- Solana is gaining attention from traditional finance firms for its scalability and efficiency, potentially giving it an edge over Ethereum.

- Companies like Visa and PayPal have started using Solana for stablecoin processing.

Solana (SOL) is emerging as a potential challenger to Ethereum (ETH) in the battle for smart contract dominance, according to a recent report from digital asset banking group Sygnum. The report highlights how traditional financial institutions may give Solana a crucial advantage, even as Ethereum holds a significantly larger market share.

Traditional Finance Firms Eye Solana’s Scalability

According to Sygnum, Solana’s current market share is much smaller than Ethereum, but the network’s high scalability is becoming appealing to conservative institutional investors. Some of the well-known corporations that have recently painted interest in using Solana for different purposes include Visa, PayPal, and Franklin Templeton.

Visa integrated Solana for USDC settlement and issued a report emphasizing the advanced characteristics of the network, including throughput, cost, and stability. This decision reveals that some institutions may prefer scalability and efficiency to Ethereum’s more secure but slower network. PayPal also launched Solana for stablecoins and revealed that Ethereum may not be the best for payments, according to a PayPal executive at the Solana event.

Sygnum also points out that the majority of the transaction volumes in Solana are due to the memecoin launch and trading. Still, tokenization platforms and stablecoins could shift the network’s position in the market. With more financial institutions considering blockchain technology, the emphasis on asset tokenization and stablecoin payments can be a significant advantage for Solana. As more and more companies experiment with Solana-based products, the platform’s uses are gradually broadening beyond the initial remit.

Ethereum Still Holds a Significant Lead

However, Ethereum is still the leading platform for smart contracts. Currently, Ethereum’s market capitalization is $297.2 billion, compared to Solana’s, which is $68 billion. Ethereum’s stability and security are still crucial in adopting the Ethereum platform for dApps and general blockchain systems.

However, the shift to scalability may change the game altogether, particularly for incumbent financial institutions. Ethereum may suffer more competition in payments and cross-border transactions if some institutions prefer Solana due to its technical features. Solana’s advancement in attracting these firms shows that it has the potential to threaten Ethereum, but Ethereum has a strong market share and is deeply integrated into the market.

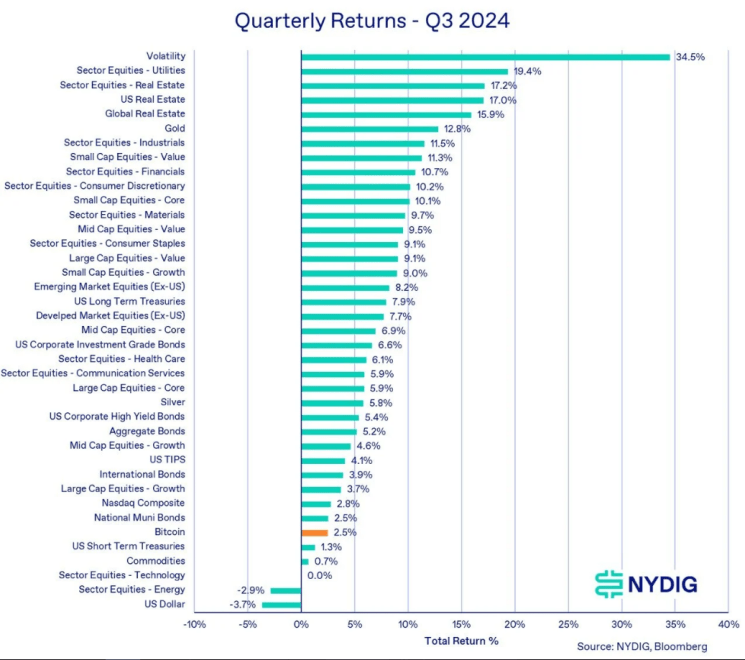

Over the past year, Solana has consistently outperformed Ethereum. Solana’s price rose by 524%, and Ethereum’s rose by 50.46% during the same period. Several key factors explain Solana’s superior performance.

One major driver is the popularity of meme coins on the Solana network, fueled by platforms like Pump.fun. Furthermore, the Solana network’s low transaction fees and high speed have remained competitive even in times of high traffic. These features make Solana a better and cheaper option than Ethereum, where users have continued to incur high fees and slow transaction speeds.