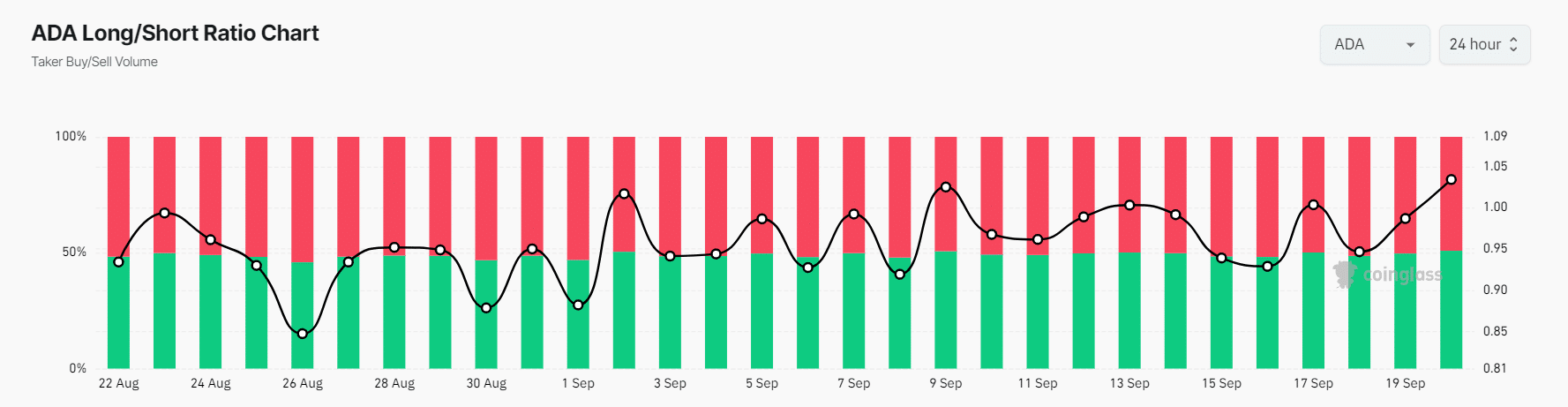

- ADA’s Long/Short Ratio stood at the 1.034 level, indicating bullish market sentiment among traders.

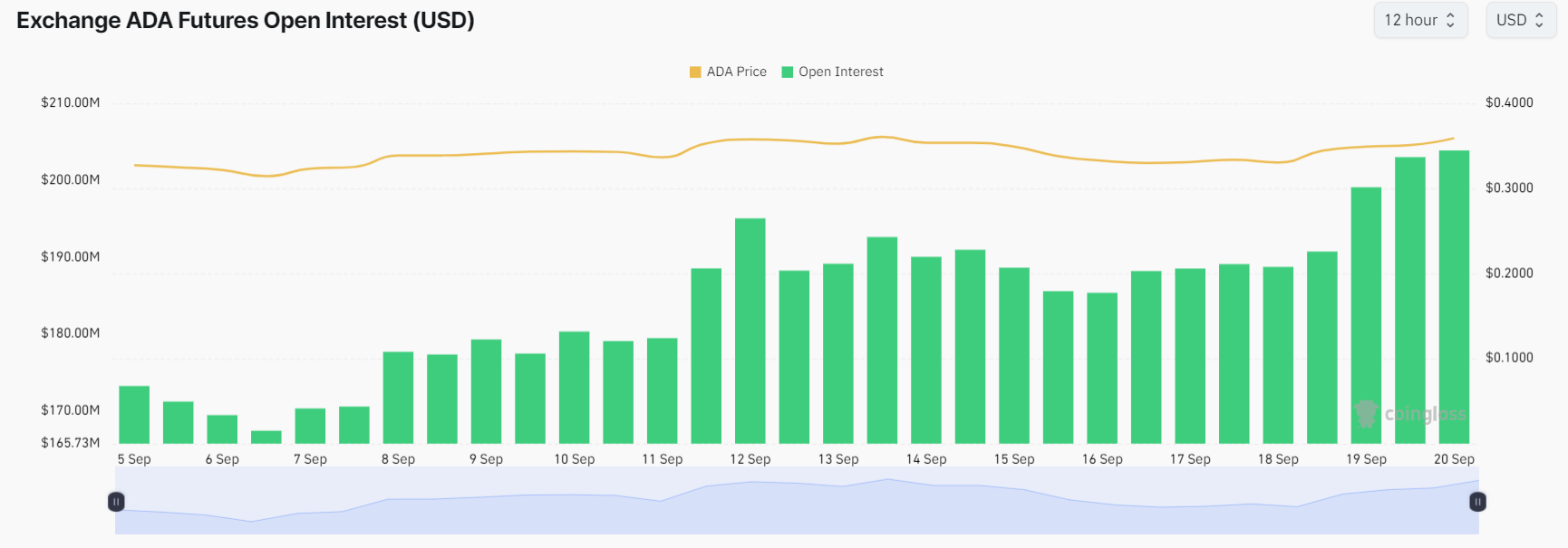

- ADA’s Futures Open Interest increased by 8.5% and continued to rise steadily.

In this ongoing market reversal, Cardano [ADA] appeared to be bullish and poised for a massive rally, driven by a potential breakout and bullish on-chain metrics.

Currently, the overall market sentiment has shifted, with major cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH] experiencing significant upside momentum, and now Cardano is following suit.

Cardano price momentum

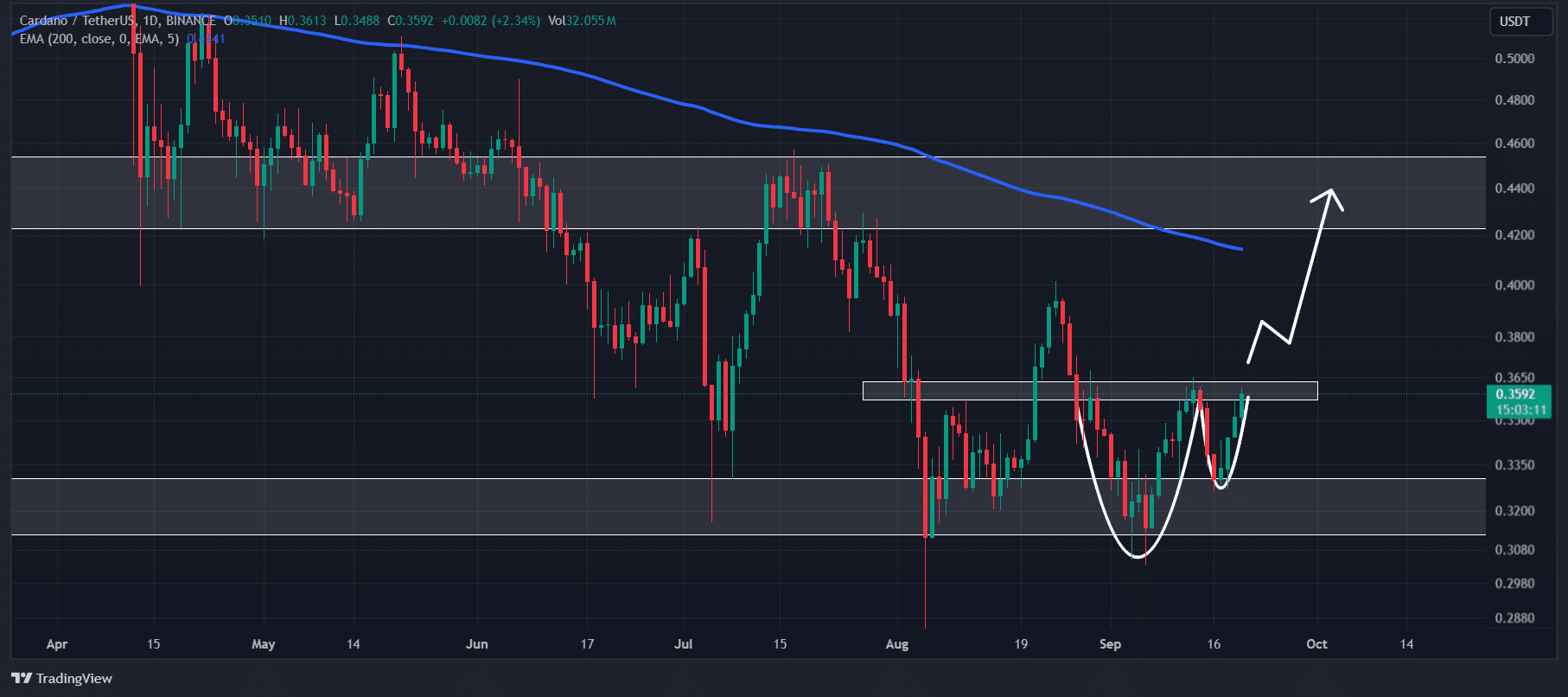

In the past three days, ADA surged more than 10%, trading near $0.36 at press time after a price surge of over 3.8% in the last 24 hours.

However, during this period, its trading volume dropped by 5%, indicating lower participation from traders and investors amid market reversal.

Despite an impressive price surge in recent days, ADA was still trading below the 200 Exponential Moving Average (EMA), indicating a downtrend on a higher frame.

The 200 EMA is a technical indicator used by traders and investors to determine whether an asset is in an uptrend or downtrend.

Despite this downtrend, ADA was near the neckline of a bullish cup-and-handle price action pattern at the $0.365 level at press time.

Historically, this level has been a point where ADA faced significant selling pressure and experienced price reversals.

If ADA breaches this neckline or resistance level and closes a daily candle above $0.367, there is a strong possibility it could rally by 20% to reach $0.445.

Bullish on-chain data

This bullish outlook is further supported by on-chain metrics. Coinglass’s ADA Long/Short Ratio was at the 1.034 level at press time, indicating bullish market sentiment among traders.

Additionally, ADA’s Futures Open Interest increased by 8.5% and continued to rise steadily.

Traders and investors often use the combination of rising Open Interest and Long/Short Ratio above 1 while building their positions.

Read Cardano’s [ADA] Price Prediction 2024–2025

As of press time, 50.84% of top traders held long positions, while 49.16% held short positions. Thus, bulls were dominating the asset.

Furthermore, ADA’s OI-Weighted Funding Rate was at +0.0096%, indicating bullish sentiment.