- NEAR could climb to $5.343 if it breaks through the resistance at $4.476.

- Whales and retailers alike are showing bullish sentiment.

Recent market activity has seen Near Protocol [NEAR] experience substantial growth, with increases of 5.52% daily and 10.19% weekly. At press time, it was trading at $4.46.

This surge was linked to NEAR’s recent efforts to overcome a month-long bullish descending channel, although it continued to encounter strong selling pressure at this resistance level.

Is this rally sustainable? Could a breakout occur soon? AMBCrypto has conducted an analysis on NEAR to find out.

Key factor holding NEAR’s potential rise to $5.34

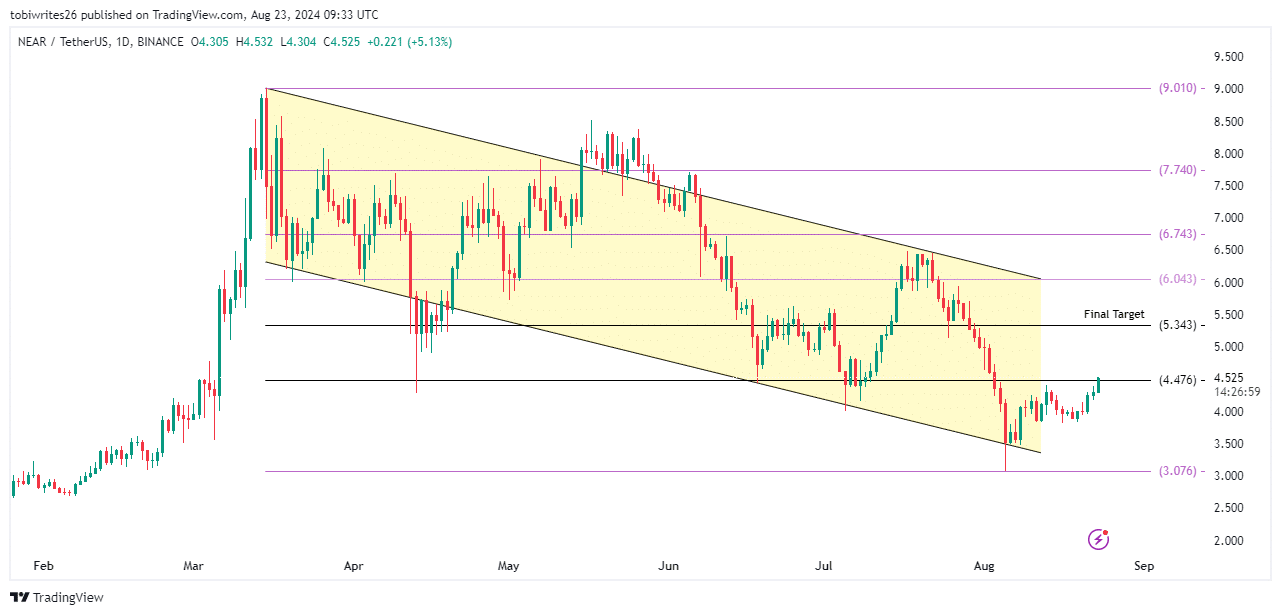

At press time, NEAR was trading within a month-long descending channel, something which dated back to May.

This pattern, defined by its rectangular shape with upper and lower bounds, typically precedes a rally after the asset bounces off the lower boundary.

NEAR has recently rebounded from the support zone, with notable wicking at the lower support level of $3.076.

Wicking signifies a rejection of lower prices, indicating that buyers have regained control and are pushing the price upward, hinting at potential upward momentum.

However, NEAR faced a significant hurdle at a major resistance level of $4.476 at press time. For the recent rally to sustain, buying pressure must surpass selling pressure.

If buyers can dominate sellers, NEAR is poised to break out of the channel and ascend to a new high of $5.343.

Otherwise, it may continue to trade within the descending channel, potentially prolonging this pattern for weeks.

Short sellers feel the heat as buying pressure mounts

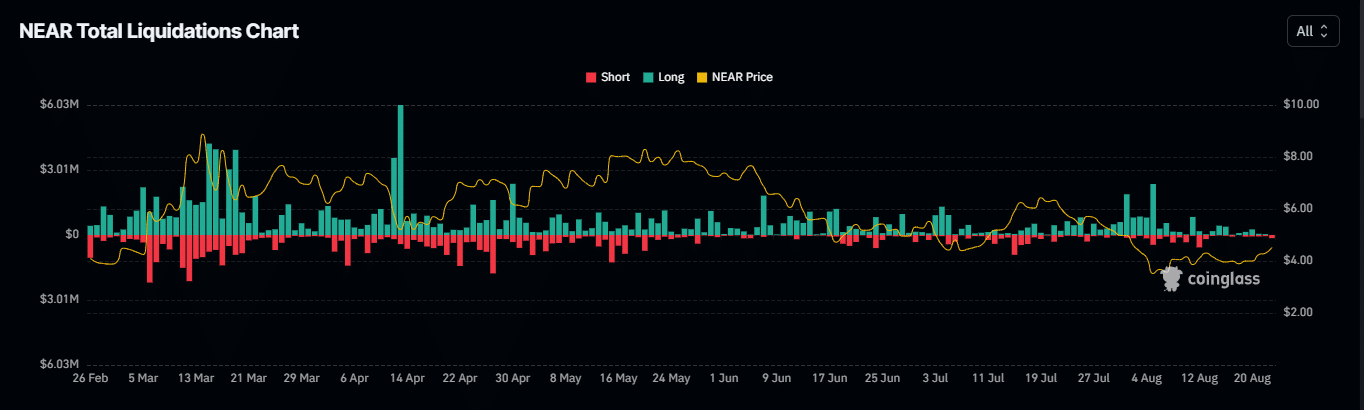

Further analysis by AMBCrypto indicated a significant likelihood that the $4.476 resistance level will be breached, as buying pressure has intensified recently.

According to Coinglass, this surge in buying activity began on the 21st of August, leading to a sharp increase in liquidations among traders who bet against NEAR.

Over the past 24 hours, $182.65k worth of short positions have been eliminated from the market.

Such events demonstrated growing buying interest and the emergence of long traders as selling pressure diminished.

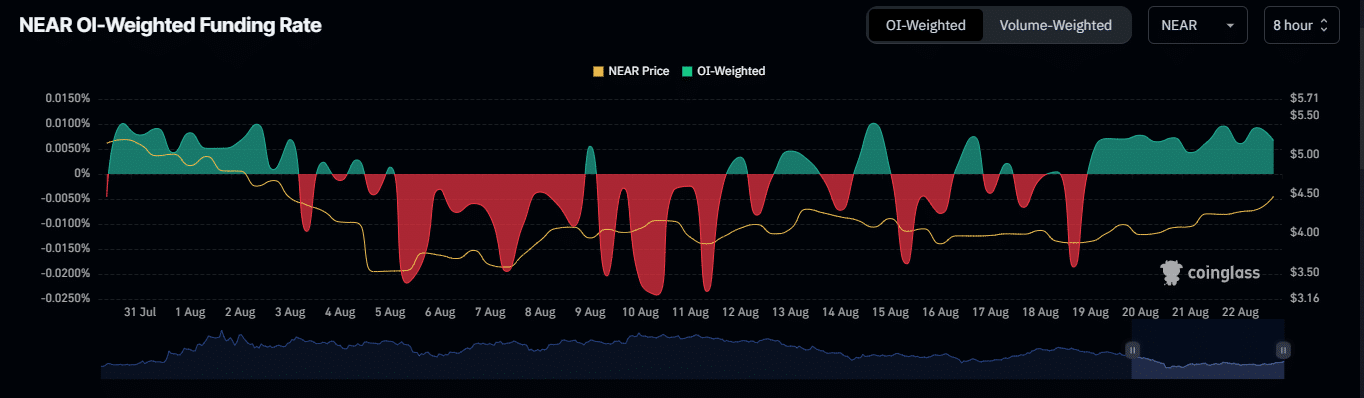

Since the 20th of August, the OI-Weighted Funding Rate has remained positive, steadily increasing to 0.0066% at press time.

This indicated that long positions were prevailing, with long traders compensating short sellers, a sign of strong buyer confidence and potential for further upward momentum.

If retail buying pressure persists, it could overpower the existing selling pressure at the resistance level of $4.476.

Read NEAR Protocol’s [NEAR] Price Prediction 2024–2025

Whales maintain buying pressure

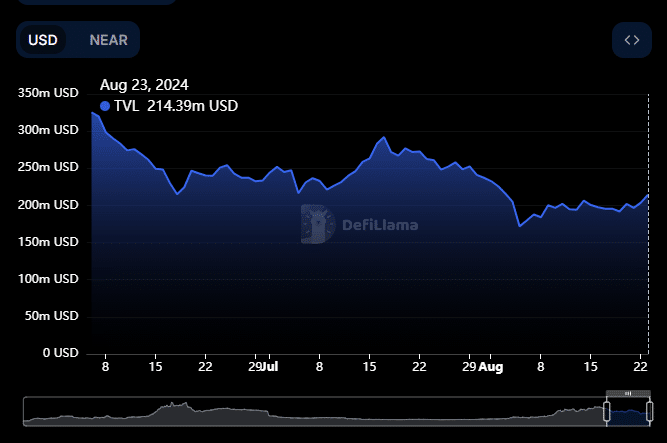

Data from DeFiLlama indicated a surge in buyer confidence, as evidenced by the rising Total Value Locked (TVL), which stood at $213 million at press time.

An increase in TVL suggests that more NEAR is being invested in the protocol’s ecosystem. Typically, such an influx predicts a continued rise in price, reflecting sustained investor interest and market strength.