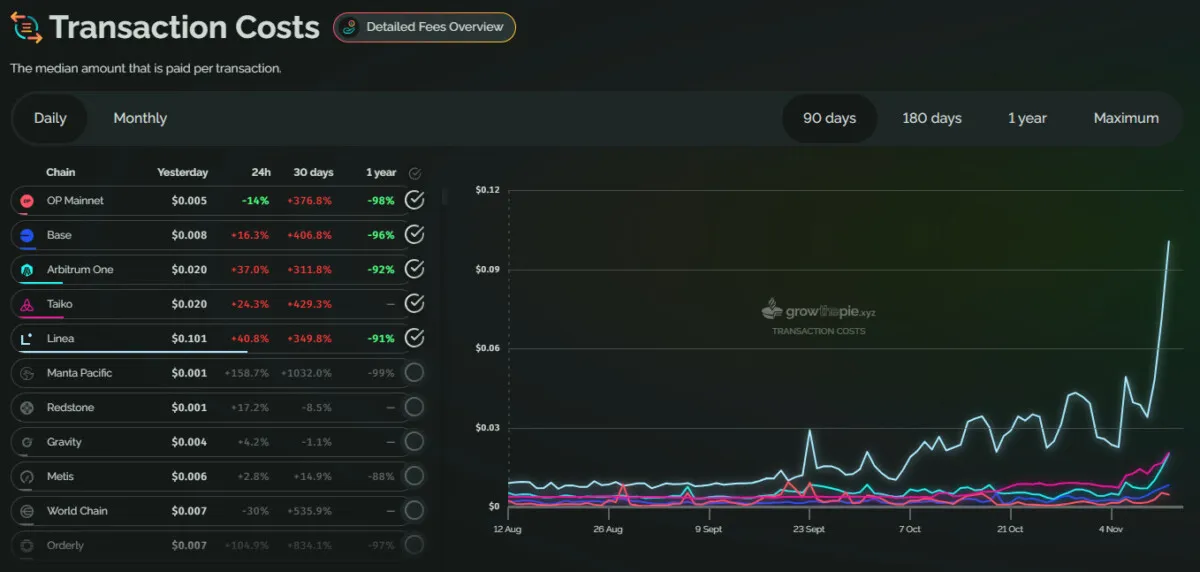

L2 chains are waking up – and requiring the highest fees in the past three months. None of the L2 chains offer their usual negligibly cheap transactions under $0.01, and all of the leading chains are competing to post to Ethereum.

Fees on leading L2 chains are catching up with the market frenzy. After months of nearly negligible fees, all major L2 chains have increased transaction costs, which they pass on to end users.

L2 transactions are still reasonable, especially given the recent peak gas fees on Ethereum. Yet even chains like Base, priding themselves on rock-bottom fees, have seen a significant increase. For high-frequency users and for more complex tasks, even the relatively scalable L2 may increase expenses.

Optimism fees increased to $0.09, the same as Arbitrum, with higher rates for priority fees. The exact fees at any moment may vary, but the past few weeks saw the end of virtually free transactions. In October and November, blobs went above target levels more often, creating competitive pricing for apps, chains, and contracts to access block space.

The biggest change is for Arbitrum, which is going through a larger DeFi reawakening led by Aave V3 lending. The Arbitrum L2 chain is the most widely used for its speed and low fees. Arbitrum also attracted additional USDT activity, allowing for more active trades. As a result, Arbitrum fees saw the biggest short-term shift.

L2 chains also started paying higher fees to Ethereum, with Taiko still the leader. In the past week, fees to the L1 increased 5-6 times for most chains, with no more virtually free blob posting.

In addition to the known chains, unidentified blob posters also used L1 to secure their finalized state, further limiting blob space. As the number of small L2 has grown to over 100, any increases in activity can lead to an even more competitive blob market.

In the past week, blobs started to fill up faster, creating competition between chains. The L2 only partially resolved the issue by posting fewer blobs, but this did not work on all occasions. Base and Taiko retained their usual blob schedule, using up the most space and driving up the rent to L1. Despite this, most L2 chains produce significant earnings, still paying only a few thousand dollars to ETH.

ETH fees become prohibitive at market peak

Previously, periods of high fees coincided with airdrop incentives. This time, overall crypto activity is raising fees across the board. Ethereum sees 1.29M transactions per day, up around 30% in the past few days. The increased activity coincided with the ETH rally above $3,200, with expectations of further gains.

Gas fees on Ethereum are also higher, with regular transactions up to $5.72. More complex tasks are once again prohibitively expensive, as DEX swaps have fees close to $100 again and NFT sales go as high as $166.

The rising fees coincide with heightened DEX activity, especially after several Ethereum-based tokens went through a price boom. However, realizing profits through a DEX has raised costs, in addition to the demand for sniping early-stage meme tokens.

Ethereum has not seen such a usage frenzy since the Dencun upgrade in March, which brought months of negligible fees both on L2 and L1. The resulting ETH burns lowered inflation on the network to only 0.12%, the lowest level in months. As a result, Ethereum adds around 2,800 new ETH per week, instead of over 16K ETH as in the past few months. At this rate of increased burns, Ethereum still has a chance to return to a deflationary structure, or at least keep its supply lower.

Base fees on Ethereum are the highest for the past 30 days. However, ETH is still relatively cheap for L2 chains and apps, running up to a few thousand dollars per day. Ethereum as an L1 remains difficult to scale, with prohibitive fees rising within hours when activity grows.