Meta is the rising new US stock, a breakout company that proves its mettle after the latest rebranding. Meta is on the verge of reporting its Q3 earnings report, which is scheduled to go live on October 30th. As investors are bracing for new positive reveals and unveilings, let’s explore the possibilities of Meta exploring a new surge after its Q3 report announcement.

Also Read: META Stock Price Target for 2030: Should You Buy Now?

Facebook’s transition to Meta was certainly not easy. The rebranding took a great deal of effort and time. The year 2022 was quite harsh for the company, but nevertheless, Meta persevered to emerge as one of the top tech companies in the world.

With billions attached to its name, Meta is surging high on the investor radar, keeping them hooked as it prepares to reveal its Q3 earnings report on October 30th.

The Meta stock is up from $542.81 on September 19th to $567 at present, spreading a generally positive sentiment in the long haul. Speaking about technical indicators, Meta’s relative strength line is still above 90, signaling an overall bullish outlook. The stock is not showing vulnerabilities, which is again a positive sign for investors to rely on.

With Meta’s giant leap of faith in the realm of the metaverse and AI, analysts are generally issuing a bullish buy call for the stock. With Meta controlling the majority of the global social media platform, analysts are bullish on Meta’s future growth.

The Q3 expectations for Meta are also quite bullish. The analysts at Factset have forecasted how Meta may posy 19% gains, with a $5.21 per share value. The platform’s sales may also report a striking surge, climbing 14.4% to $40 billion.

“For the full year, Meta’s earnings are seen increasing 37% to $21.36 per share, while sales rise 20% to $161.8 billion, according to FactSet.”

Also Read: SEC Can’t Stop It: Ripple CEO Predicts Inevitable XRP ETF Approval

TipRanks Forecast For The Leading US Stock

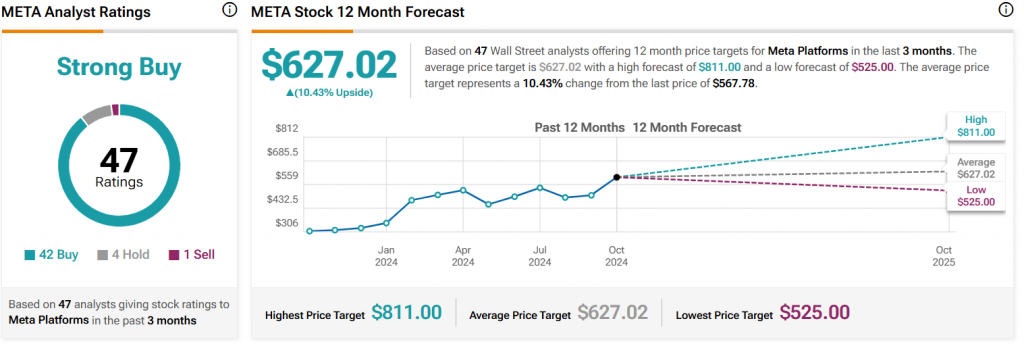

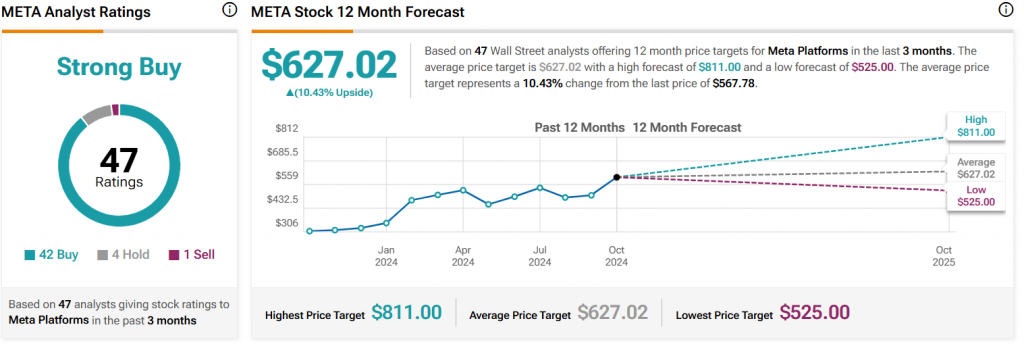

As per TipRanks, Meta is currently targeting the $627 value, with a high mark of $811, which it can achieve in the next 12 months.

“The average price target for Meta Platforms is $627.02. This is based on 47 Wall Street Analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $811.00; the lowest forecast is $525.00. The average price target represents a 10.43% increase from the current price of $567.78. Meta Platforms’s analyst rating consensus is a strong buy. This is based on the ratings of 47 Wall Street analysts.”

Also Read: Shiba Inu Forecasted To Hit 2-Cent, Find Out When