Notcoin was gearing up for a breakout after a lengthy period of consolidation as of press time with the price action flirting with the Point of Control (PoC) resistance zone on the daily timeframe, indicating strong buying interest at these levels.

Recently, Notcoin’s price swiftly bounced off the horizontal trendline that has been acting as resistance, reinforcing the bullish sentiment among traders.

This rebound from the trendline, combined with a successfully break and retest for the challenging PoC suggesting that Notcoin could soon witness a sharp rally.

– Advertisement –

If the bulls manage to decisively flip this resistance into support, NOT could see an aggressive push, potentially driving prices up by as much as 120%.

A successful breakout above the PoC could catalyze a substantial bullish movement in the near term.

NOT’s liquidation heatmap outlook

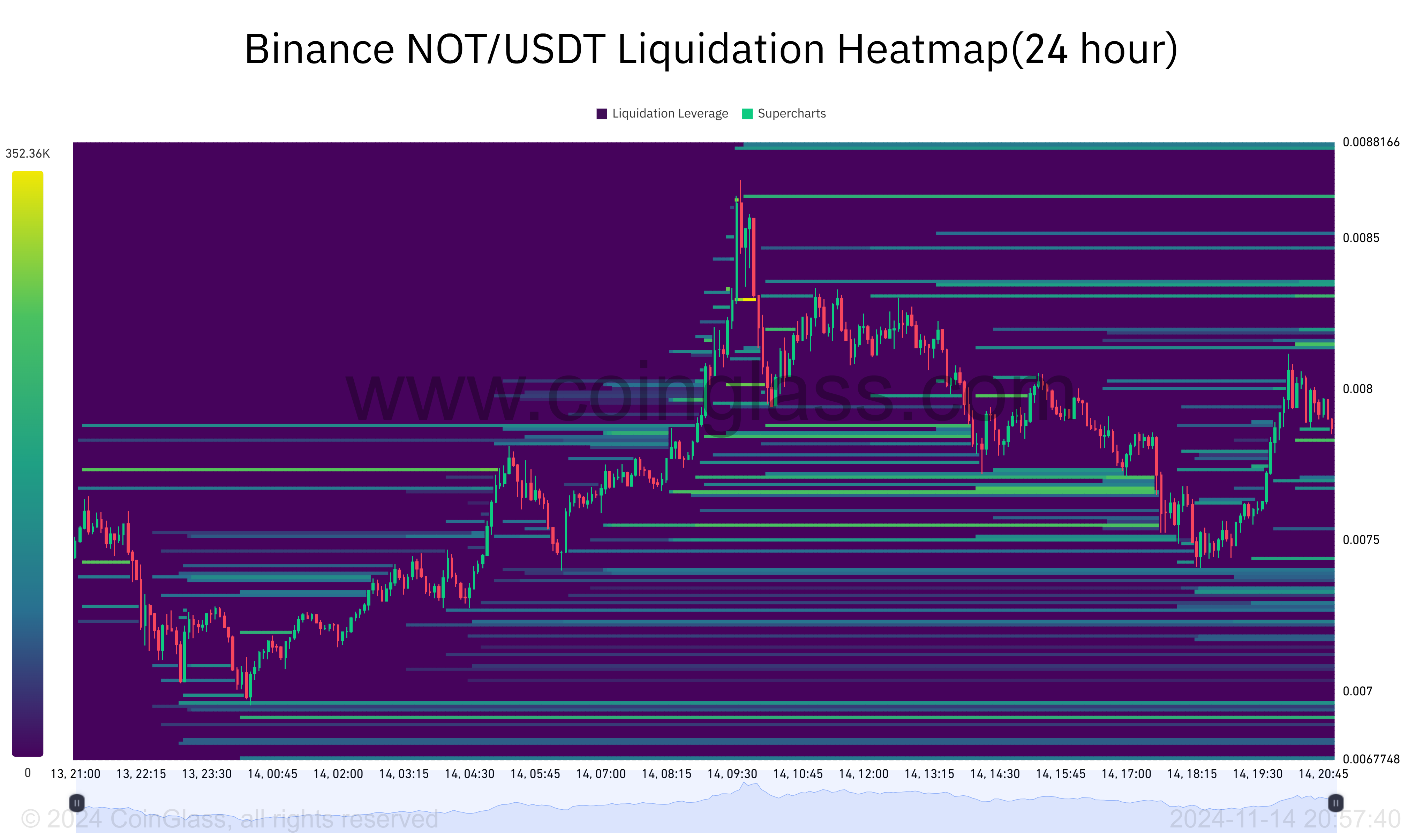

Analysis of NOT/USDT liquidation heatmap on Binance exchange for the past 24 hours revealed increased trading activities at multiple price levels, particularly around the $0.0088 mark.

– Advertisement –

Notcoin’s price movements were marked by a sharp increase in trading volumes as it approached this liquidity-rich zone.

Historically, price zones with high liquidity attract more price action, suggesting that Notcoin could target these areas for potential breakthroughs or reversals.

The heatmap showed a concentration of liquidity just above $0.0088, which was an indication that traders were positioning for a potential move to the upside.

If Notcoin continues this trajectory, breaking through the $0.0088 could lead to further upward momentum, potentially targeting higher resistance levels.

These zones closely as they can provide opportunities for strategic entries or exits based on the heightened trading activity and the potential for price shifts dictated by these liquidity pools.

This dynamic could set the stage for Notcoin to attempt breaking past its current thresholds, possibly initiating a new rally if sustained buyer interest persists.

Address profitability

Most of the active addresses that are profitable are at $0.0068, where a large number of NOT holders are currently “in the money.”

Specifically, 76.75% of the addresses, representing 6,080 holders, are profitable at this price level, indicating strong support and a possible accumulation zone.

Conversely, 19.33% of the addresses are “out of the money,” struggling with losses, which may prompt these holders to sell if prices approach their breakeven point near $0.0068 to $0.007785.

The relatively low percentage of addresses “at the money” (3.92%) suggested minimal indecision among holders at the current price, which hints at either a potential stability in price or preparation for a directional move based on incoming trading volumes.

These metrics change can provide insights into potential price pressures or support areas for NOT as traders may target these price zones to maximize returns or minimize losses.

This active address data was crucial for predicting short-term movements and possible price stabilization points, especially around key liquidity zones.