Pseudonymous crypto analyst Ember CN has said the drop in Ethereum gas fees could increase its annual supply by almost $1.6 billion. This comes in light of the gradual increase in ETH supply in recent months and the concerns about the potential impact on price.

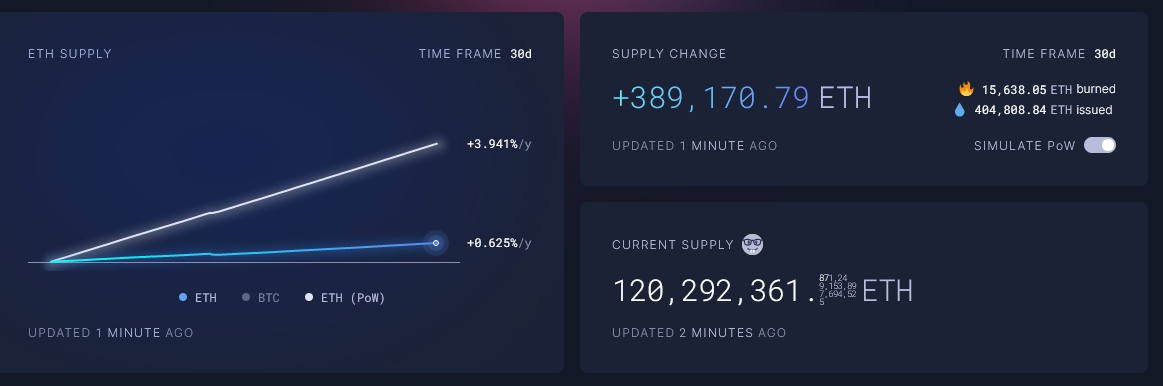

According to data from Ultrasoundmoney, the ETH supply has increased by over 228,717 ETH in the past four and a half months, from 120,063,605 ETH in April to around 120,292,322 ETH. Many believe the increase shows that ETH has become an inflationary asset, a reversal of its previous deflationary status.

Ethereum network produces over 1,600 ETH daily

The increase in ETH supply is due to its low burn rate, which in turn is due to the low network fees, a result of the Dencun upgrade. While many consider the low fees to be good for Ethereum usage, they have also reduced the burn rate on the network, resulting in more ETH being issued than destroyed.

Ember CN analyzed the growth rate of ETH supply since the upgrade, noting an average daily increase of 1,652 ETH. When annualized, Ether supply will grow by 600,000 ETH, which is $1.59 billion at its current price.

He wrote:

“If the subsequent ETH chain activity continues to be sluggish, according to this output data, the annual inflation will be 600,000 coins, which is worth $1.59 billion at the current price, with an inflation rate of 0.5%.”

Consequently, he noted that the only way to fix this is if Ethereum activity increases. However, that might be unlikely given how layer-2 networks such as Arbitrum, Optimism, and Base now dominate Ethereum transactions. This is in part due to the even lower fees on those networks.

ETH inflation is not that big of a deal

Despite the inflationary turn in ETH supply, the analyst does not think it is much of an issue. He noted that this only represents about 0.5% of its supply, which means it might not have much impact on the price. Data from Ultrasound Money also shows that inflation is currently at 0.62% per year. This is relatively negligible, given Ethereum’s supply and market cap.

Coinbase analysts believe the ETH turning inflationary is not due to layer-2 networks but rather the lower fees on Ethereum mainnet and the increase in the ETH staking ratio. The analysts noted that an increase in ETH staking ratio, which would lead to more issuance, will speed up the rate at which ETH becomes inflationary.

David Han, Coinbase’s institutional research analyst, wrote:

“We don’t think this is a problem driven primarily by L2 scaling, however. While L2 transaction fees do lack the EIP-1559 burn mechanism, the total fees spent on L2s are comparatively inconsequential. That is, even if 100% of L2s fees were burned, ETH would remain inflationary.”

However, they don’t expect ETH to lose its value just because it turns inflationary. Instead, they argued that ETH’s value proposition is its application-based utility rather than its value as a store of value. Thus, they expect more applications-based utilities to emerge with more scalability and lower fees.

While some critics question Ethereum’s value as ultrasound money now that it has turned inflationary, ETH supply growth has actually been better under PoS consensus. According to Ultrasoundmoney’s Proof of Work simulation, the ETH supply has increased by 61,721 tokens over the last 30 days. Under PoW, it would have been up by 389,529 tokens, with an inflation rate of almost 4% per year.

In fact, ETH supply has decreased by 0.10% since the Merge which happened almost two years ago. The network has burned 228,696 ETH more than it has produced within that period.