NEAR Protocol is currently one of the top performers in the market, with bulls aiming to capitalize on the uptrend to break through a key psychological barrier.

Notably, NEAR Protocol (NEAR) has seen a remarkable surge over the past month, gaining nearly 31%. Most of its recent performance came from a notable intraday gain of 14.43%, the largest in over four months.

This came on the back of a partnership between leading AI chipmaker Nvidia and Alibaba, which triggered a favorable reaction from AI tokens.

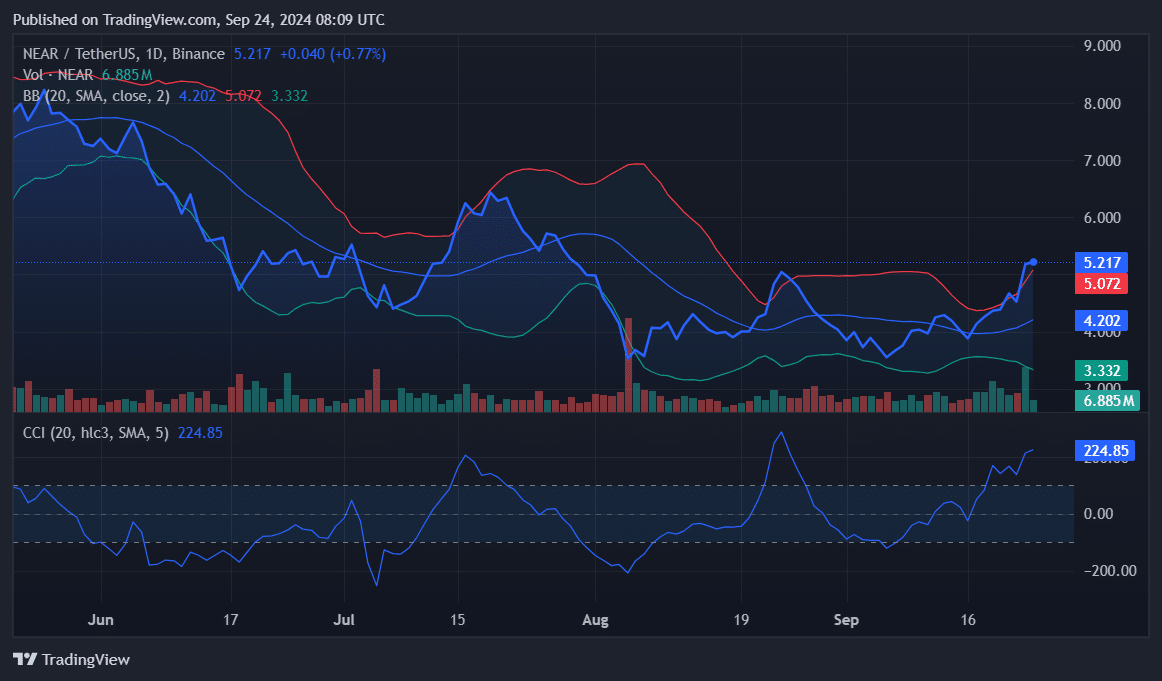

NEAR is trading at $5.217 at the time of writing, having appreciated by as much as 6.36% over the past 24 hours. The latest upsurge has pushed its market cap to $5.79 billion, with a massive daily trading volume of $890 million.

This surge has driven the asset above the upper Bollinger Band, currently at $5.072. This position suggests that NEAR is in an overbought condition, but confirms the strong bullish momentum in the short term.

In addition, the Commodity Channel Index surged to 224.85 following the recent rally. A CCI reading above 100 is considered overbought. As a result, caution is warranted, as such high readings often precede corrections.

However, following a minor drop this morning, NEAR Protocol retested the upper Bollinger Band and sustained a value above it. This indicates that the bulls are firmly in control of the market at the reporting time.

This momentum could persist if buying pressure continues. NEAR is now facing a critical juncture as it approaches resistance levels at $5.469 and $6.301.

The $6 psychological level represents a major target for bulls. However, the last time NEAR approached $6, it faced strong resistance at $5.9, resulting in ten consecutive days of losses.

For the bulls to breach this level, NEAR would need to consolidate above $5.469 and maintain its current momentum. Failure to break past $5.469 could see a retracement to the Pivot level support at $4.954 or further down to $4.121.