- MEW has surged by 47.06% over the past months

- Analyst and market fundamentals indicate a correction as market sentiment turns bearish

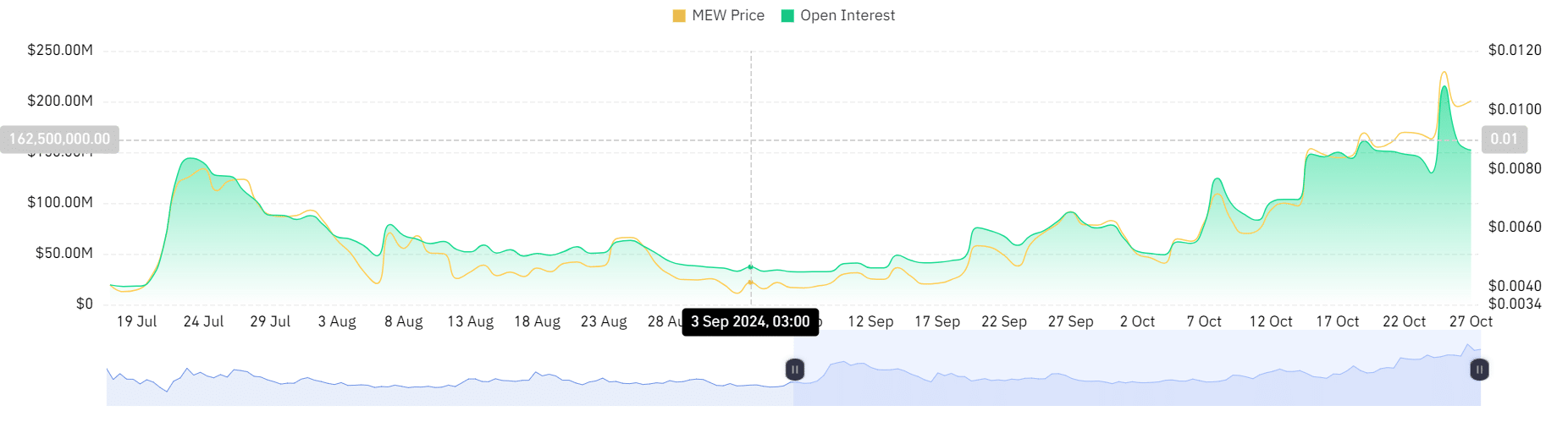

Over the past month, Cat in a Dogs World [MEW] has experienced strong upward momentum. Since hitting a monthly low of $0.0046, MEW has been on an upward trajectory.

In fact, as of this writing, MEW was trading at $0.01. This marked a 47.06% increase over the past month with an extension to this bullish trend by 16.74% on weekly charts.

This prevailing market condition has left analysts deliberating on the memecoin’s future trajectory. While some were optimistic about the current trend, others were pessimistic and saw the trend coming to an end.

One of these analysts who sees a potential pullback was Man of Bitcoin, who suggested a correction citing wave 4 of the Elliot wave.

Market sentiment

In his analysis, Man of Bitcoin posited that MEW was working on wave C of 3 on the upside.

Source: XThis meant that the memecoin was in the final phase of the upside. Thus, according to him, MEW was completing the upward movement within wave 3 by forming a peak before wave 4.

When the peak of wave 3 forms, the corrective wave 4 usually begins. This implied that the memecoin was set to decline in its price charts.

Therefore, a break below the ascending trendline would indicate a shift in market sentiment. This will signal the end of Wave 3 and the start of Wave 4, where the memecoin will see a pullback.

Based on this analogy, the memecoin might be getting ready for a pullback even though it’s still in an upward movement.

What MEW’s chart says

Undoubtedly, the analysis provided above provides caution, pointing out that the memecoin was likely to decline. However, it’s essential to counter-check other market indicators and determine what they suggest.

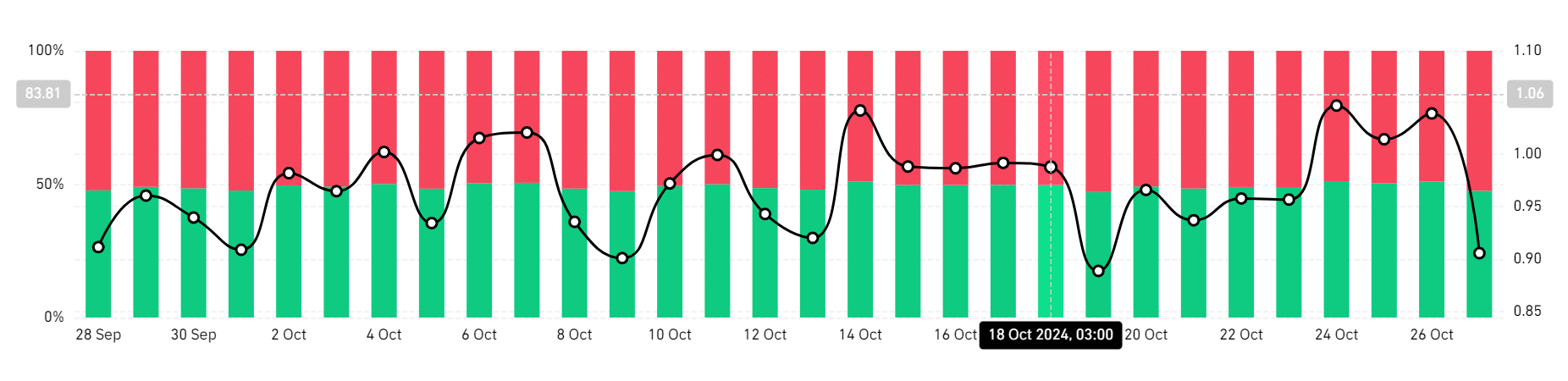

Firstly, MEW’s long-short ratio showed that short positions were dominating the market. Shorts had 52.7% of total positions, while longs were 47.2%. This suggested that most traders were bearish and were betting on prices to drop.

Additionally, MEW’s open interest declined by 29.30% over the past 48 hours, dropping from $215 million to $152 million. This suggested that investors were closing positions without opening new ones, signaling a lack of confidence in the memecoin’s direction.

MEW’s Directional Movement Index showed that the current trend was losing momentum. The ADX surged to 54.8 while +DI declined to 37., indicating that bears were starting to gain control of the market.

Realistic or not, here’s MEW’s market cap in BTC’s terms

Simply put, although MEW was in an uptrend, the memecoin was experiencing a shift in sentiment. Thus, as observed above, the memecoin was in the final stages of the uptrend, and a market correction was imminent.

If the memecoin declines, it will find its support at $0.0087. Consequently, for a continued uptrend, the memecoin must remain above its SMA at $0.0095.