Bitcoin ended Q3 with a modest 0.8% price increase, overshadowed by gold’s significant 13.8% rise, fueled by concerns about the economy and global tensions.

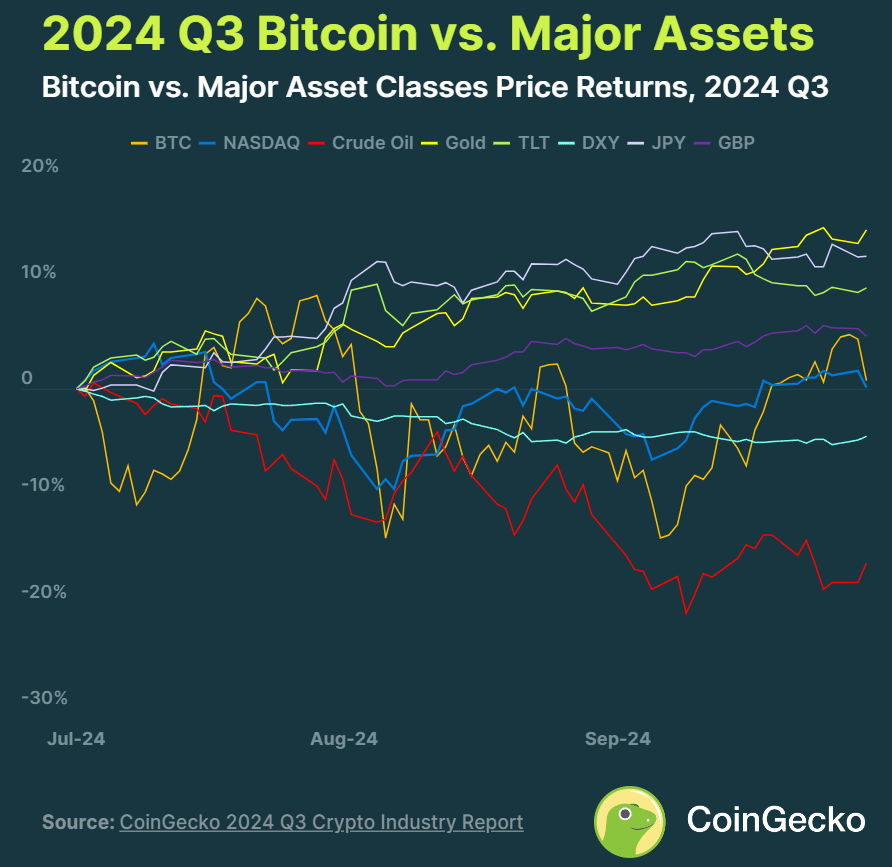

As global uncertainties loom, investors are turning to safe havens for stability, leaving Bitcoin (BTC) trailing with a modest 0.8% price increase in Q3 2024, according to data compiled by crypto price aggregator CoinGecko. For comparison, major assets like gold surged 13.8% amid growing fears of an economic slowdown in the U.S. and escalating tensions in the Middle East.

Moreover, even the Japanese Yen demonstrated strong performance, climbing 12.0% after the Bank of Japan’s surprise rate hike alongside rate cuts by the Federal Reserve. In contrast, Bitcoin outperformed only crude oil and the U.S. Dollar Index, as all major fiat currencies gained against the dollar, reflecting shifting market dynamics amid fears of weakening demand and monetary policy adjustments.

Bitcoin’s modest gains lead to decline in trading volumes

While Bitcoin posted modest gains, the top ten centralized crypto exchanges reported a combined spot trading volume of $3.05 trillion, reflecting a nearly 15% decline quarter-on-quarter. Despite this downturn, Binance retained its status as the largest CEX, although its market share slipped below 40% for the first time since January 2022, ending September at 38%.

Crypto.com emerged as the second-largest CEX, leaping from ninth place in Q2, with a remarkable 160.8% growth in trading volume, capturing a 14.4% market share. Meanwhile, OKX and Gate.io struggled, each experiencing trading volume declines exceeding 30%. U.S.-based crypto exchange Coinbase also faced challenges, with a 23.8% drop in trading volumes, resulting in a fall from sixth to tenth place among the top exchanges.

Despite the market’s modest gains in Q3, analysts at CoinGecko noted that Bitcoin increased its dominance to 53.6%, a rise of 2.7% quarter-on-quarter, adding that the “last time BTC was able to achieve such dominance was in April 2021.”