With the Bitcoin network’s hash rate surpassing 414 EH/s, miners are facing challenges due to declining profits.

Bitcoin mining revenue, also known as “hash price,” which measures earnings per TH/s per day, has dropped to levels comparable to the collapse of FTX in November 2022. Despite this, the hash rate has reached all-time highs.

Recently, the Bitcoin network hash rate reached 414 exahashes per second (EH/s) on August 18th, marking a new record.

This surge represents a 54% increase from the start of 2023 and an 80% rise over the last year, as reported by Blockchain.com.

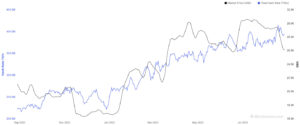

BTC hash rate and price 1 year. Source: blockchain.com

Challenges for Bitcoin Miners Amid Declining Revenue

While the Bitcoin network’s security seems solid, miners are facing tough times due to a sharp drop in earnings. Revenue has plunged significantly, reaching levels reminiscent of November 2022 when BTC hit a low of about $16,500.

As per HashPriceIndex, revenue currently stands at just $0.060 for every terahash per second per day. This is roughly half of what it was in early May, when high demand for block space emerged during the Bitcoin Ordinals craze.

Dylan LeClair, a market analyst, noted that even though more efficient mining rigs are being developed, the time is nearing for prices to rise. This is essential to maintain profitability for miners amidst the high hash rates.

Miner revenue per terahash. Source: Glassnode

Bitcoin Miners Turn to Stock Sales Amid Bear Market

During the challenging bear market, Bitcoin miners have reportedly been using proceeds from stock sales in the second quarter to stay financially afloat.

Bloomberg’s report on August 24th highlighted that in Q2, the 12 major publicly traded miners managed to gather approximately $440 million through stock sales.

🚨🚨Major $BTC miners are in BIG trouble heading to the halving 🧵👇

To avoid selling the ~$900M BTC they're hoarding, miners relied on debt and diluting shareholders

Now those lifelines are drying up. Soon their only option is dumping into the markethttps://t.co/I27tvV4kxu

— Rho Rider (@RhoRider) August 26, 2023

Mark Jeftovic, the creator of the Bitcoin Capitalist newsletter, mentioned that certain mining firms are excessively diluting shareholders. He added that if the rate of dilution surpasses Bitcoin’s price increase, it’s akin to moving in the wrong direction on a treadmill.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News