BlackRock ETF head Samara Cohen has told CNBC that most demand for Bitcoin comes through investment tools like ETFs, not direct purchases from crypto exchanges.

She highlighted that 80% of Bitcoin ETF buyers are direct investors, and 75% are first-time buyers of BlackRock’s iShares products.

The total market cap of all 11 spot Bitcoin ETFs has reached over $63 billion, with nearly $20 billion in inflows. In the last five trading days, spot Bitcoin ETFs saw over $2.1 billion in net inflows, with BlackRock responsible for half.

Bitcoin hit its highest price since July, trading above $68,300, ending Q3 up 140% year-over-year. Cohen also emphasized that they initially aimed to educate ETF investors about crypto, but instead found themselves teaching crypto investors about the benefits of ETFs.

New Bitcoin ETF options

On Friday, the U.S. Securities and Exchange Commission (SEC) granted accelerated approval for 11 exchange-traded funds (ETFs) to list and trade options tied to spot Bitcoin prices on the New York Stock Exchange (NYSE).

This marks an important step forward for institutional investors, as Bitcoin options provide a flexible and efficient tool for hedging and amplifying exposure to Bitcoin.

These options offer investors a way to speculate or hedge risks related to Bitcoin’s price movements in a regulated market, with less capital required compared to trading the actual asset.

Bloomberg analyst Eric Balchunas has commented on yet another historic moment for the crypto market. According to him, the SEC approved the same thing for Nasdaq recently, so this news doesn’t come as a major surprise, despite being positive news for crypto in general.

However, the actual listing will require more time, as the new options still need CFTC approval, Balchunas said.

Bitcoin returns surpass expectations

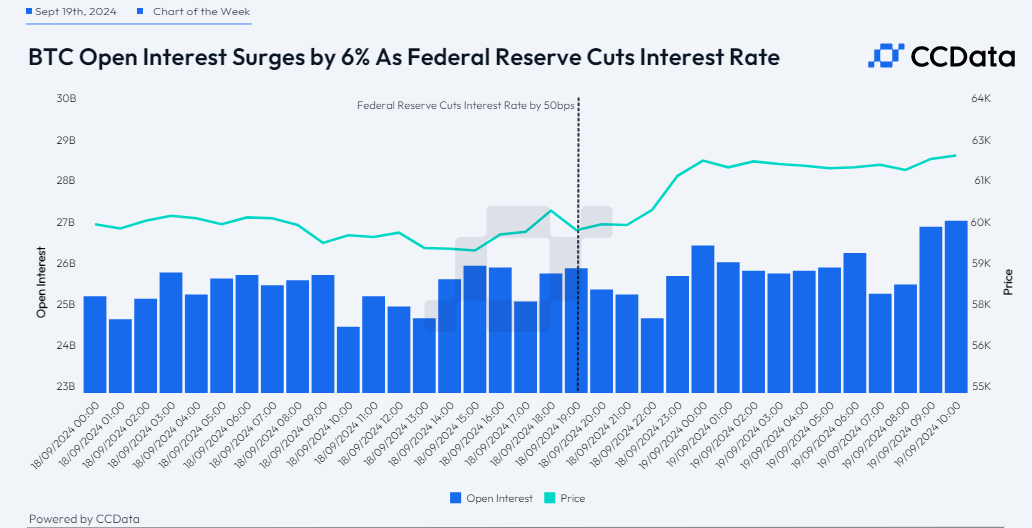

Bitcoin closed Q3 with a modest 1.00% gain, recovering after dropping below $50,000 in August, according to CCData. As we head into Q4, market sentiment has turned bullish, supported by historical data showing an average return of 49.9% in Q4 since 2014.

This optimism is reinforced by a shift in market dynamics following the Federal Reserve’s interest rate cut of 50 basis points. The cut boosted market activity, with Bitcoin’s aggregated open interest jumping 6% to nearly $27 billion.

Bitcoin’s price surged past $62,000, reflecting a strong bullish response, and altcoins followed suit, outperforming U.S. equities, which saw volatile movements.

This outperformance in the crypto market suggests that liquidity injections could follow, as the rate cut often indicates macroeconomic weakness after a multi-year tightening cycle.

If further economic stimulus is required, risk-on assets like Bitcoin are expected to benefit most, with upward momentum likely to continue in the near term.