At least three significant economic data releases are scheduled to take place this week: Jobless Claims, Manufacturing PMI, and Services PMI. All these crucial data releases are set to happen on October 24. What are our expectations? And how will it influence the crypto market?

United States Jobless Claims: An Overview

On October 12, the Initial Jobless Claims index was 241 thousand – lower than the index value of 260 thousand recorded on October 5. This week, the consensus shows that the value may rise to 247 thousand – a slight rise of 6 thousand.

A slight rise in jobless claims could signal a slightly weaker job market. If this trend continues, it could, in theory, push the Federal Reserve to consider more interest rate cuts, which could be beneficial for cryptos.

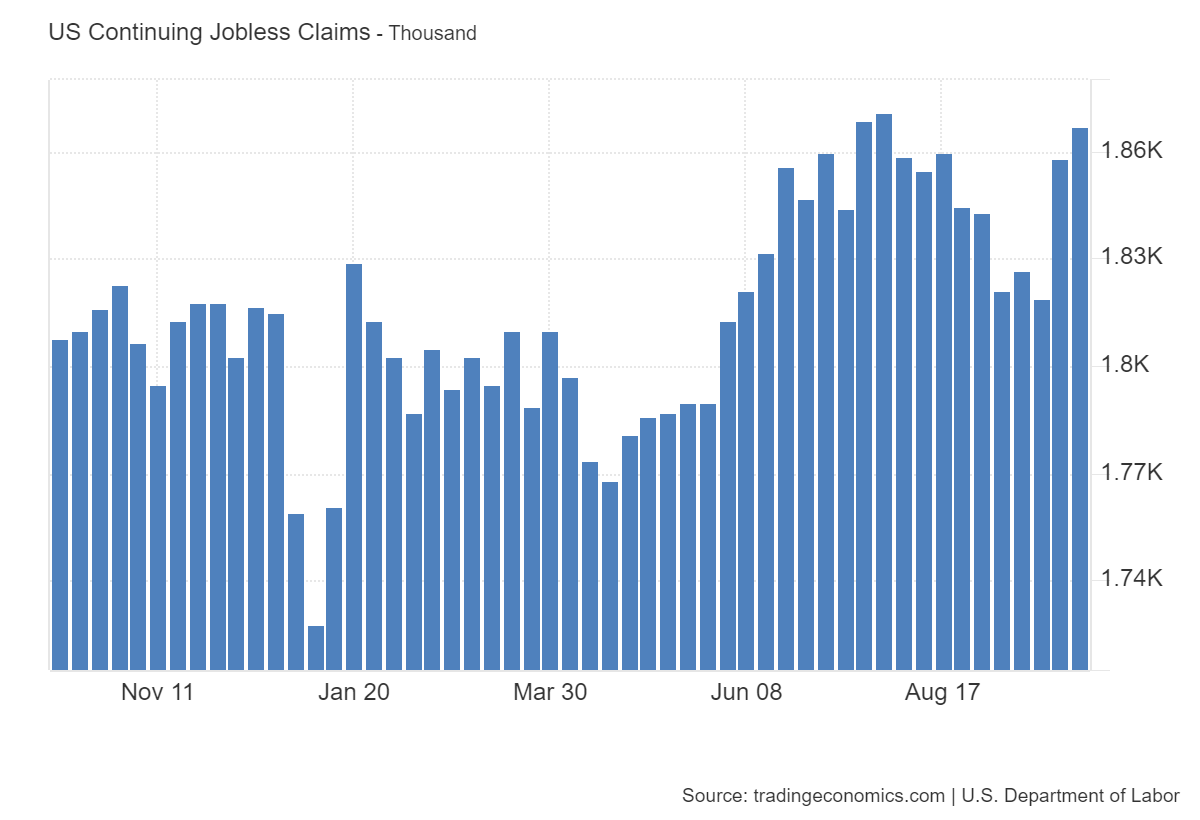

Meanwhile, on October 17, the US Continuing Jobless Claims index was 1.867K – higher than the value of 1861K recorded on October 10. This week, as per TEForecast, the value is expected to drop slightly to 1865K.

A small drop in continuing claims suggests the labor market is still stable. If these numbers improve, it could mean the economy is stronger.

Manufacturing PMI & Services PMI: What You Should Never Miss

In September, the US Manufacturing PMI index was 47.3 – the lowest since June 2023. In May 2024, it was above 51. In June, it rose even higher. However, since June, it has been consistently declining.

A continued drop in the manufacturing PMI could signal an economic slowdown. Investors may turn to cryptocurrencies as a hedge against traditional market risks.

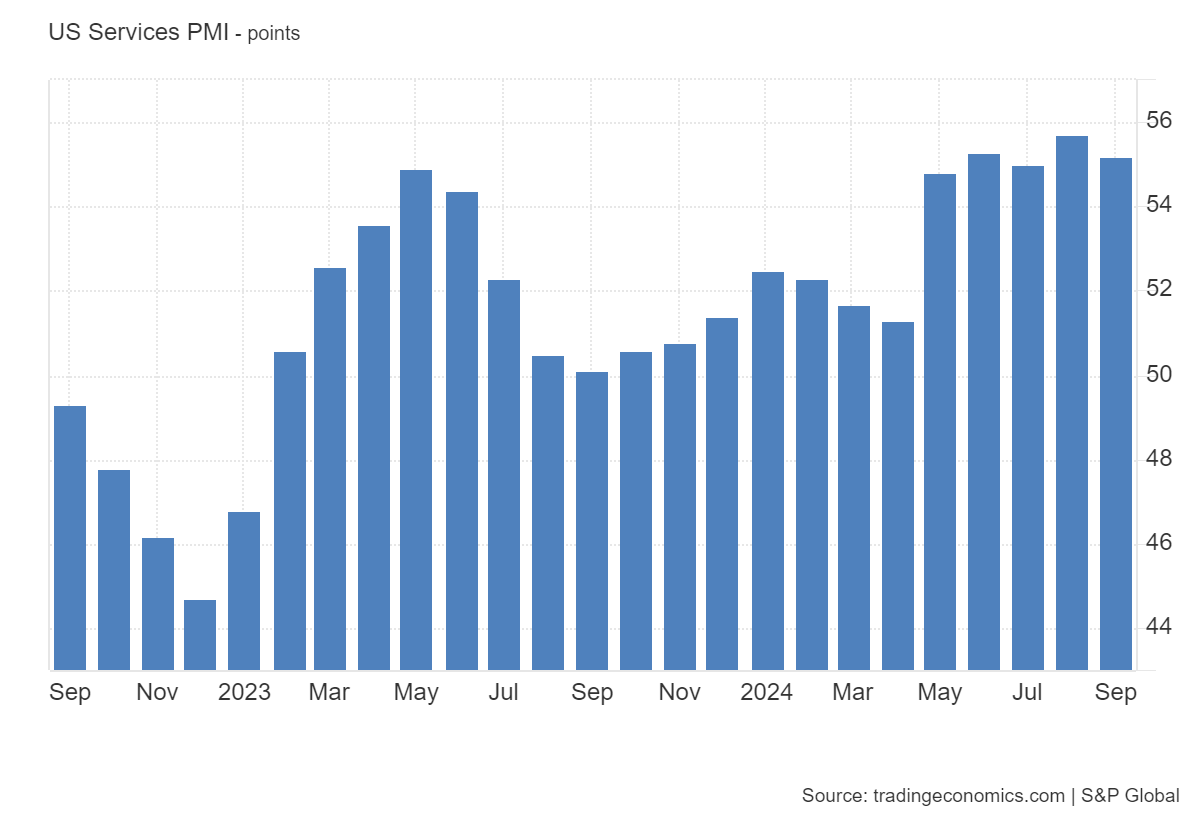

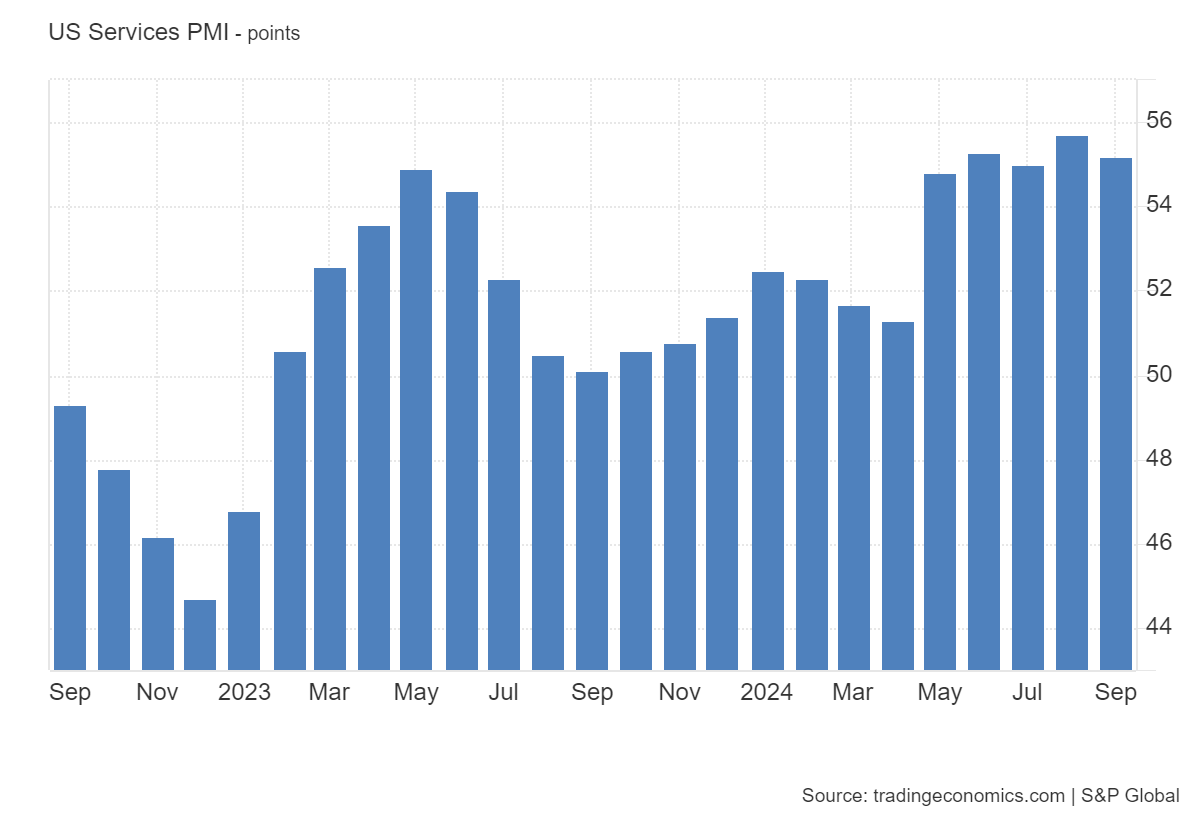

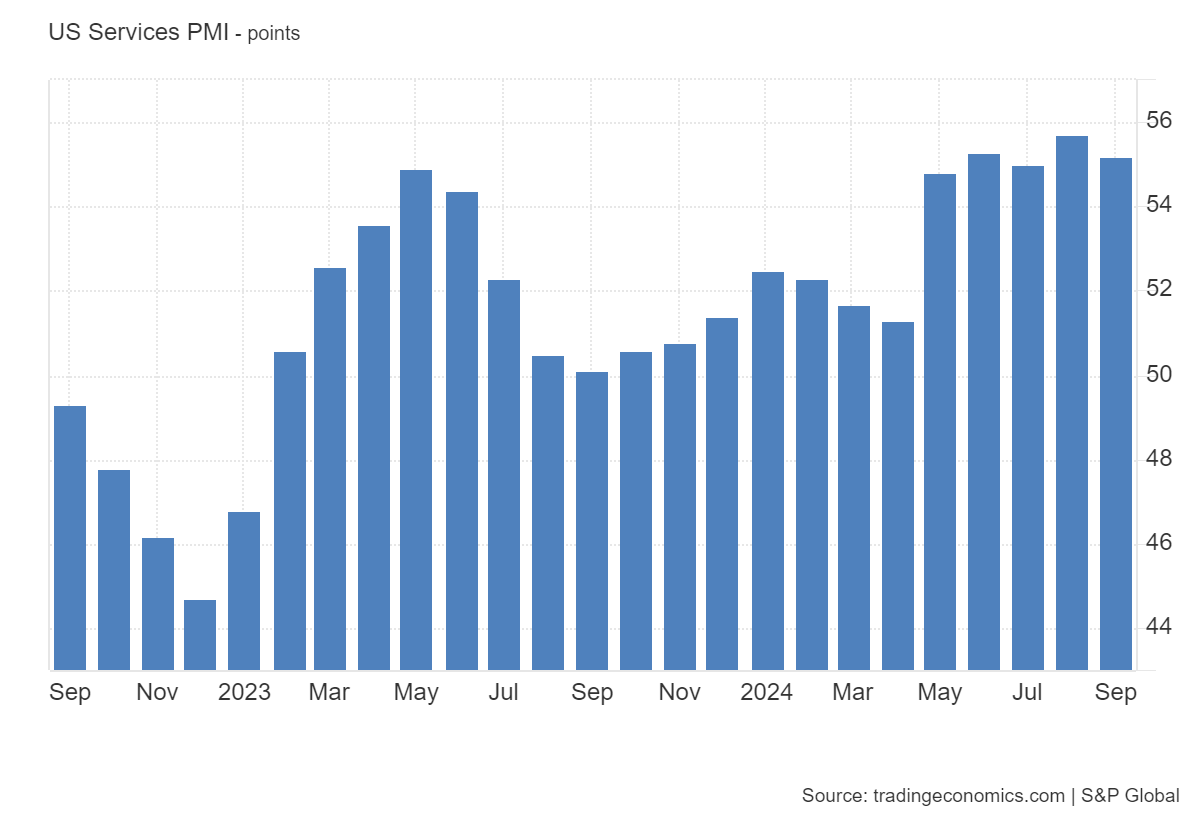

In September, the US Services PMI index was 55.2 – lower than the value of 55.7 reported in August.

A strong services sector is a positive sign for the economy, which may reduce interest in riskier assets like crypto.

In conclusion, the week’s economic data is expected to show minor changes, with slight increases in unemployment claims and modest movement in the PMI indices. It is important to watch the data releases closely – especially the Manufacturing PMI. If the data reveals a weakening economy, deviating from the expected pattern, it could boost interest in the cryptocurrency sector for sure.

Stay tuned to Coinpedia for more economic insights capable of influencing cryptos!