bitcoin ETFs, has been instrumental in sustaining demand. For instance, BlackRock’s iShares Bitcoin Trust has amassed $10 billion in assets within seven weeks, accounting for over 40% of spot ETF volumes. ETFs now channel 75% of new Bitcoin investments, and their growing influence could further stabilize the market amid heightened scarcity from the upcoming halving event.

Bitcoin Shows Mixed Signals

Market data reflects Bitcoin’s mixed signals. The Coinbase Premium has surged as US-based investors leverage price dips to accumulate BTC. Simultaneously, $1.7 billion in Bitcoin liquidations within a single day underscores the intense volatility at play, with prices oscillating between critical liquidity zones.

The fear and greed index, suggests Bitcoin may pause before resuming its upward momentum, especially as liquidity clusters around $102K and $105K present attractive short-term targets. However, risks of a drop to $90K remain, demanding cautious trading strategies.

As the market navigates this consolidation, institutional moves, such as Riot Platforms’ $500 million Bitcoin acquisition plan and speculations of corporate giants like Microsoft and Amazon adopting Bitcoin, could act as catalysts. Bitcoin’s path to $100K hinges on balancing scarcity, liquidity, and evolving investor dynamics, showcasing its unique role as both a speculative and maturing asset class.

Highlighted News Of The Day