Microsoft shareholders face a critical decision on a Bitcoin investment plan this December. The board opposes the proposal of the National Center for Public Policy Research (NCPPR). The group says Bitcoin works well against inflation.

They suggest companies put at least 1% of their assets into cryptocurrency. Major corporations like Microsoft are now showing more interest in using Bitcoin to spread their investments, and the vote comes as more companies seek new ways to protect their assets.

Also Read: SEC Can’t Stop It: Ripple CEO Predicts Inevitable XRP ETF Approval

Exploring the Potential Impact of Microsoft’s Shareholders Voting on Bitcoin Investment

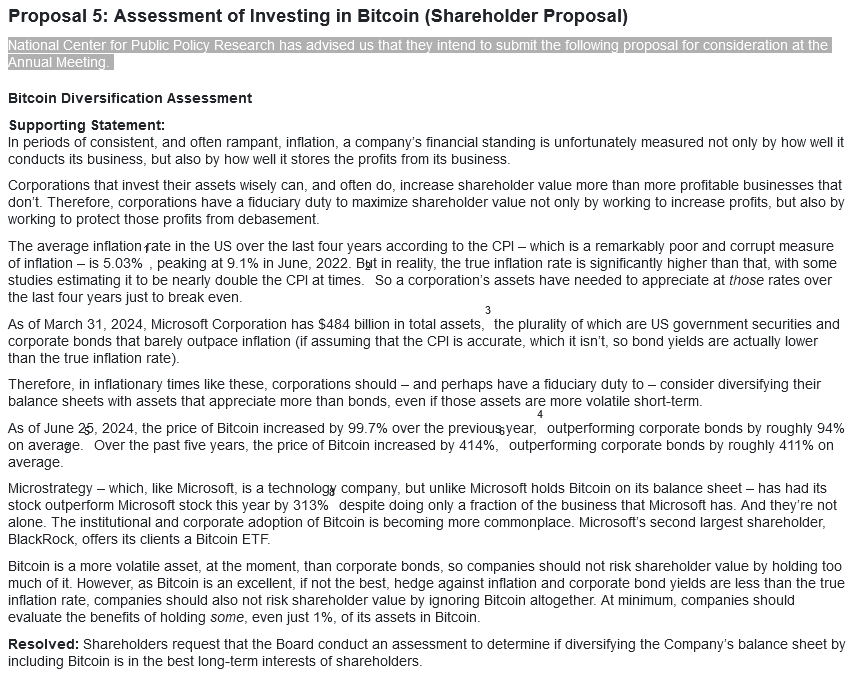

The Proposal’s Foundation

NCPPR points to Bitcoin’s strong performance. The cryptocurrency rose 99.7% in one year, beating corporate bonds by 94%. They note how competitor MicroStrategy’s stock grew 313% more than Microsoft’s through Bitcoin holdings.

Microsoft currently holds $484 billion, mostly in government securities and corporate bonds, which barely keep up with inflation. Microsoft received a proposal suggesting that this traditional approach needs updating.

Board’s Opposition and Current Strategy

“Microsoft has strong and appropriate processes in place to manage and diversify its corporate treasury for the long-term benefit of shareholders and this requested public assessment is unwarranted,” the board stated.

They say they’ve looked at Bitcoin before. The board worries that cryptocurrency’s price swings could affect their daily operations and cash needs. Microsoft’s current investment approach focuses on stability and predictable returns.

Also Read: New Solana Memecoin Rises 1500% in 2 Weeks, Could Soar Higher: Analyst

Market Implications and Institutional Adoption

More big institutions now invest in cryptocurrency. BlackRock offers Bitcoin ETFs. NCPPR believes “Bitcoin is an excellent, if not the best, hedge against inflation.” They highlight how Bitcoin beat corporate bonds over five years, growing 414%. This trend shows the growing acceptance of cryptocurrency in traditional finance.

The December Vote’s Significance

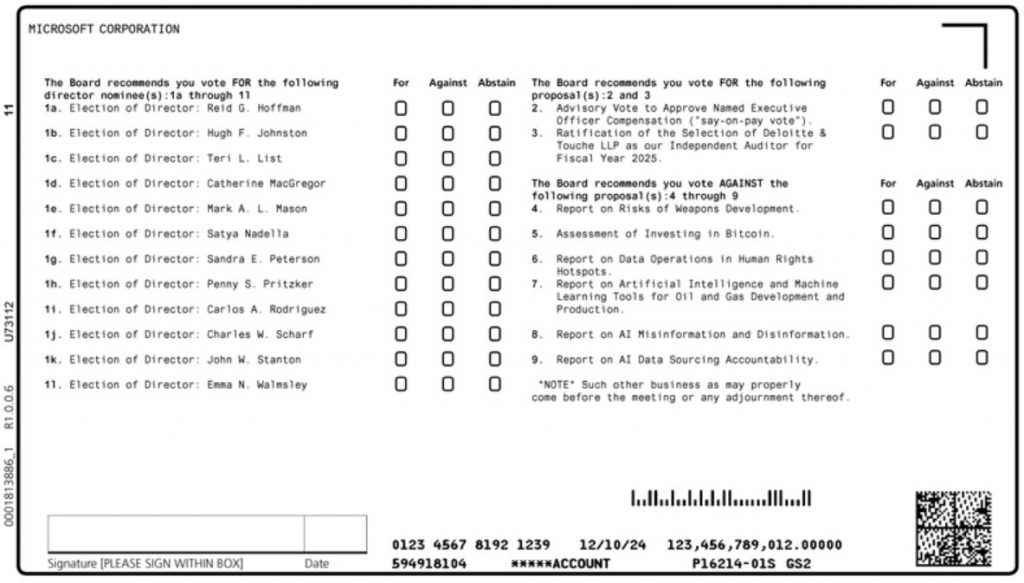

The December 10, 2024, vote could change how big companies view cryptocurrency investment. Microsoft’s board likes its current strategy. However, NCPPR says companies must look at investments that grow more than bonds.

Also Read: Shiba Inu Forecasted To Hit 2-Cent, Find Out When

They believe this duty exists even if these investments show more short-term price changes. The outcome could influence other major corporations’ investment decisions.