In this bearish market sentiment, Nervous Network (CKB) is gaining significant attention from investors and traders due to its impressive performance and substantial whale activity. In recent days, while other major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have struggled to gain momentum, Nervos’s CKB has skyrocketed by 100%.

CKB Price Momentum

At press time, CKB is trading near $0.0177 and has experienced a price surge of over 10% in the last 24 hours. During the same period, its trading volume has skyrocketed by 150%, indicating higher participation from traders and investors.

With its impressive price surge today, it has outperformed major cryptocurrencies like BTC, ETH, SOL, and other top tokens.

Nervos Network (CKB) Price Prediction

According to expert technical analysis, despite experiencing a significant price surge CKB appears bearish in the short term and may face price correction in the coming days.

Today, CKB’s price has reached its strong resistance level of $0.020 level, but due to strong selling pressure, it has fallen more than 15% in the past 12 hours. Based on its historical price momentum, there is a strong possibility it could fall to the $0.151 level in the coming days to retest its breakout level before it rallies hard.

On the other hand, if the bullish sentiment continues and CKB breaches the resistance level and closes a daily candle above the $0.020 level, there is a high chance it could rise by 25%. Moreover, this bullish thesis will only hold if CKB closes its daily candle above the $0.020 level, otherwise, it may fail.

However, CKB’s 200 Exponential Moving Average (EMA) suggests that it is in an uptrend as it is trading above the indicator.

CKB’s Mixed Sentiment on On-chain Metrics

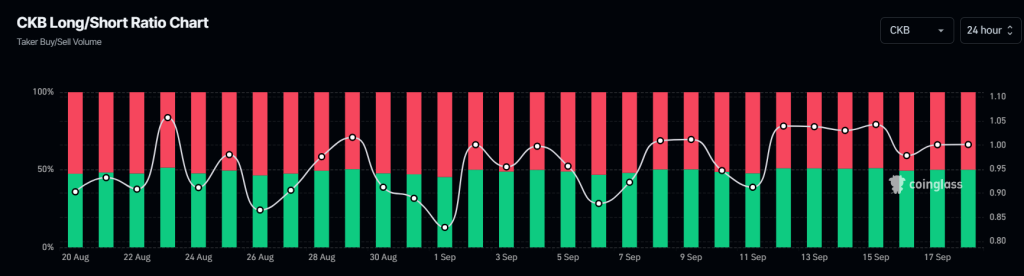

As of now, CKB’s on-chain metrics flash a mixed sentiment. According to the on-chain analytic firm Coinglass, CKB’s future open interest has dropped by 2% over the last 24 hours. This decline in the open interest may be attributed to profit-taking, significant long liquidations, and the overall bearish market sentiment.

On the other hand, CKB’s Long/Short ratio currently stands at 1.0012, indicating bullish market sentiment among traders.