MANTRA (OM) price continued its bullish streak and was on the cusp of a multi-month breakout. The market trend and technicals appear poised to initiate a new bullish cycle above the $1.42 ATH mark soon.

Since the first week of September, OM crypto saw a V-shaped recovery and surged over 50% last month. A rounding bottom pattern was observed, and the OM price edged closer to the crucial neckline barrier of $1.40.

A successful breakthrough above $1.40 would validate the ATH breakout. This could send OM crypto toward the $2 mark in the following sessions.

– Advertisement –

MANTRA price traded at $1.36 at press time, noting an intraday surge of over 1.89%. It was positioned as the 62nd largest crypto with a market cap of $1.25 Billion.

It has a circulating supply of 916.80 Million, and the OM/BTC pair was traded at 0.0000219 BTC.

OM Price Prediction: Can MANTRA Make a New All-Time High This Month?

The daily timeframe analysis showed that OM crypto was mired in a parabolic upward movement. It has created a bullish streak in the past six days, surging more than 15% this week.

The Daily RSI supported the bullish outlook; it rests in the overbought zone, at 73 at press time. This conveyed a heightened buying pressure on the chart.

****

****

****

**

OM Price by TheCoinRepublic on TradingView.com

**

****

Moreover, the MACD indicator plotted the green histogram readings. It indicated a bullish stance.

What Are Analysts Saying?

Crypto traders and analysts on X positively view the future OM price trend. A tweet by @neil_xbt in his post said that OM crypto showed a sustained upward movement despite the weak market cues.

It has a strong support of around $0.85 and may reach the $2 level by the end of this year.

Furthermore, a tweet by @Blockunity highlighted that the OM crypto price is testing a crucial resistance zone at around $1.40. Above this mark, new highs are imminent.

However, the prompt support zone was around $1.10. From the indicators’ view, trend identifiers and magic bands represented a strong bullish momentum, favoring the rise.

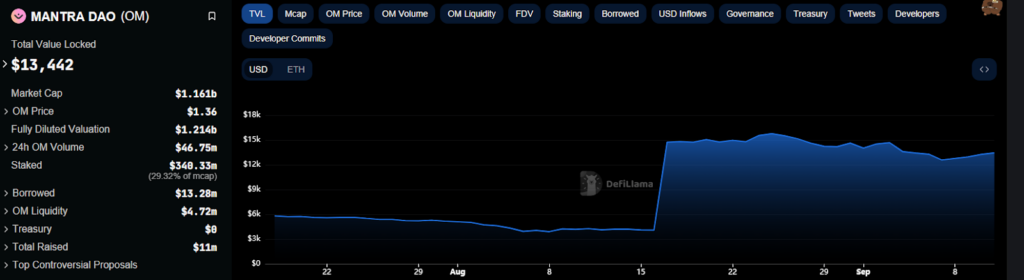

Since September 2024, MANTRA’s TVL saw a significant surge, noting around $13,442 at press time.

This significant surge in TVL reflected the growing investor confidence in the network. Hence, the OM price rose.

Source: DeFiLlama

Looking at the futures market, the Open Interest (OI) surged by over 16.82% to $32.96 Million. This signified the long buildup activity over the past 24 hours.

More than $29.54k of short liquidations were noted. At the same time, only $8.7k of long liquidations were now. It conveyed that short traders were in a dilemma and looked in fear.

The immediate support zone was $1.20 and $1.10. In contrast, the upside barriers were $1.42 and $1.60.