- XRP’s supply was tightening as large holders accumulate and ODL transactions increase.

- Falling exchange reserves and bullish sentiment suggest potential for a price rally.

Ripple [XRP] supply is reportedly running low as significant amounts are being funneled through Ripple’s On-Demand Liquidity (ODL) corridors.

At the same time, large holders, or “whales,” continue to accumulate, creating a rapid consolidation of XRP by institutional players.

This accumulation is shrinking the available supply for retail investors, creating urgency for those who want to enter the market.

As the window for retail participation narrows, one pressing question remains: will this scarcity drive XRP prices higher, or will it lead to market volatility?

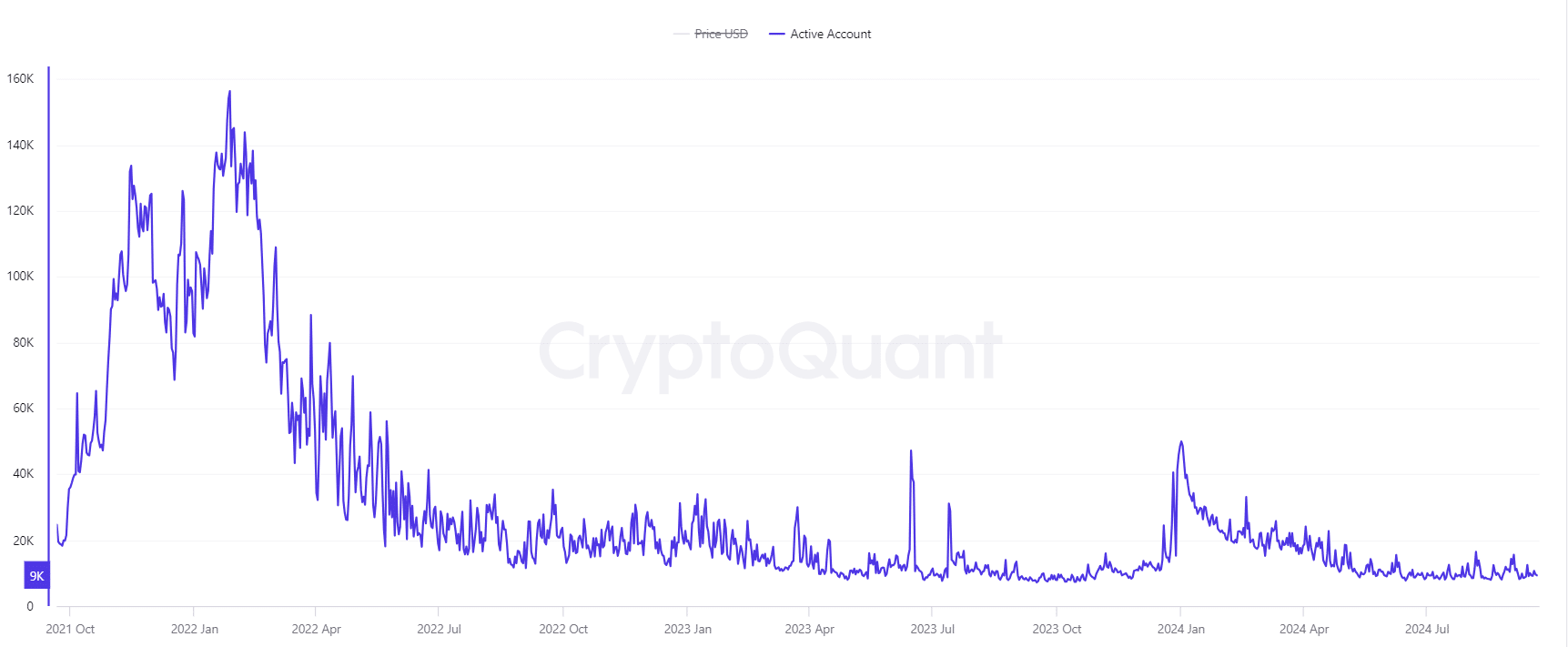

Are active addresses and transactions increasing?

The XRP Ledger is showing signs of growing network activity. At press time, the number of active addresses had risen by 0.97%, reaching 9.339K.

Similarly, transaction counts are also on the rise, with a 0.98% increase, bringing the total to 1.6345 million transactions, according to CryptoQuant data.

This uptick indicates greater participation and larger transaction volumes, further hinting that whales are moving XRP at a rapid pace. With transaction and address activity climbing, the market could be positioning itself for a supply-driven price surge.

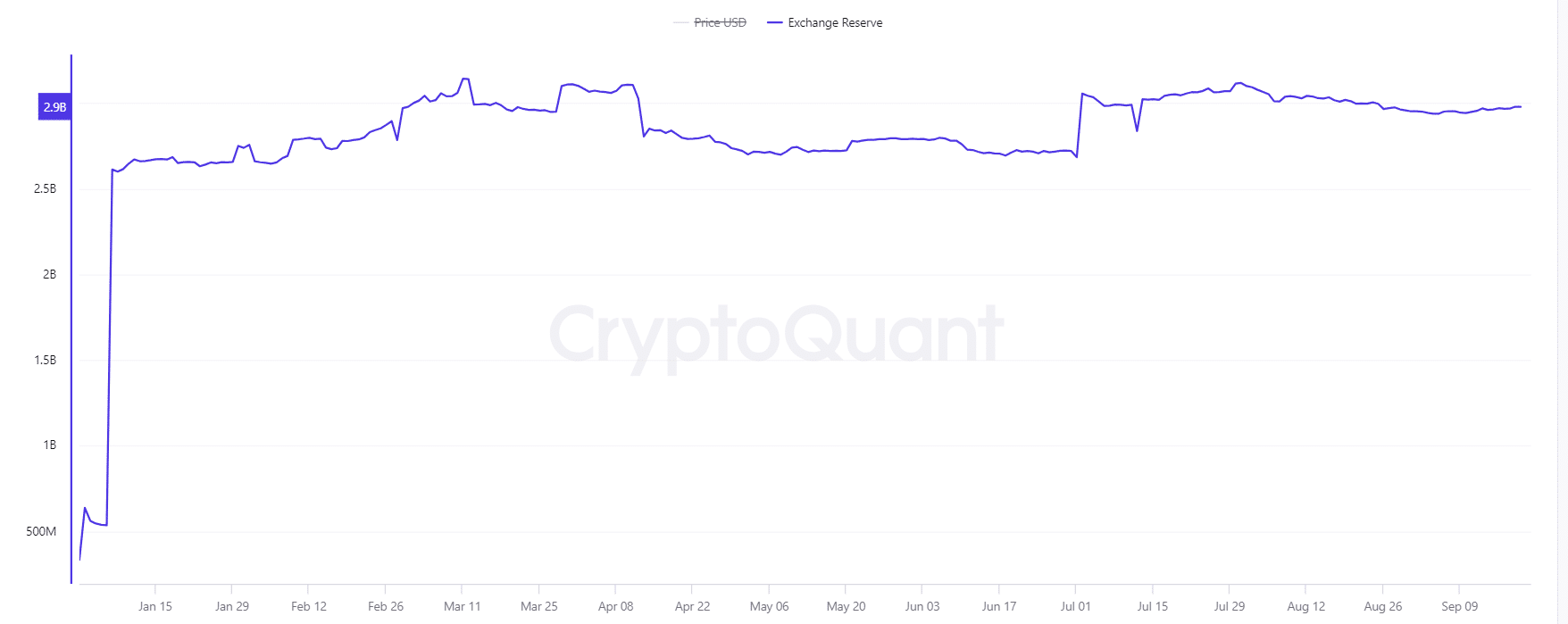

How is XRP exchange supply shaping market sentiment?

XRP’s exchange supply continues to drop, with reserves declining by 0.26% over the past week to 2.977B XRP. Lower exchange supply typically signals increasing demand and fewer tokens available for trading, which could lead to upward pressure on price.

Retail traders face an increasingly competitive landscape as large holders continue to absorb supply.

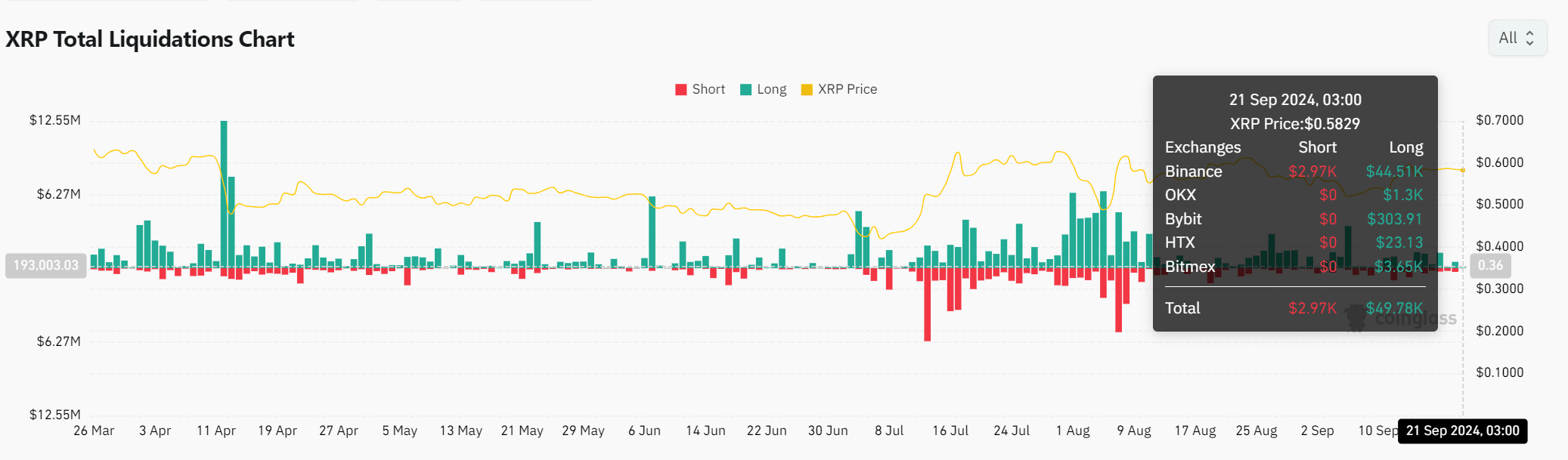

What does XRP’s liquidation data reveal?

XRP’s liquidation data further supports the idea of a supply crunch. As of September 21, 2024, long liquidations totaled $49.78K, significantly outweighing short liquidations at $2.97K. This indicates a bullish sentiment among traders who are betting on rising prices.

However, XRP’s market could experience sharp price fluctuations with a shrinking supply and growing long positions.

Read XRP’s Price Prediction 2024–2025

Will scarcity drive XRP prices higher?

The rapid accumulation of XRP by whales and increasing usage in ODL corridors is leaving retail investors with fewer opportunities to secure tokens. With active addresses and transaction counts rising, along with falling exchange supply, market conditions appear ripe for a potential price surge.

However, the scarcity of XRP could also create volatility, making it critical for retail investors to act swiftly.