Michael Saylor, the founder of MicroStrategy, opted to sell shares ahead of the SEC’s approval of a Bitcoin ETF. This strategic move resulted in over $20 million in net gains, marking Saylor’s first share sale in approximately 12 years. Notably, the value of MicroStrategy’s Bitcoin assets surged, rendering the company 40% profitable on paper.

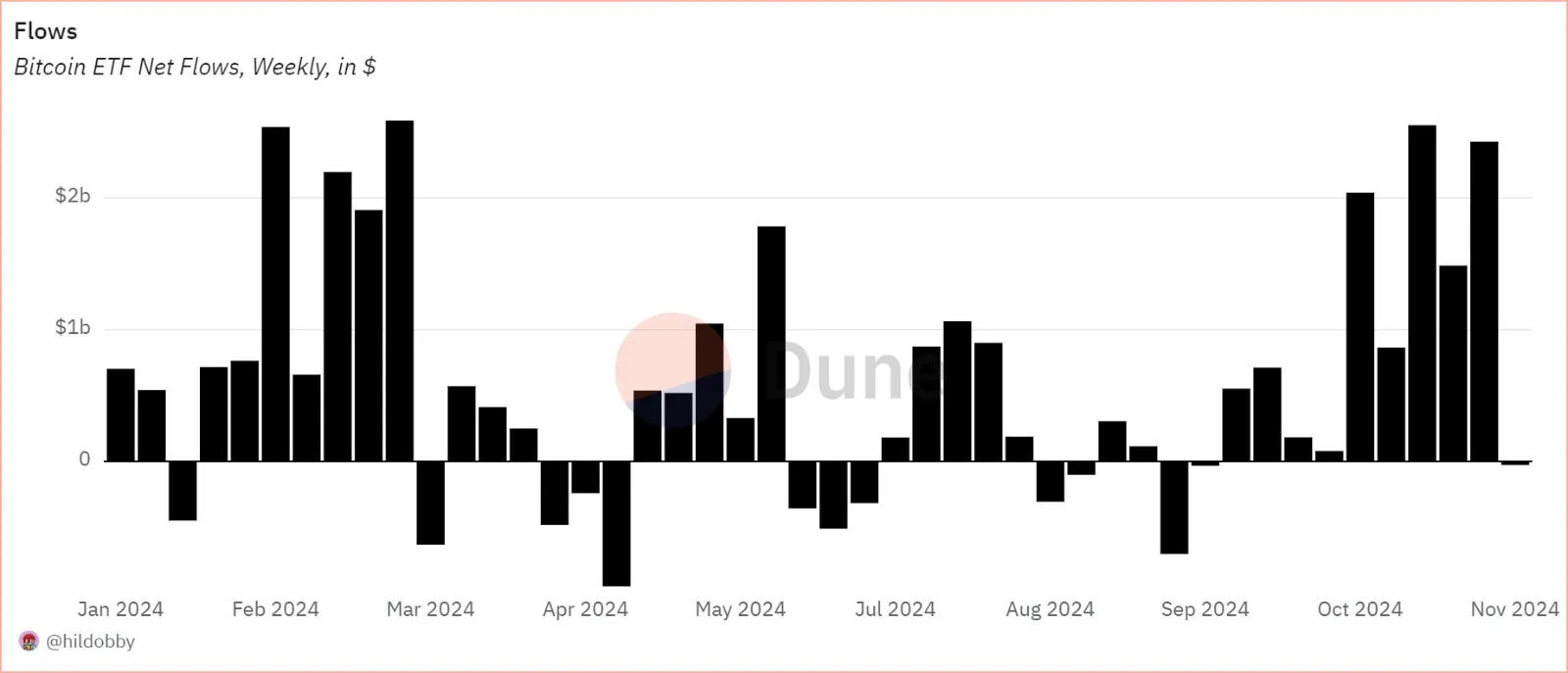

MicroStrategy’s co-founder, Michael Saylor, made a series of stock sales leading up to the recent approval by the U.S. Securities and Exchange Commission (SEC) for Bitcoin-focused exchange-traded funds (ETFs). There’s speculation that Saylor might continue selling more MicroStrategy shares, intending to use the funds from these sales for personal Bitcoin investments.

MicroStrategy Co-Founder Sells Company Shares

Recently, Michael Saylor, one of the founders of MicroStrategy, sold a bunch of company shares, making over $20 million. This move happened around the time when the U.S. Securities and Exchange Commission (SEC) gave the green light for Bitcoin-related exchange-traded funds (ETFs). Interestingly, MicroStrategy had separately sold shares worth $216 million the week before.

MicroStrategy clarified that Saylor’s stock sales were part of a plan disclosed to the SEC last year, and they were not influenced by the recent approval of Bitcoin ETFs. The plan allows for daily sales of up to 5,000 shares, scheduled from January 2, 2024, to April 26, 2024, with a total of 400,000 shares expected to be sold during this period.

MicroStrategy, known for its software solutions and significant Bitcoin holdings, faced losses during the previous crypto downturn. However, with the crypto market’s recovery, the value of MicroStrategy’s Bitcoin assets increased to around $8.3 billion, leading the company back to profitability. Currently, the company is 40% in profit on paper from its Bitcoin investments.

MicroStrategy Shares Decline Amidst Changing Crypto Landscape

Shares of MicroStrategy, a prominent player in the software sector, have experienced a 23% decrease since the start of the year. This decline is attributed in part to the approval of spot Bitcoin exchange-traded funds (ETFs), which could diminish the attractiveness of the company’s shares as an investment option.

Headquartered in Tysons Corner, MicroStrategy has long been regarded as a reflection of Bitcoin, given its substantial holding of BTC on its balance sheet. However, this correlation shifted with the SEC’s approval of 11 spot Bitcoin ETFs on January 10. Despite this change, Michael Saylor, MicroStrategy’s co-founder, does not anticipate the SEC’s approval of spot Bitcoin ETFs to have a negative impact on the company’s shares.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News