- Neiro has declined by 15.76% over the past week.

- Fresh wallets accumulates 13.64 million tokens worth $1.029 million.

After a sustained upswing, Neiro on Ethereum [NEIRO] has experienced a sharp decline over the past week. In fact, at the time of writing, NEIRO was trading at $0.001552. This marked a 3.78% decline over the past day.

Also, the memecoin has declined on weekly charts by 15.76%.

This drop over the past week has presented an opportunities with investors buying the dip. As such, Lookonchain observed that new wallets have started to accumulate NEIRO during this dip.

NEIRO sees increased accumulation

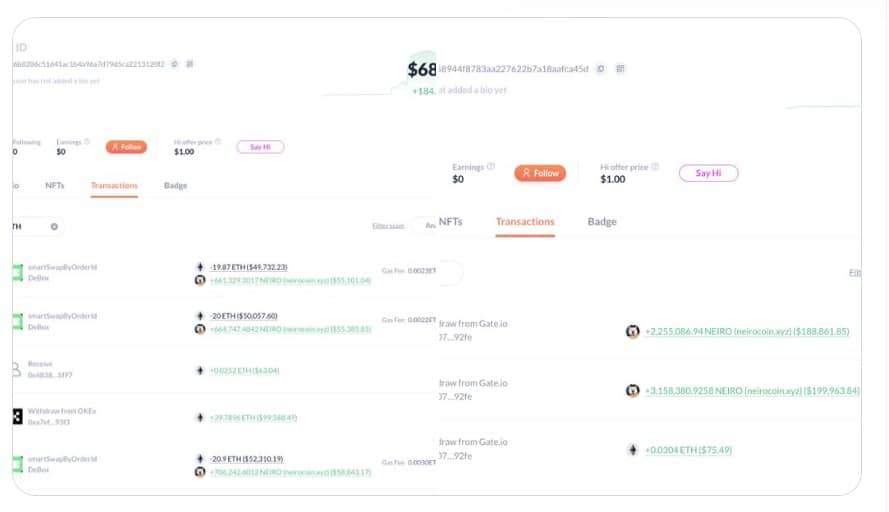

According to Lookonchain, fresh wallets were aggressively accumulating the token. The blockchain monitor shared this observation through their official X page noting that,

“Wallet “0xec6b” was created yesterday and withdrew 230.4 $ETH($575K) from #OKX to buy 8.23M $NEIRO. Wallet “0xd753” was created yesterday and withdrew 5.41M $NEIRO($453K) from #Gateio.

These new wallets have accumulated a total of 13.64 million NEIRO tokens worth $1.029 million. Usually, when new wallets start accumulating a token, it signals increased interest and demand.

When markets are poorly performing, new investors enter the market anticipating price appreciation.

Buying activities result in buying pressure which further raises prices through supply squeeze. Thus, the question is, can these accumulations help raise the price?

Impact on price charts?

Although the increased accumulation plays a vital role in changing the market dynamic, NEIRO’s short-term data told a different story.

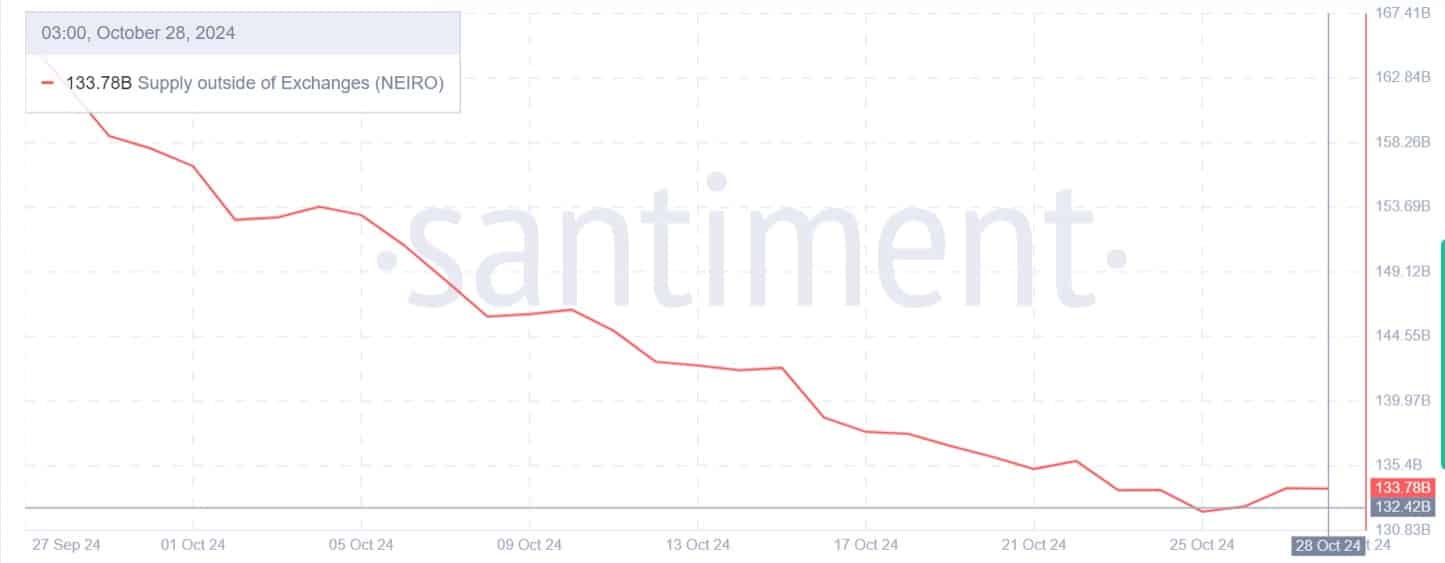

For example, the token’s supply outside of exchanges has declined over the past month from a high of 165.75 billion to 133.78 billion tokens. This decline suggests that investors are depositing their NEIRO tokens into exchanges reducing their holdings.

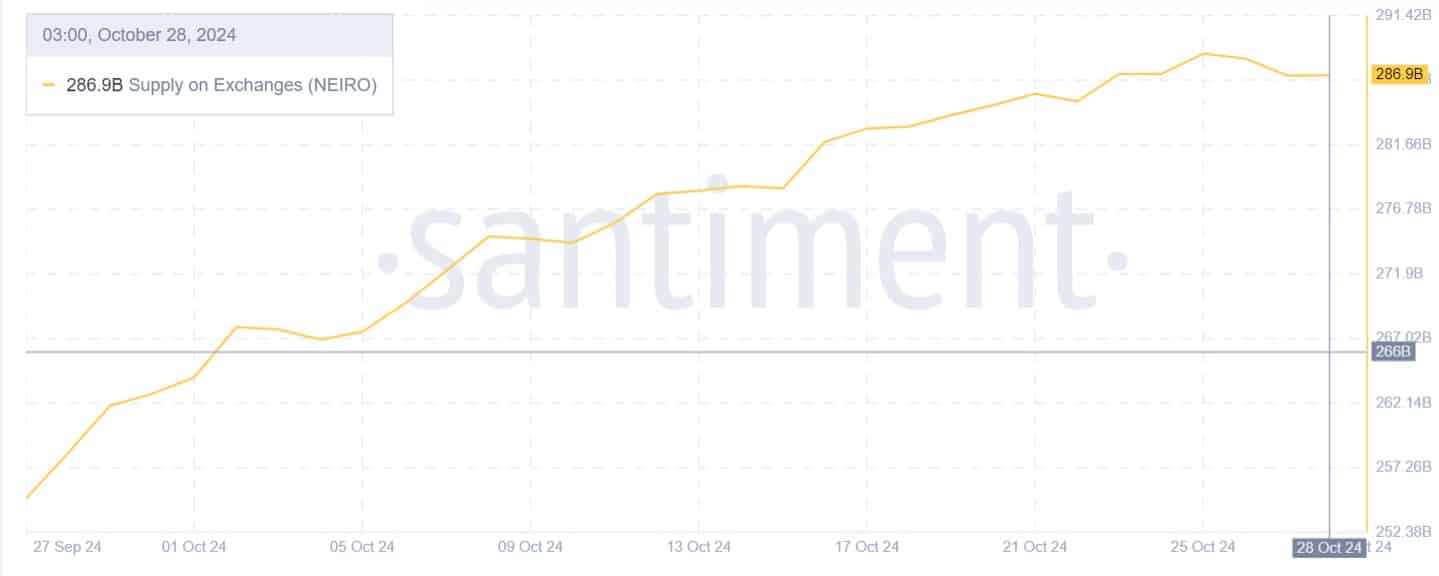

This phenomenon was evidenced by the fact that supply on exchanges has been increasing over this period. Santiment’s data showed supply on exchanges has increased from 254.98 billion to 286.9 billion.

This implied that most investors were preparing to sell their assets which could result in selling pressure.

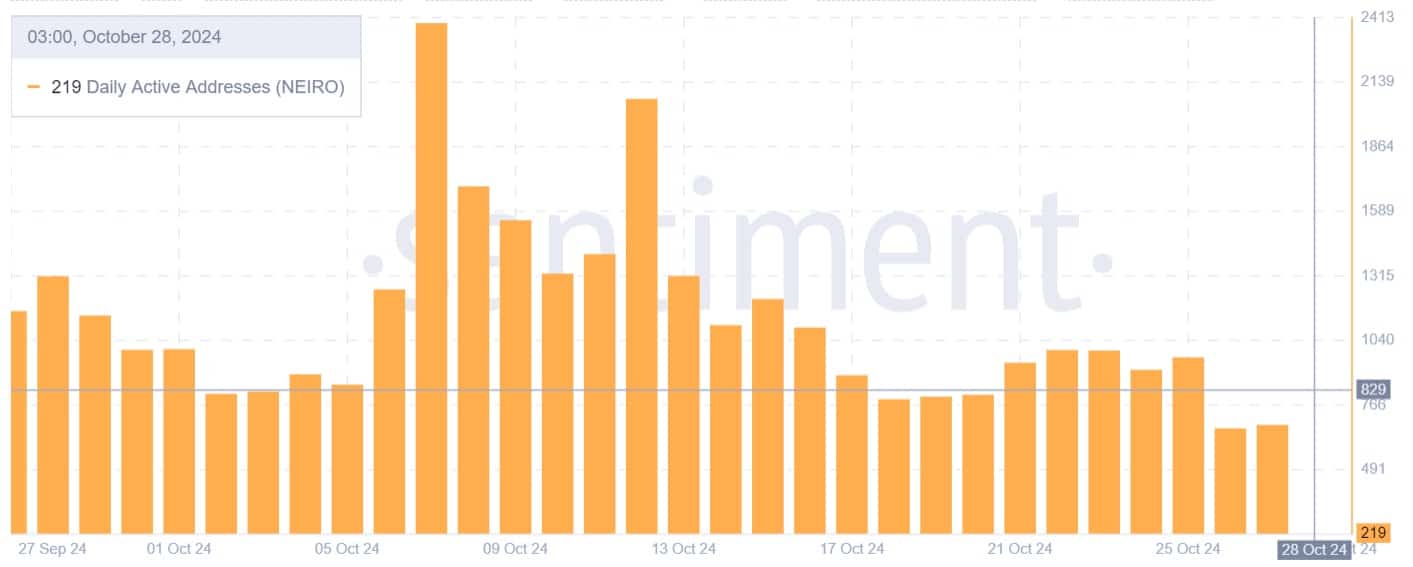

Additionally, NEIRO’s daily active addresses have dropped for the past 3 weeks from 2390 to 219. This suggested reduced participation, interest, and demand signaling investors’ indifference and lack of confidence in the memecoin’s prospects.

What next for the memecoin?

Although these new wallets have entered the market, NEIRO needed more activities, or events to jumpstart its price rally. The accumulation has so far not brought a positive impact on price charts.

Read Neiro on ETH [NEIRO] Price Prediction 2024-25

The current conditions could set the memecoin up for further decline unless more buying opportunities arise. Thus, the memecoin could decline to find its next support at $0.001355.