- MEW hit a record high after its Bitstamp listing

- Threat of a pullback still looms large

After the era of dogs and frogs, cats have now claimed their space in the memecoin world. Leading this trend is cats in a dogs world [MEW], which pounced to an all-time high [ATH] of $0.0117 on the charts.

This record high was driven by Bitstamp’s listing of the token with two trading pairs: MEW/USD and MEW/EUR. Following the announcement, the Solana [SOL]-based token rallied by double-digits.

Here, it’s worth noting that the decentralized on-chain perpetual swap platform, Drift Protocol, also added support for MEW Perpetual Futures.

Previously, on 22 October, MEW Perpetual Futures were launched on Kwenta and the Synthetix – A layer-2 chain on Base.

MEW tops market gainers

This new ATH followed just days after MEW set its previous record, thanks to its listing on Upbit. At press time, the price had settled at $0.0112, marking a 7.91% hike over the last 24 hours, according to data from CoinMarketCap.

Additionally, the token secured the first spot among the market’s daily gainers. The 24-hour trading volume also climbed by 35.71%.

On the back of this price surge, MEW’s market capitalization saw a notable boost too. It hiked by 5.30% to reach $955.51 million, signaling robust confidence in this Solana-based token’s future potential.

Is the bullish rally under threat?

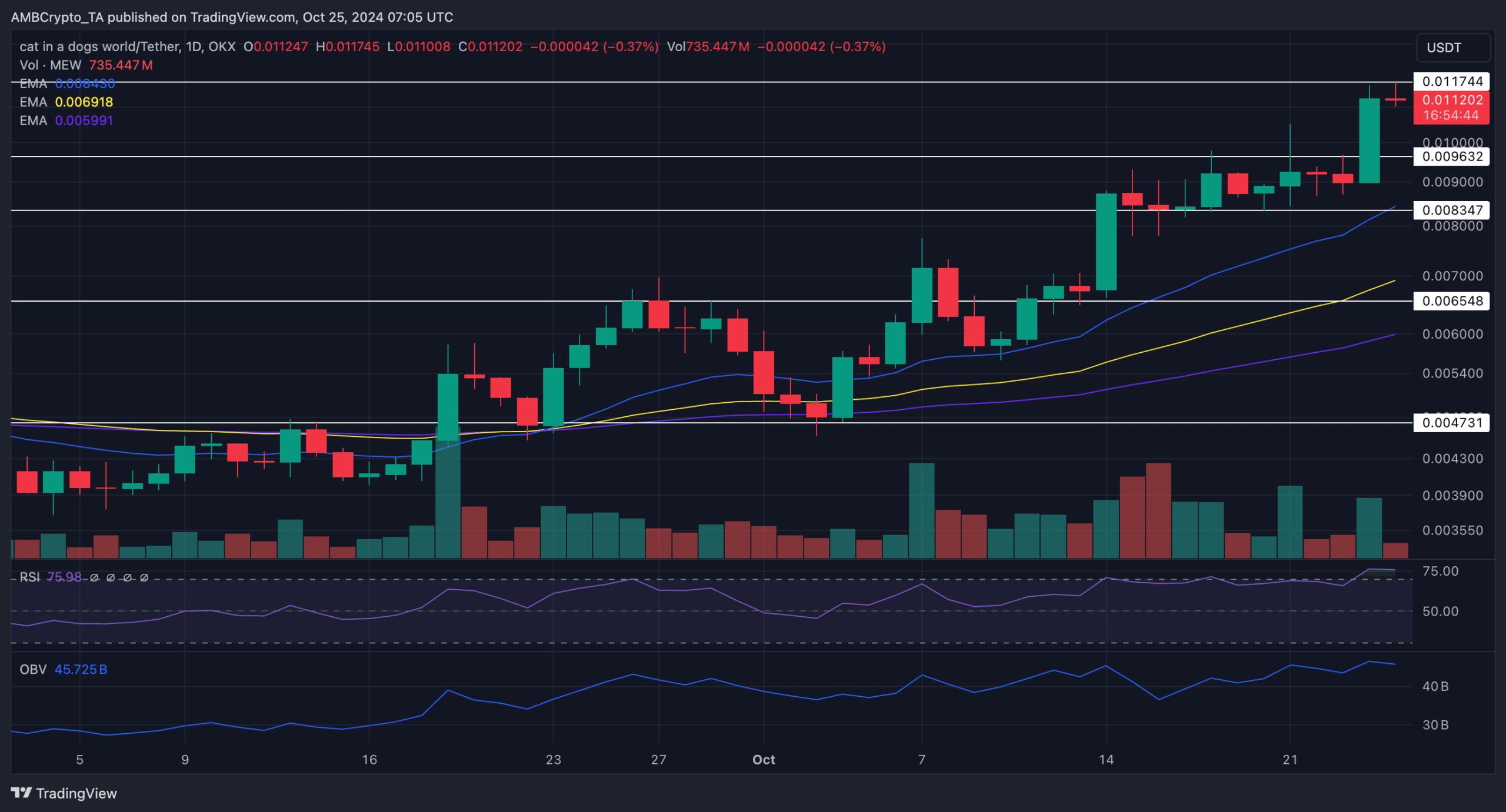

Despite the current optimism, however, the risk of sell-offs shouldn’t be underestimated. AMBCrypto took a closer look at the daily chart to find out how the bullish momentum would fare under current market conditions.

The RSI’s press time value of 75.98 indicated the asset was slightly overbought, which may lead to a correction. Additionally, a dip in the OBV to 45.725 million alluded to a mild fall in buying pressure.

In the event of a pullback, the $0.009 level can likely provide support to MEW. However, if selling pressure intensifies, the price could retrace towards the 20 EMA at around $0.008.

A fall below this level would slightly tip the scales in the sellers’ favor. On the other hand, if the bulls hold steady, the token could continue rising, potentially hitting new record highs.

Liquidation heatmap analysis

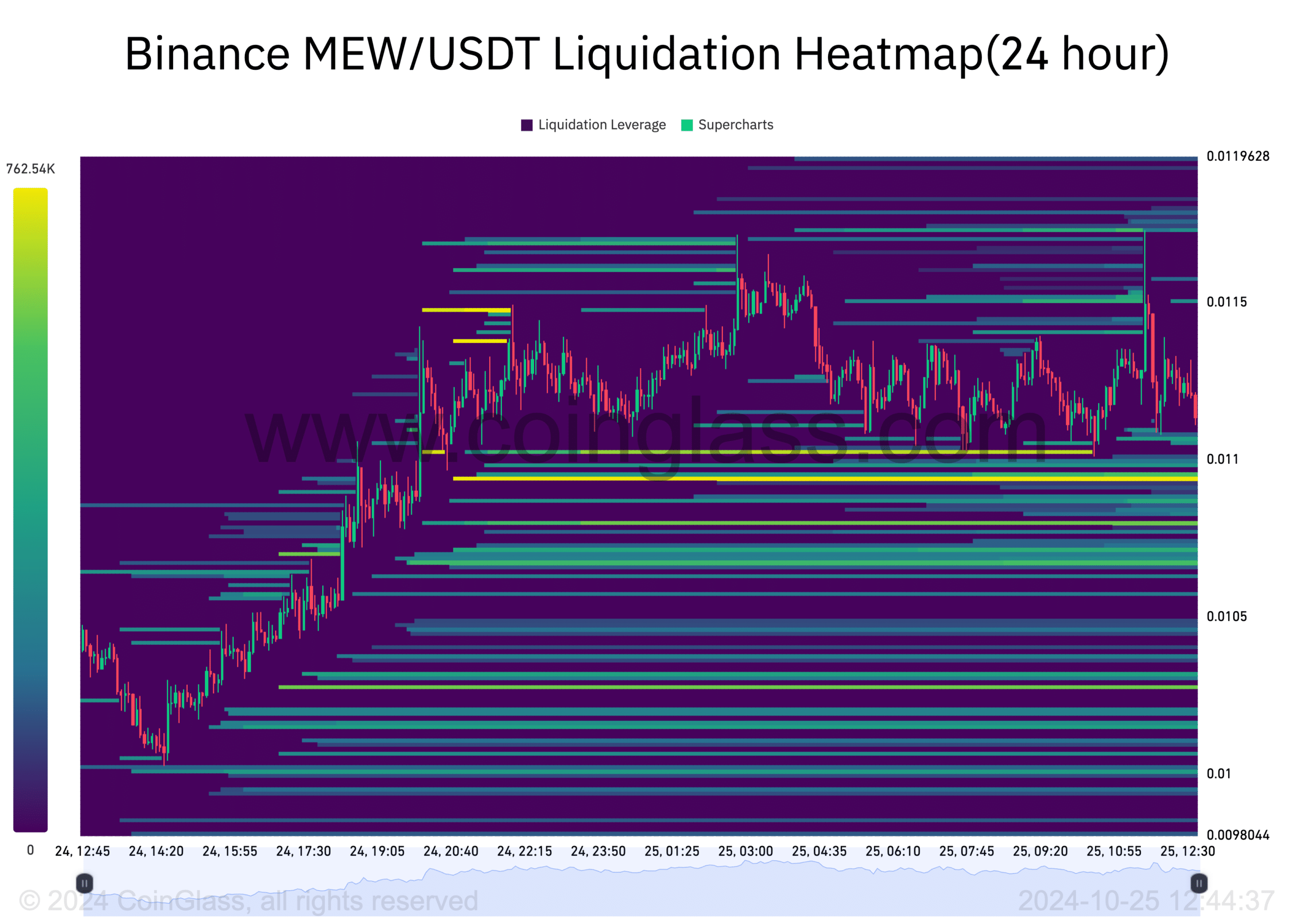

However, before the bull rally continues, a short-term drop could be on the cards.

AMBCrypto identified a significant liquidity cluster around $0.011 on Coinglass’ liquidation heatmap. Another stronger magnetic zone was found at $0.0109.

Realistic or not, here’s MEW’s market cap in BTC’s terms

These clusters suggested the price may briefly dip to these levels to capture liquidity before the uptrend resumes, drawing in fresh buying interest from these zones.