- Notcoin creators leveraged Telegram’s user base to create a community around the NOT token.

- Key indicators show diminished potential for a price recovery despite Notcoin burning 233 million tokens.

Notcoin [NOT] was displaying signs of exhaustion in the spot market, with the token’s price tumbling 31% over the last 30 days. Technical and on-chain metrics indicate weakening momentum, suggesting the price downtrend could endure.

Weakening price strength

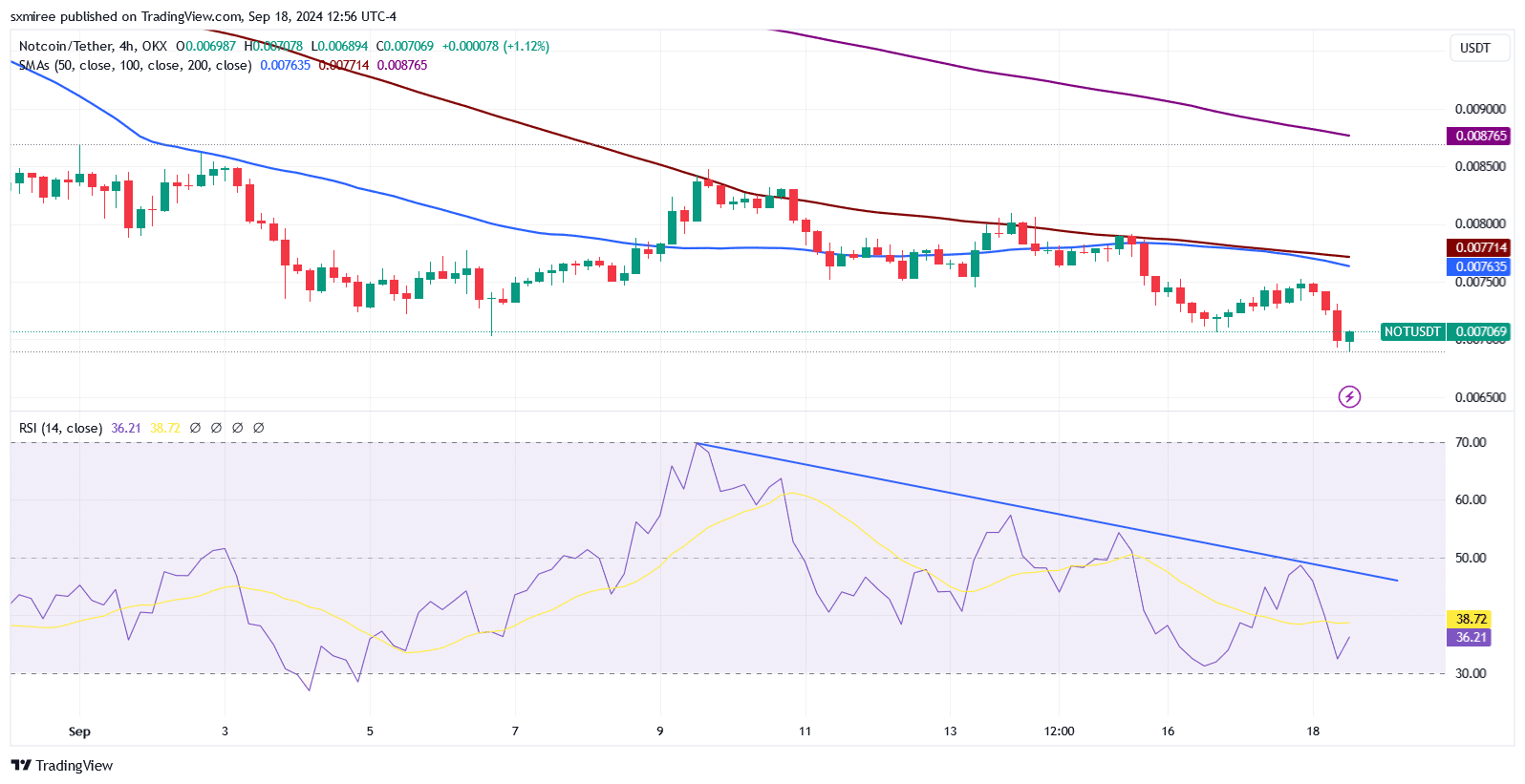

TradingView’s NOT/USD 4-hour chart data shows that the Relative Strength Index (RSI) has been trending downwards since peaking near the overbought zone on September 9.

The down-trending 4-hr RSI indicates that selling pressure has been weighing on the pair and could be a precursor to further price declines.

Notably, only 23% of Notcoin addresses are in profit at current prices, while a staggering 65.50% are in the red, according to data from IntoTheBlock.

NOT faces notable resistance at $0.0083, where 171,780 addresses holding a total of 3.59 billion tokens are underwater.

Declining network activity

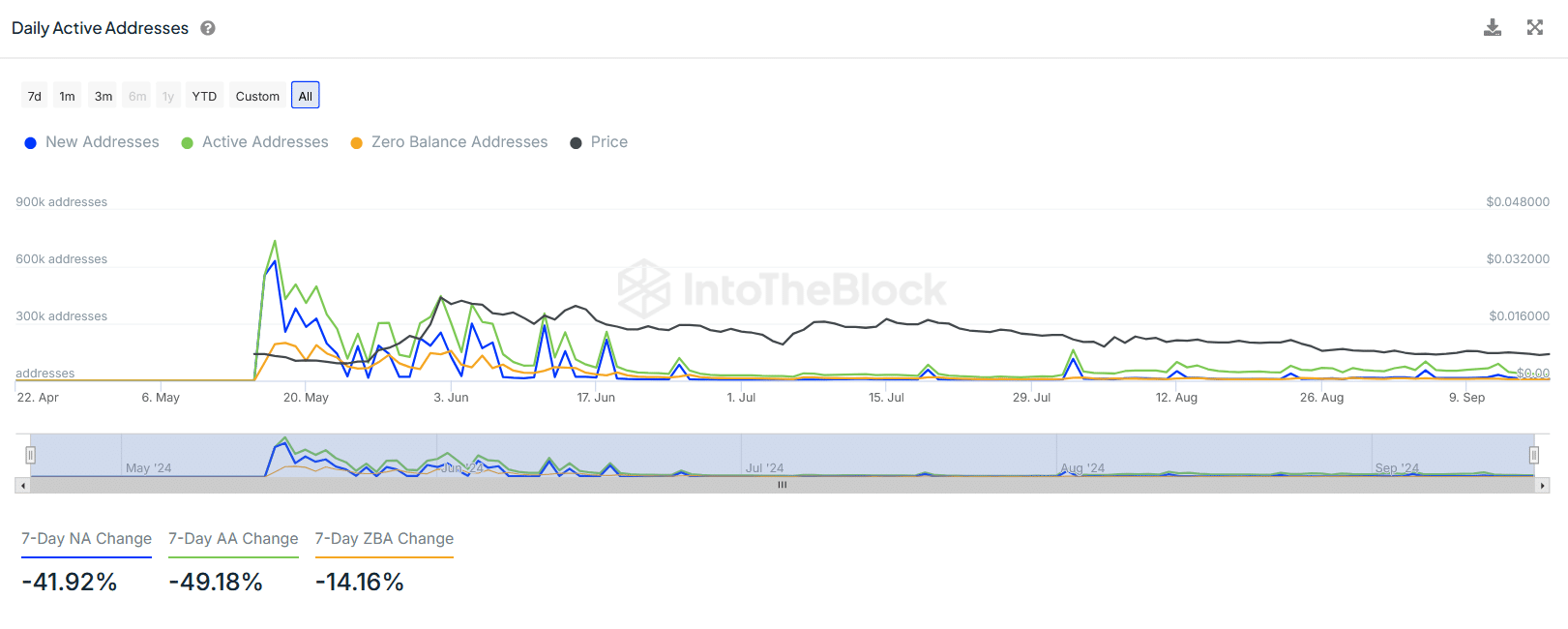

Further reinforcing the bearish outlook, on-chain metrics reveal a steep decline in Notcoin’s network activity, affirming that the excitement around the tap-to-earn game has been shrinking.

New addresses on the network have dropped by 41.9% in the last 7 days, while active addresses have plummeted by 49.2% during the same period.

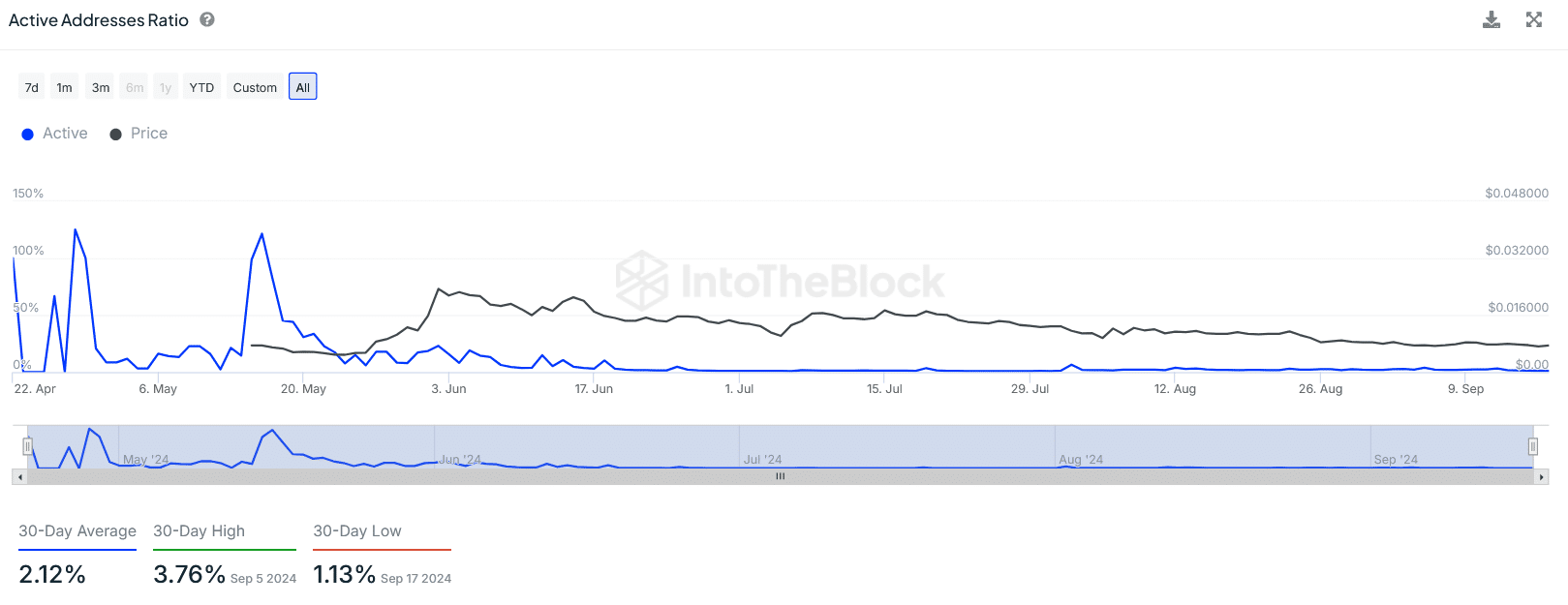

Consistent with this trend, the active address ratio (expressed as a percentage) has been decreasing across September, indicating dwindling user engagement.

Notcoin registered a 30-day low active addresses ratio of 1.13% on September 17, down from a 30-day high of 3.76% on September 5.

Transaction volumes have similarly taken a hit. The number of transactions on the network has consistently hovered below 50,000 since September 13 and reached a 7-day low of 41.23K on September 17.

The number of daily large transactions has also been decreasing this month, recording a 7-day low of only 3 transactions on September 16. The decline points to reduced whale activity and implies that even deep-pocketed holders are pulling back.

NOT/USDT outlook

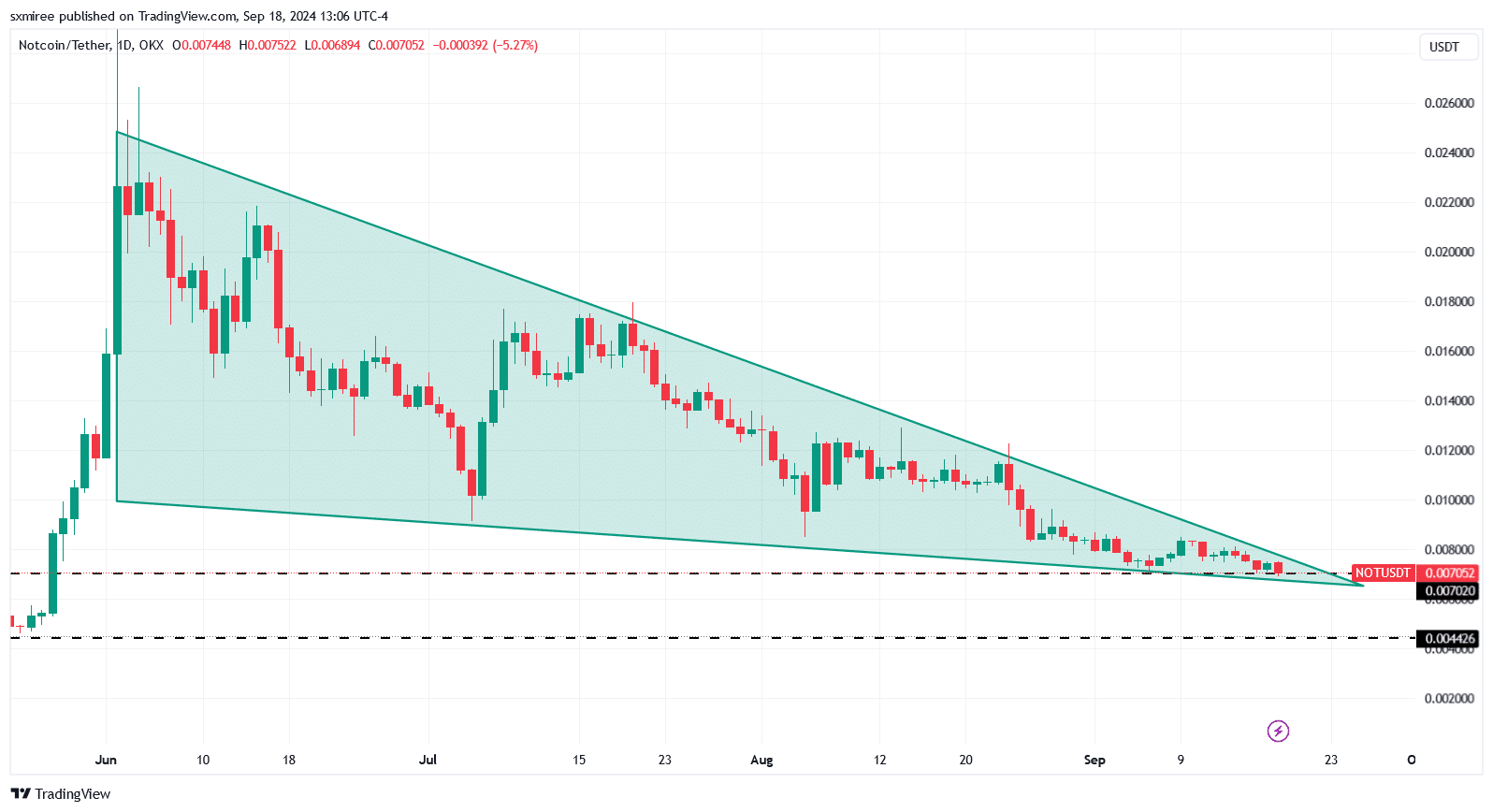

NOT was trading slightly above the $0.0070 support level at writing, with the next cushion around $0.0044. The 1-D NOT/USDT chart shows the pair has been moving inside a falling wedge pattern since June, consistently testing new lower resistances.

Given the lack of buying interest in the market, a slip below the current support level could lead to extended losses.

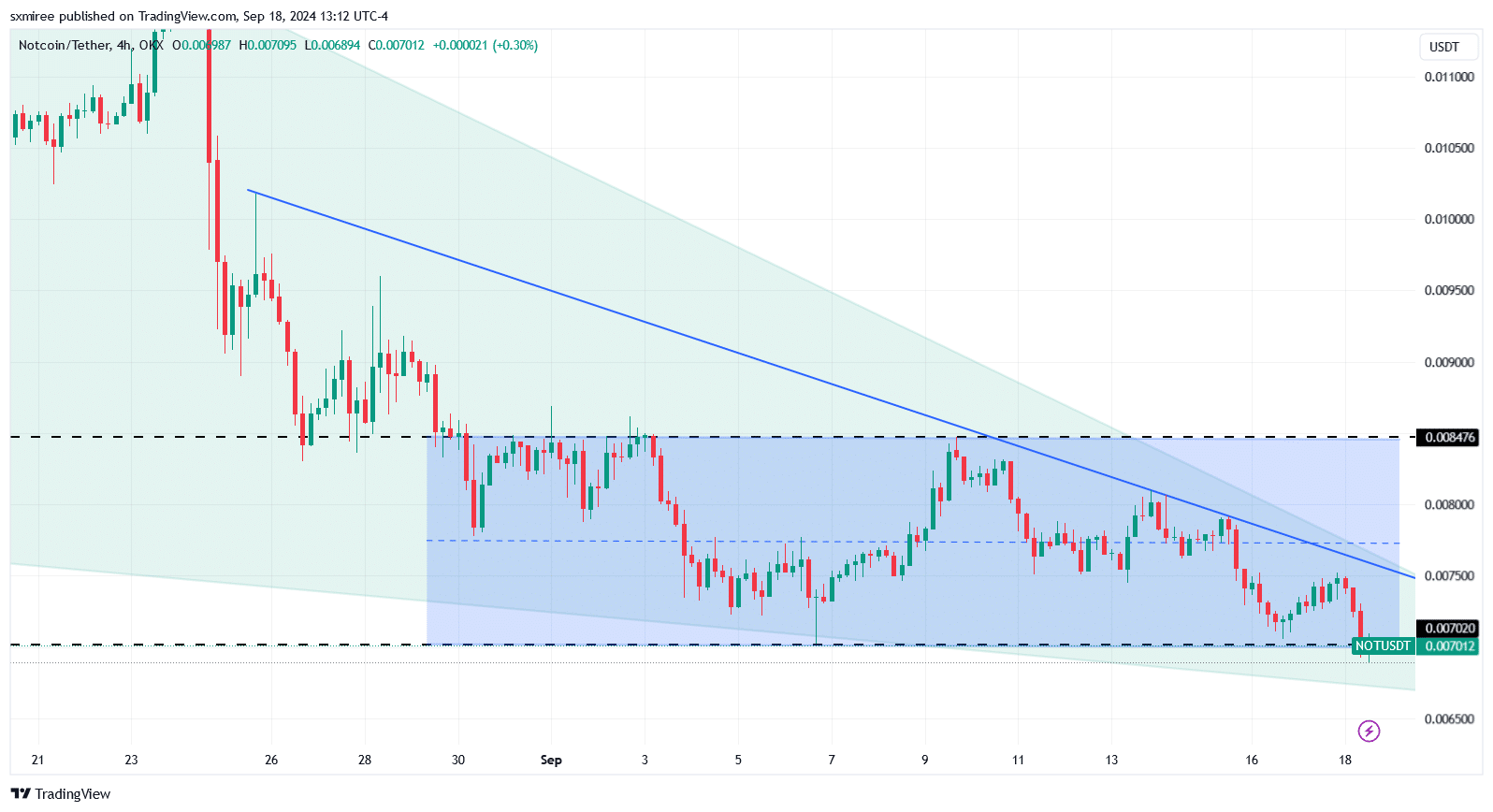

Zooming in on the 4-hr chart, NOT/USDT has been consolidating between $0.007 and $0.0084 since the beginning of September.

The pair rose to $0.0076 on September 17 before being rejected and reversing course in line with its recent price action under a descending resistance line.

Worth noting, Notcoin (NOT) correlation with both Bitcoin (BTC) and Ethereum (ETH) has been growing across the month, especially for the later.

Read Notcoin’s [NOT] Price Prediction 2024–2025

IntoTheBlock data shows the 30-day correlation between NOT and ETH currently stands at 0.81, approaching its highest value of 0.85 seen on August 20.

The growing correlation indicates that NOT’s price movement is increasingly becoming tied to that of the flagship altcoin.