- Attempted price action below $58k could set up an opposing move

- BTC’s movement across Monday – Tuesday could be key to crypto’s next move

Bitcoin [BTC], at press time, was on a downtrend on the higher timeframe charts. The volatility it saw in the first half of August has left behind targets on the chart that the price would likely revisit soon.

Since the highs made on 25 August, Bitcoin has fallen by 10.6% on the charts. However, the price drop below $60k could see a short-term reversal. What should traders expect for the coming week of trading?

Dreaded Monday volatility could be full of opportunities

Mondays have a lot of importance in traditional markets and the high and low made on the day could set the tone for the coming week of trading. It is important for the crypto markets for similar reasons.

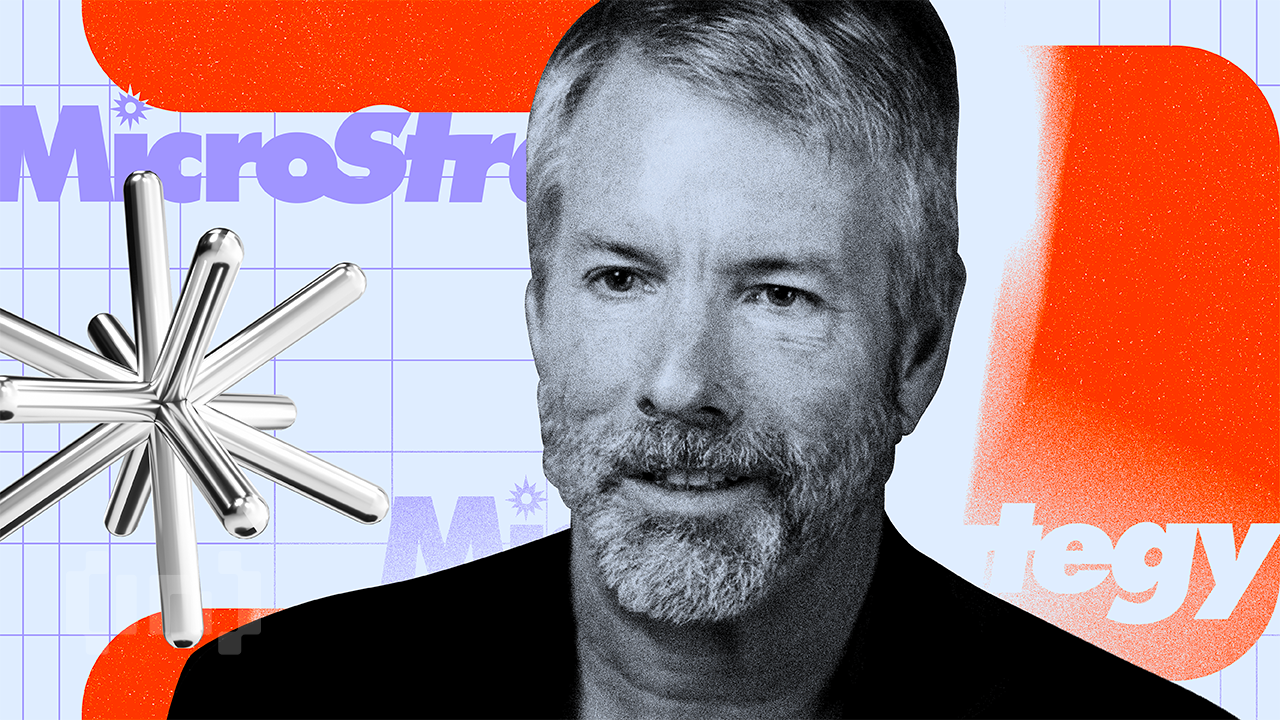

Source: CrypNuevo on X

Crypto analyst CrypNuevo observed in a post on X that there were interesting liquidity targets for BTC over the next 24-48 hours. To the south, the $56.3k region, where the price left a large wick on 15 August, could be an attractive target in the coming days.

He noted that attempted price pushes below $58k did not materialize and this was likely indicative that the market maker is building a position.

What this means is that we can expect a price move upwards to hunt the liquidity that has been built in the short term. Especially as market participants expect an extended move south. This liquidity run upwards could present a tradable opportunity.

What are the chances of a short squeeze?

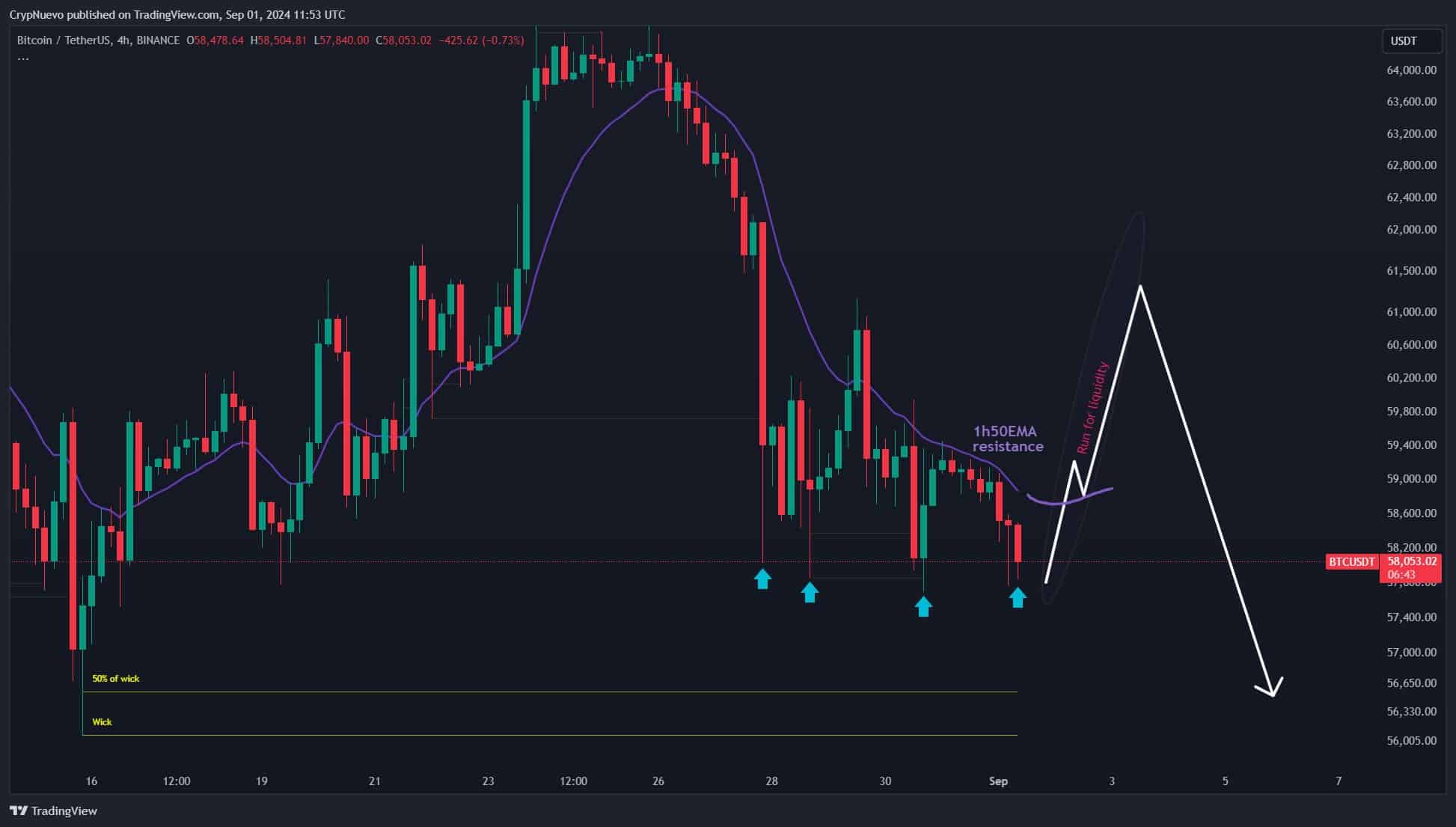

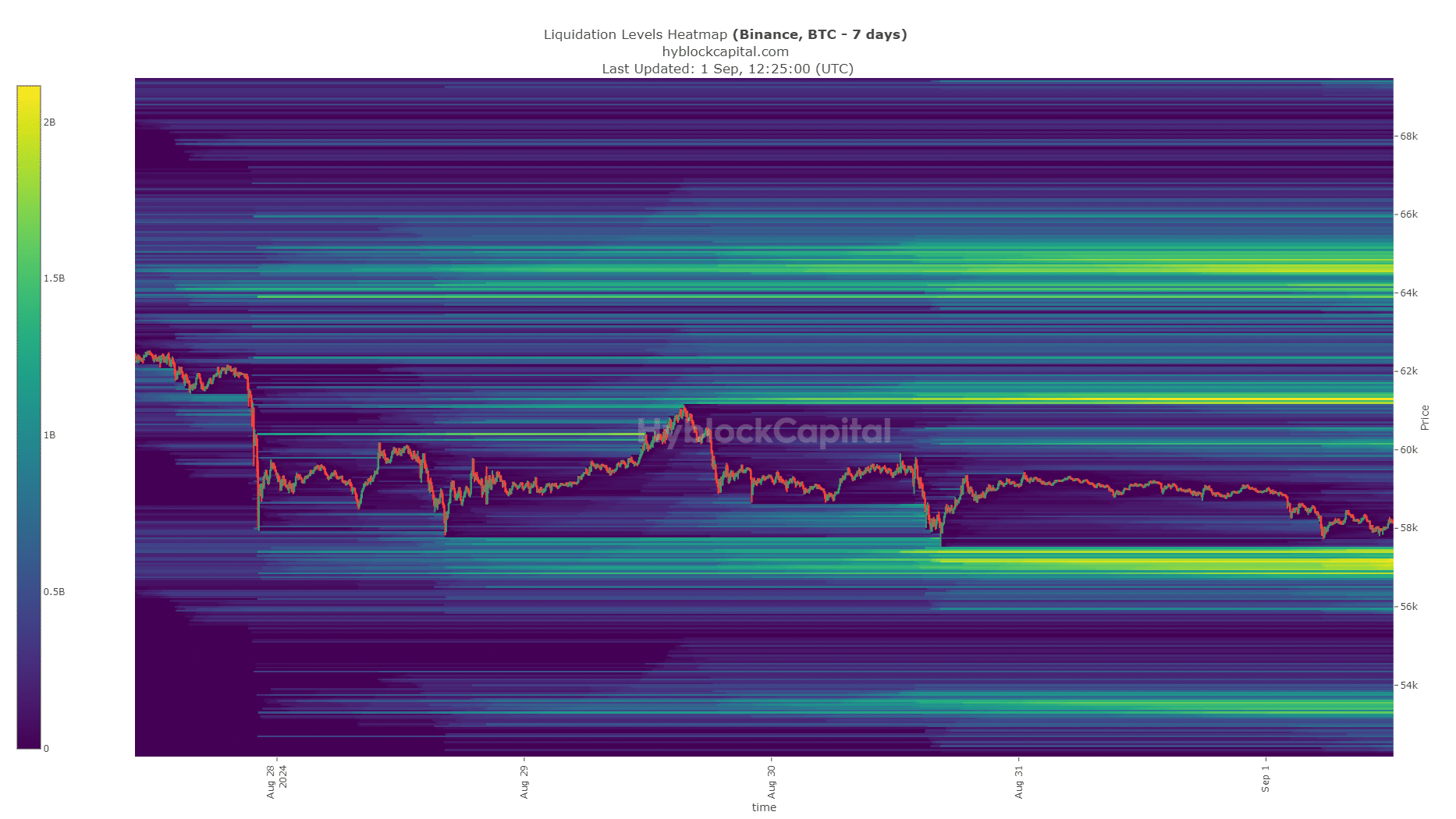

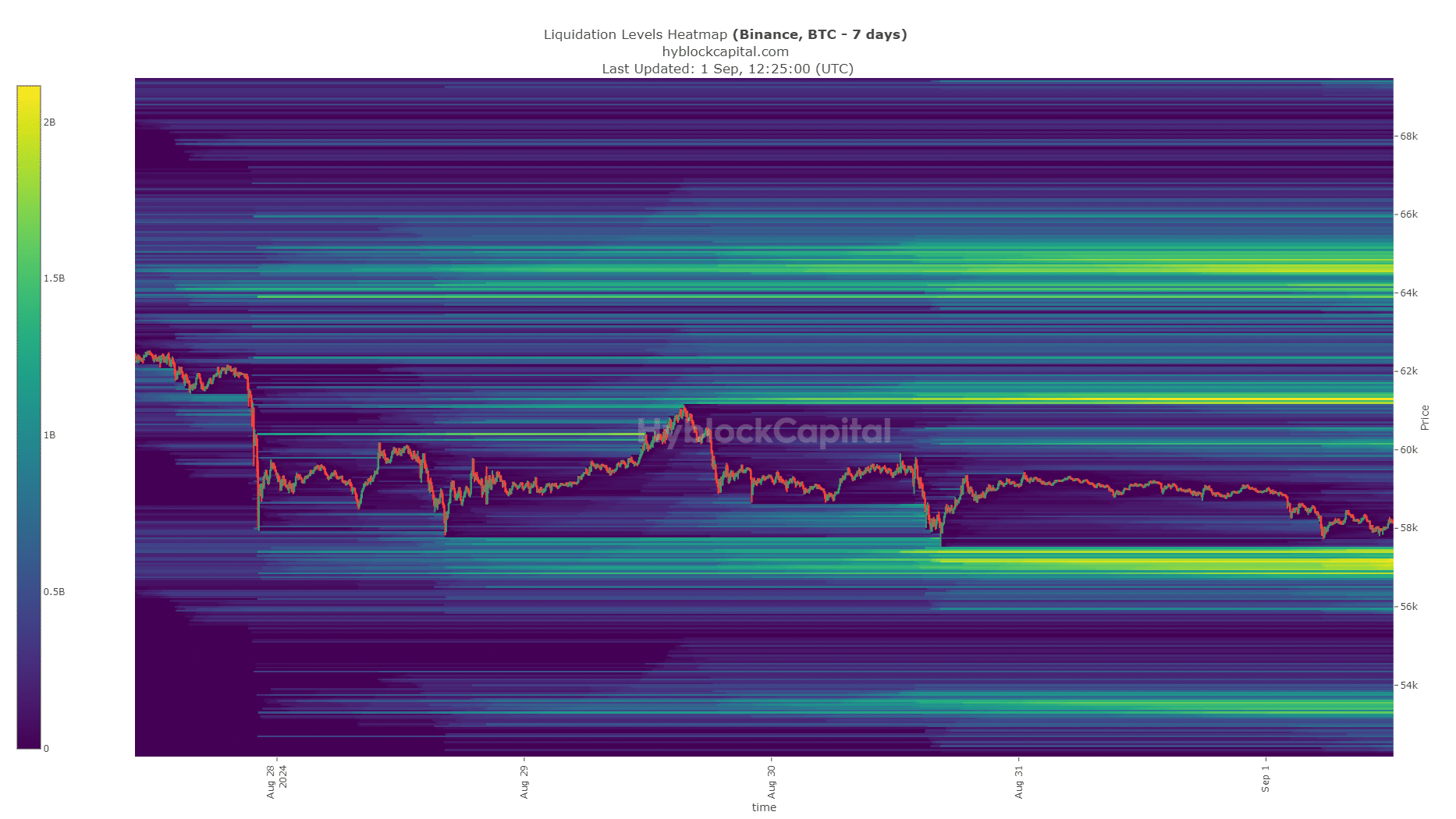

Source: Hyblock

AMBCrypto found that the short-term liquidation levels were clustered around the $57.1k and $61.3k region. Given the proximity of the market price to $57.1k, participants expect a move south.

However, this expectation has built liquidity overhead, as covered previously.

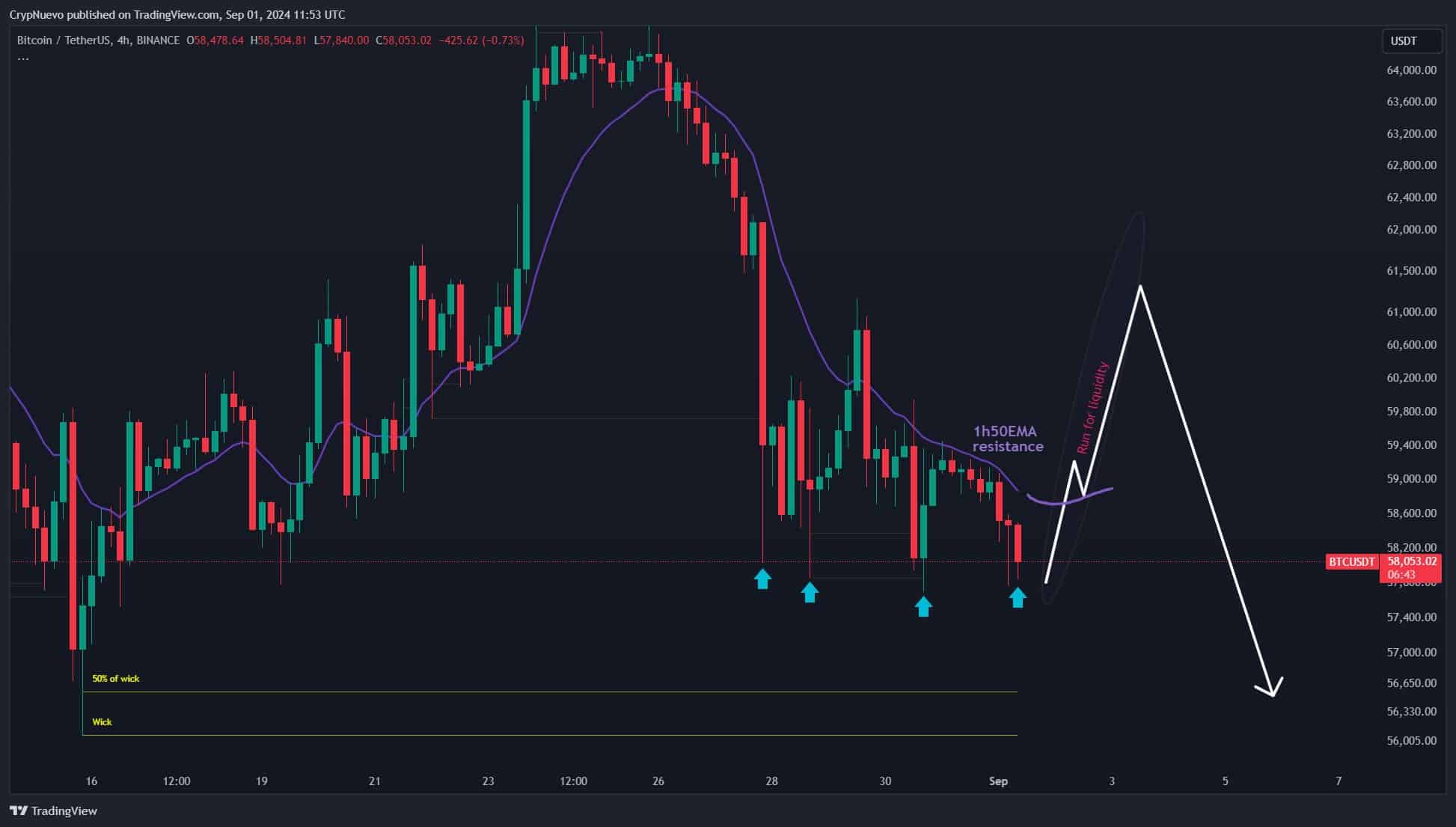

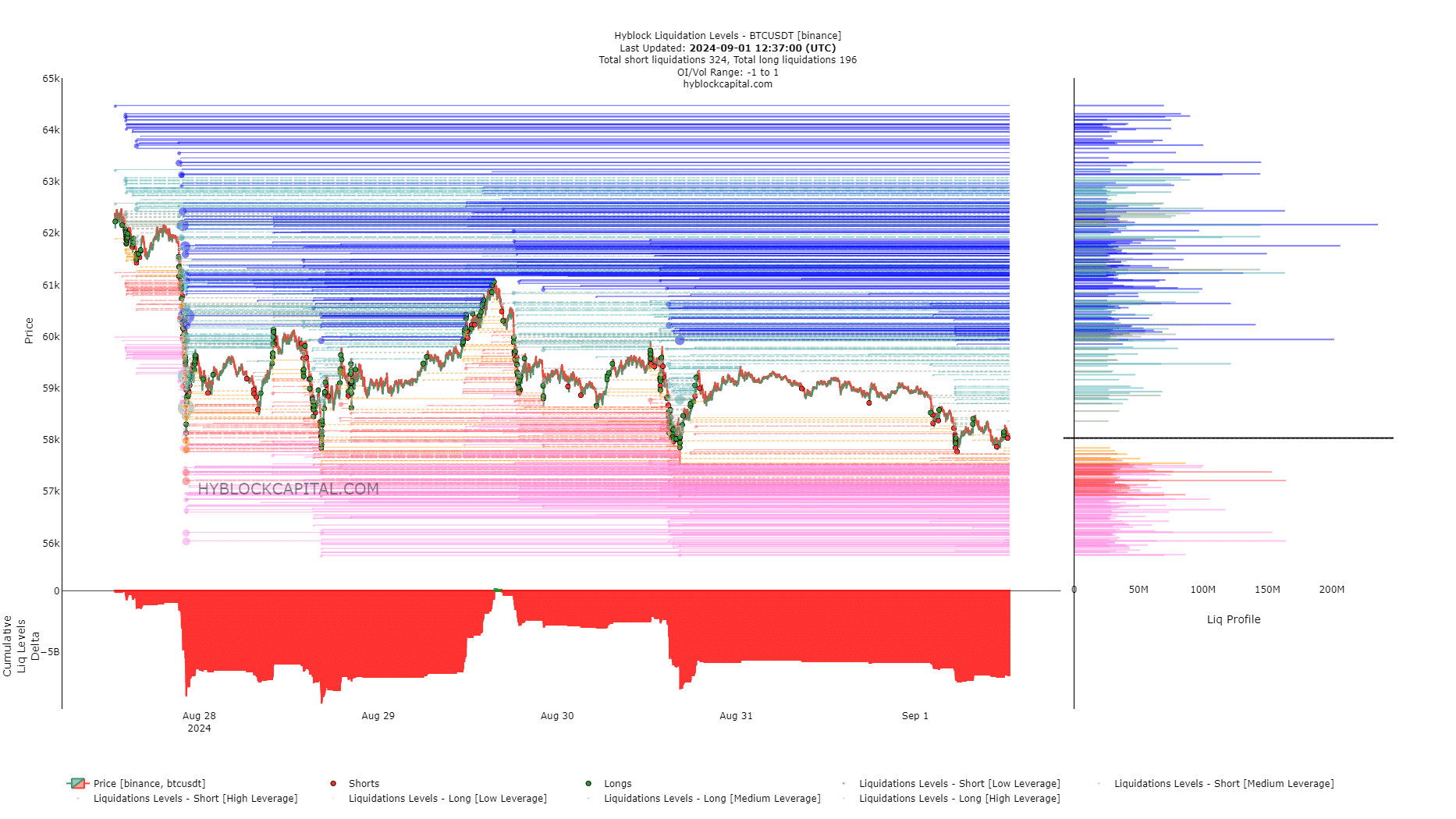

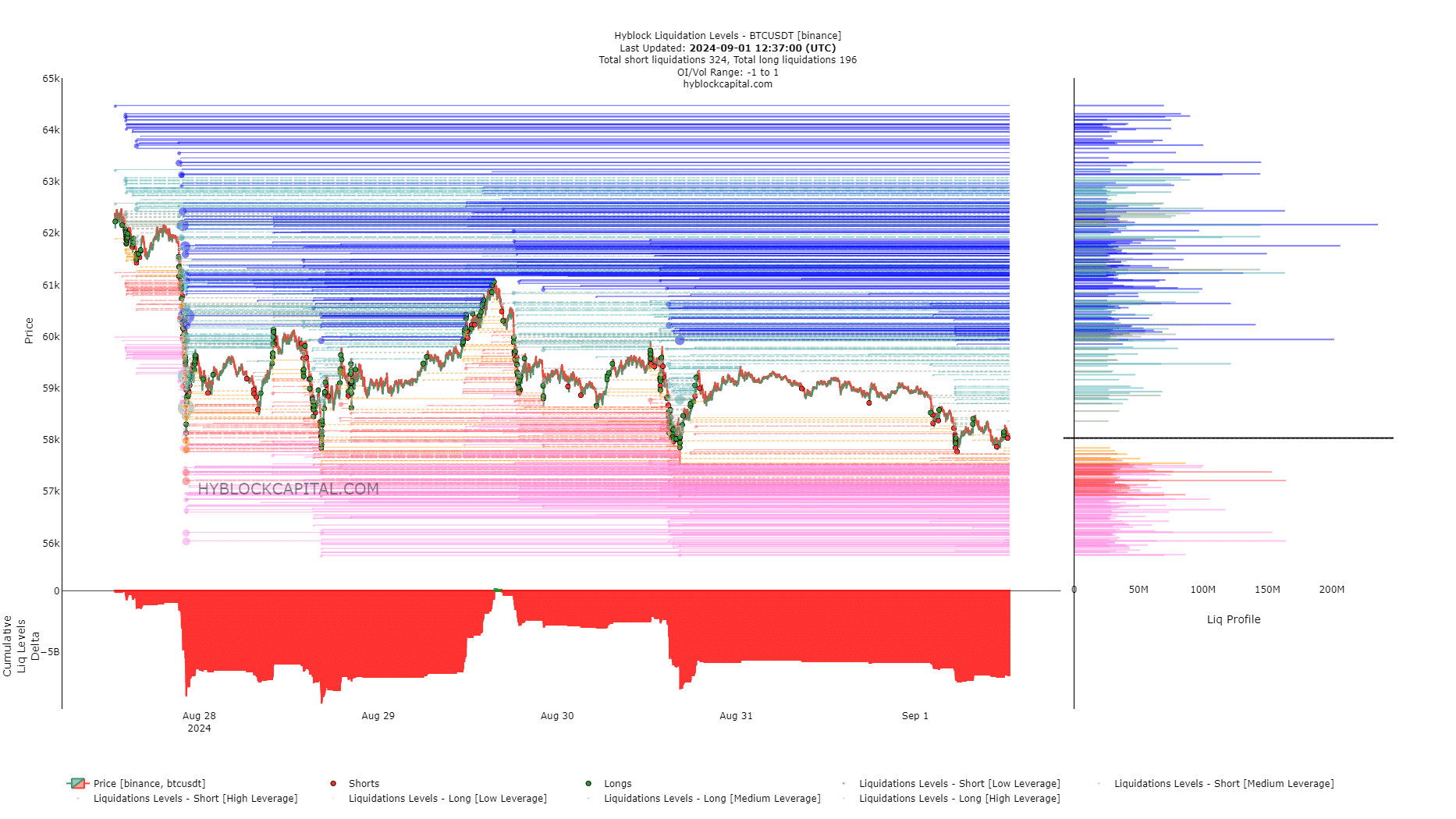

Source: Hyblock

The cumulative liquidation levels delta was highly negative and showed that the short liquidations outweighed the long ones. This could see prices shoot higher in search of liquidity and balance the Futures market’s expectations.

Is your portfolio green? Check the Bitcoin Profit Calculator

The liquidity levels saw a notable cluster at $59.9k and $61.7k, marking these as short-term targets. Traders going long before Monday would need to be brave in the face of volatility to earn profits.