In a significant shift in Nigeria’s cryptocurrency landscape, the country’s Securities and Exchange Commission (SEC) is preparing to license crypto exchanges, signaling a move towards formal regulation of the burgeoning digital asset market.

Expressing optimism about the imminent regulatory changes in an interview with Bloomberg, SEC Chief Emomotimi Agama said, “Being a crypto enthusiast and fintech enthusiast, I can tell you without doubt that this is going to happen sooner than you think.”

He emphasized the importance of supporting Nigeria’s youth in harnessing the benefits of fintech, noting, “The market size is huge and it is growing.”

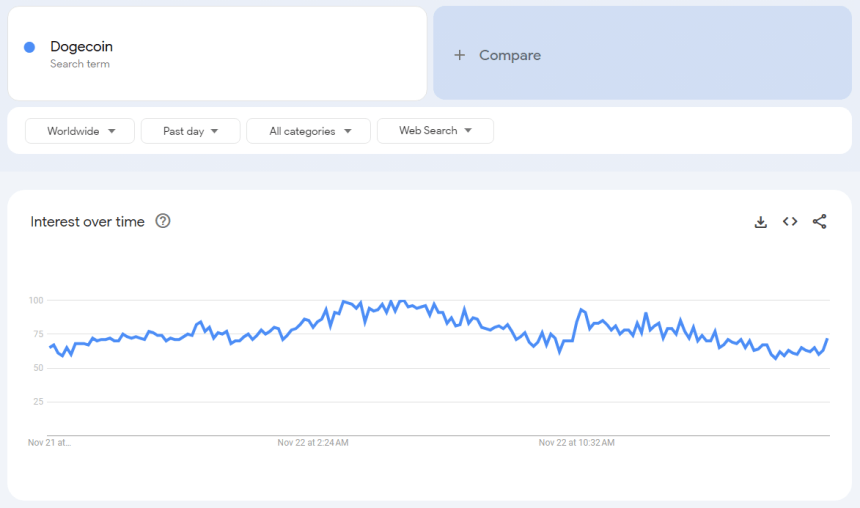

The SEC’s move comes as Nigeria experiences a surge in cryptocurrency adoption.

Despite previous regulatory hurdles, including a central bank ban on crypto transactions through banks, the West African nation climbed to the second position on the Global Crypto Adoption Index by blockchain intelligence firm Chainalysis in 2023, up from 11th place in 2022.

Agama highlighted the SEC’s objectives, saying, “We want to provide a platform where people can formally do these things and we are able to get all of the information that we need.” However, he cautioned against potential misuse, adding, “What we will not encourage is the use of cryptocurrency to manipulate our currency.”

The regulatory shift follows the SEC’s June 2023 directive for cryptocurrency exchanges and digital asset traders to re-register their businesses within 30 days, or face potential enforcement actions. This initiative is part of a broader effort to amend rules on digital asset issuance, offering platforms, exchanges, and custody for virtual asset service providers (VASPs).

Addressing the media in June this year, Agama revealed the substantial scale of Nigeria’s cryptocurrency market, estimating its value at over $400 million. He projected an increase in crypto trade volume in the coming years, despite recent regulatory challenges.

The SEC’s approach represents a balancing act between fostering innovation in the fintech sector and addressing concerns about illicit transactions and currency manipulation. This regulatory framework aims to provide clarity for operators in the crypto space, who have faced uncertainty due to conflicting policies from different Nigerian authorities.

The imminent moves come amid an ongoing dispute with leading crypto exchange Binance, however, with Nigeria detaining company executive Tigran Gambaryan since February. Gambaryan’s family has said that his health is deteriorating significantly in custody, claims that Nigerian officials have disputed.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.