Metaplanet, a Japanese investment firm, ranks second on TradingView’s list of top-performing stocks in Japan. The firm has registered an outstanding year-to-date performance of 740%, ranking second behind Beat Holdings Limited, which currently claims the top position with a 980% performance metric within the same timeframe.

Metaplanet’s involvement in Bitcoin has boosted its stock price significantly. In May, the company adopted Bitcoin as a strategic reserve asset due to economic pressures in Japan.

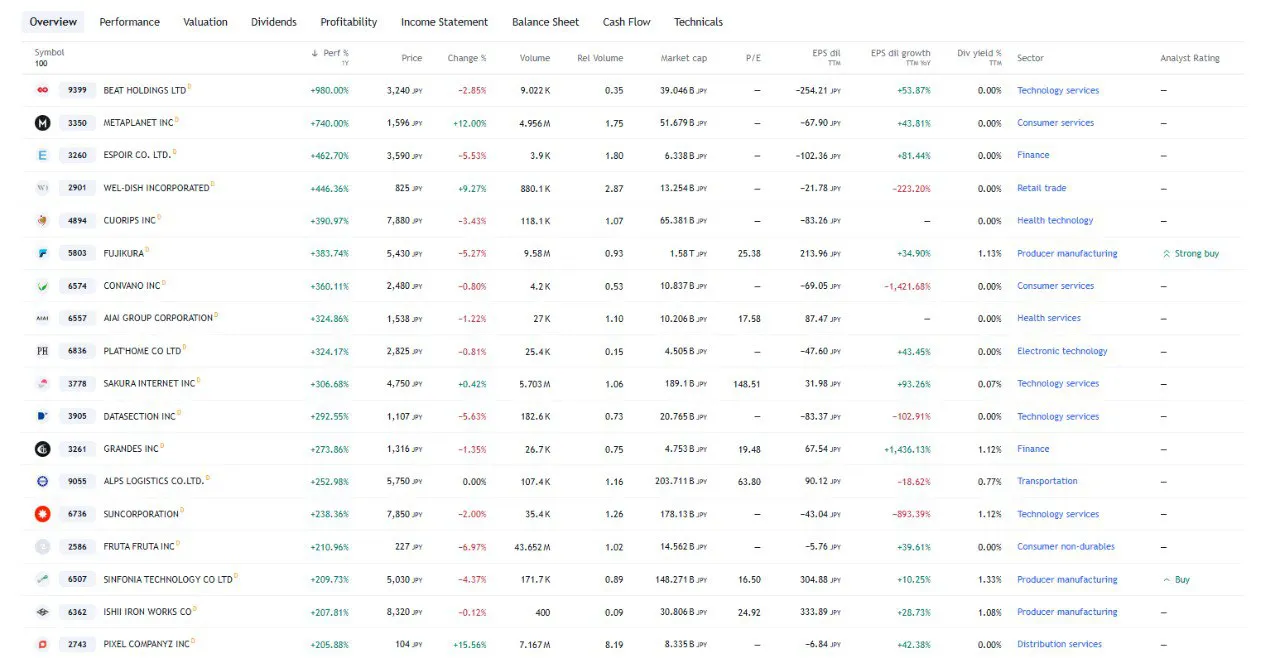

Metaplanet stock records 740% YTD growth

Metaplanet’s stock has grown by 740% since the beginning of the year and currently ranks second behind Japanese global investment company Beat Holdings Limited, which boasts a 980% growth. Metaplanet’s performance is heavily attributed to its decision to follow Michael Saylor’s playbook and adopt Bitcoin as part of its reserve asset.

Metaplanet stock is currently retailing at 1,596 yen (approximately $10.45 at current rates) and is up 12% in the last 24 hours. According to data from price-tracking software TradingView, the company’s trading volume in the last 24 hours settled at 4.956 million yen.

Japanese stocks with the best yearly performance Source: Tradingview

According to data from Bitcoin Treasuries, Metaplanet currently holds 1018 Bitcoin worth approximately $71,38 million at current market prices. The company’s average cost of 1 BTC is $62,854, and the PnL of the holdings sits at 11.52% at the time of this publication. The company ranks nineteenth on Bitcoin Treasuries’ top companies with the largest Bitcoin holdings.

Data from Bitcoin Treasuries shows the company actively purchased Bitcoin on seven different occasions in October. The highest purchase involved 156 Bitcoin on October 28th, which is the highest single-day purchase the company has made so far.

Metaplanet is publicly traded on the Tokyo Stock Exchange and has diversified business experience in financing, trading, and real estate. The company recently reorganized its focus to buying Bitcoin in a bid to enhance shareholder value amid rising economic uncertainty in Japan that has caused increased volatility in the country’s fiat currency.

The yen is set to continue being volatile following analysts’ speculations that the Bank of Japan will likely stay on its course. A rate hike is expected in December or early next year.

Metaplanet secures a 1 billion yen loan to buy Bitcoin

In August, the company said it had secured a 1 billion yen loan ($6.8 million) from British Virgin Islands-based MMXX Ventures with a 0.1% annual interest that would be dedicated to accumulating more Bitcoin. The company also sold put options yielding 23.97 Bitcoin worth $1.4 million at the time to Singaporean digital asset trading firm QCP Capital.

Michael Saylor, chief executive officer of Microstrategy, was among the first executives to add Bitcoin as a strategic reserve asset. Microstrategy began accumulating Bitcoin in August 2020 and currently ranks first among companies with the largest Bitcoin holdings.

According to data from Bitcoin Treasuries, the company has 252,220 Bitcoin books valued at approximately $17.67 billion. Microstrategy’s average Bitcoin purchase price is $39,266. The company’s most recent purchases were a 7,420 Bitcoin purchase on September 20th and another transaction worth 18,300 Bitcoin on September 13th.