Mt. Gox sent 1,265 Bitcoin (BTC) worth $75.36m to the Bitstamp exchange, which suggests that payouts to the company’s creditors may follow soon. This is a regular repayment process following the famous hack 10 years ago that saw 850,000BTC lost.

The latest transactions from Mt Gox’s cold wallet suggest that the repayment process is picking up. This could mean more people are set to get their lost Bitcoin back.

Mt. Gox Initiates Major BTC Transfer to Bitstamp

The transfer was 1,264.69 BTC from Mt. Gox’s cold wallet address to Bitstamp, the chosen platform to distribute the repayments. This transfer comes after Mt. Gox received 12,000 BTC from another wallet, indicating that liquidations are still happening.

These wallets help manage the repayments, as has been the trend of late, with large amounts preceding payout activities.

Bitstamp has also been central to the distribution channel. In its operations, the exchange has ensured that the funds are returned to the owners correctly.

Similar to Bitstamp, other platforms, such as Kraken, have seen creditors pay their money without much latency. This integrated approach among these platforms shows a strong process of trying to regain investor confidence.

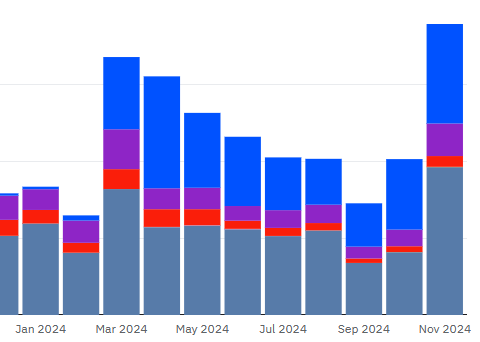

Furthermore, the order of such transactions has become a rather accurate signal of the next payments. This form of movement is seen to occur just before financial distributions and can impact the overall price of Bitcoin.

While these transfers are becoming more recurrent, stakeholders keep on observing any effects that may occur on cryptocurrency prices.

Institutional Investors Show Confidence in Bitcoin

The recent transfer has shaken the crypto market, and the price of Bitcoin has slightly reduced. Post-transaction, the cost of Bitcoin fell below $60K but has been on the rise in the subsequent days. This is a typical pattern after big wallet operations; it demonstrates the market’s reaction to the operations linked to Mt. Gox.

Ethereum’s second-most traded cryptocurrency also dropped and was trading below the $2,600 level.

Although short-term market responses have some consequences on the crypto fear and greed index, it is currently showing signs of increasing fear among investors that may affect their trading behavior shortly. However, the general feeling in the market is cautious optimism as the repayment process is being conducted.

Such interest from institutional investors is a positive sign for the market’s stability in the long term. Inflows into US spot Bitcoin ETFs, especially from BlackRock’s Black Oak Investment Trust and Ark’s Next Generation Internet ETF, mean investors remain optimistic about Bitcoin’s price potential.

On the other hand, GBTC of Grayscale has seen outflows, which show that managers are not only buying the fund’s holdings but diversifying their portfolios.