Lista DAO (LISTA), a decentralized platform for lending stablecoins, has seen a remarkable 37% increase in its token price following the completion of its token airdrop on June 20. The price of LISTA surged from $0.565 to a high of $0.84 across major exchanges.

This surge positions Lista DAO’s native token among the top gainers in the last 24 hours. In contrast, LayerZero (ZRO), Beercoin (BEER), and Iggy (MOTHER) experienced significant sell-offs, each dropping more than 20% in the same period. LayerZero’s price decline is particularly notable following its own airdrop on June 20.

Lista DAO Gains Traction After Listing and Airdrop

Lista DAO (LISTA), a decentralized stablecoin lending protocol, experienced significant momentum on June 20 as several major crypto exchanges, including Binance, Gate.io, Bitget, and MEXC, listed the token for trading following its airdrop. These listings were accompanied by promotional campaigns aimed at boosting liquidity and investor interest in LISTA.

Adding to this support was DWF Labs, a prominent Web3 investor and market maker, which played a crucial role in enhancing LISTA’s market presence. According to Spot On Chain data, DWF Labs received 10 million LISTA tokens prior to their listing on centralized exchanges (CEXs). Subsequently, DWF Labs distributed these tokens strategically: 2.5 million LISTA to Bitget, 2 million to Binance, 1.5 million to MEXC, and 850,000 to both Gate.io and KuCoin.

Despite initial volatility that often accompanies new listings and airdrops, the visibility and support from exchanges and investors like DWF Labs suggest a positive outlook for LISTA’s price. Bullish sentiments may drive LISTA towards the $1 mark as demand grows across the ecosystem. However, fluctuations in Lista DAO’s price are anticipated amid potential selling pressures in the short term.

Lista DAO’s Dual-Token Ecosystem and Growth in Total Value Locked (TVL)

Lista DAO operates a decentralized stablecoin and liquid staking protocol centered around two tokens: LISTA, its utility token, and lisUSD, its decentralized stablecoin. This ecosystem allows users to stake tokens or borrow using lisUSD, earning yield on collateralized assets like BNB and ETH.

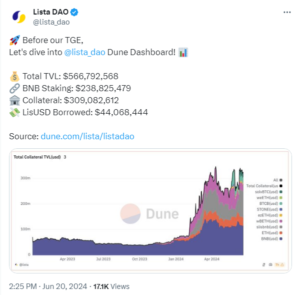

The maximum supply of LISTA is capped at 1 billion tokens, with an initial circulating supply of 230 million tokens. Since February this year, data from Dune Analytics indicates a substantial increase in Lista DAO’s total value locked (TVL), encompassing both liquid staking and stablecoin lending. In early February, TVL stood at $204 million, rising sharply to over $537 million currently, peaking at $566 million just before the token generation event (TGE).

Source: X

Specifically, TVL attributed to BNB staking currently amounts to $231 million, slightly down from $238 million previously, with nearly 395,000 BNB tokens staked. Collateral TVL surged to over $309 million pre-airdrop and currently hovers around $301 million, reflecting strong participation and confidence in Lista DAO’s ecosystem.

This growth underscores Lista DAO’s expanding role in decentralized finance (DeFi), supported by robust user engagement and strategic tokenomics designed to incentivize participation in its staking and lending protocols.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News