- As of press time, Notcoin had surged over 9% in the last 24 hours.

- NOT breaks out of one-month range as long percentage for top traders rise.

Notcoin [NOT] launched on the TON blockchain, is finally bringing optimism back to the ecosystem after a period of struggles following uncertainty surrounding Pavel Durov.

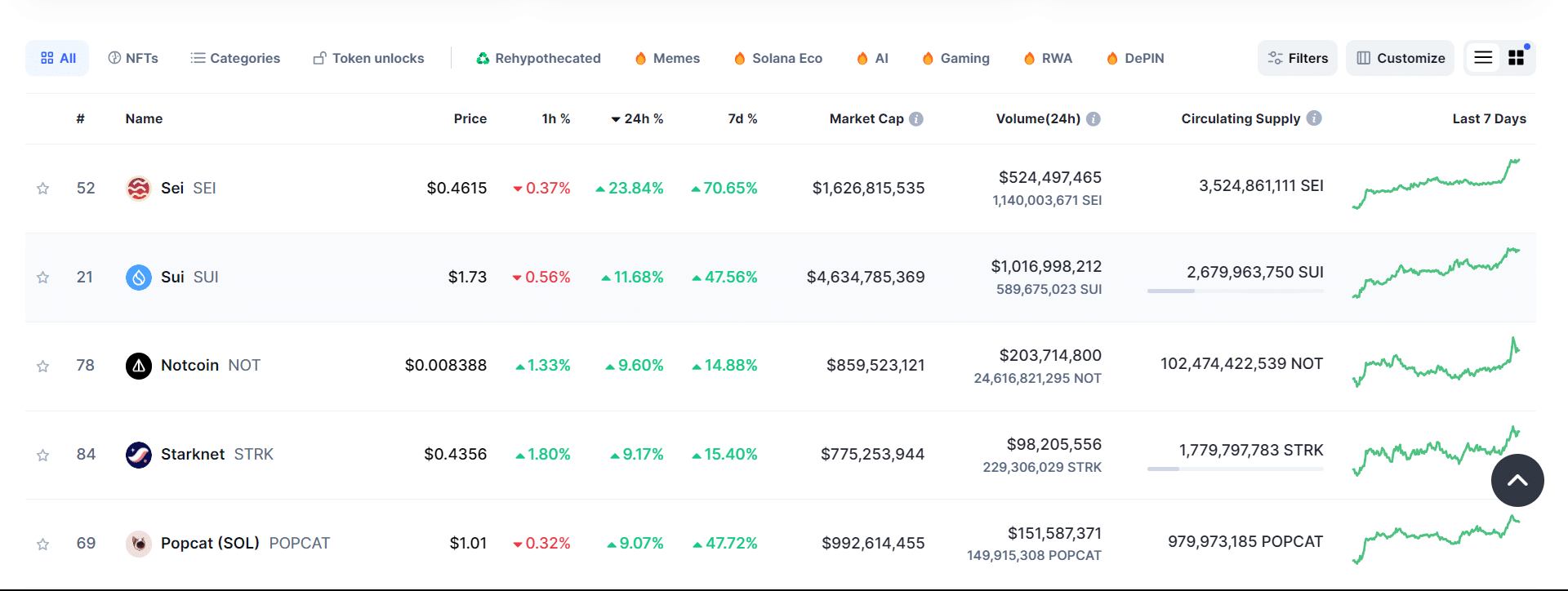

Despite TON’s challenges, Notcoin is now showing signs of resurgence. As of press time, Notcoin ranks third behind SEI and SUI in 24-hour gains, with over 9% growth among the top 100 cryptocurrencies on CoinMarketCap.

Its trading volume has surged by 67%, raising hopes that this positive momentum could continue, potentially driving a revival of the TON blockchain, led by Notcoin’s rise.

Notcoin breaks out of falling wedge

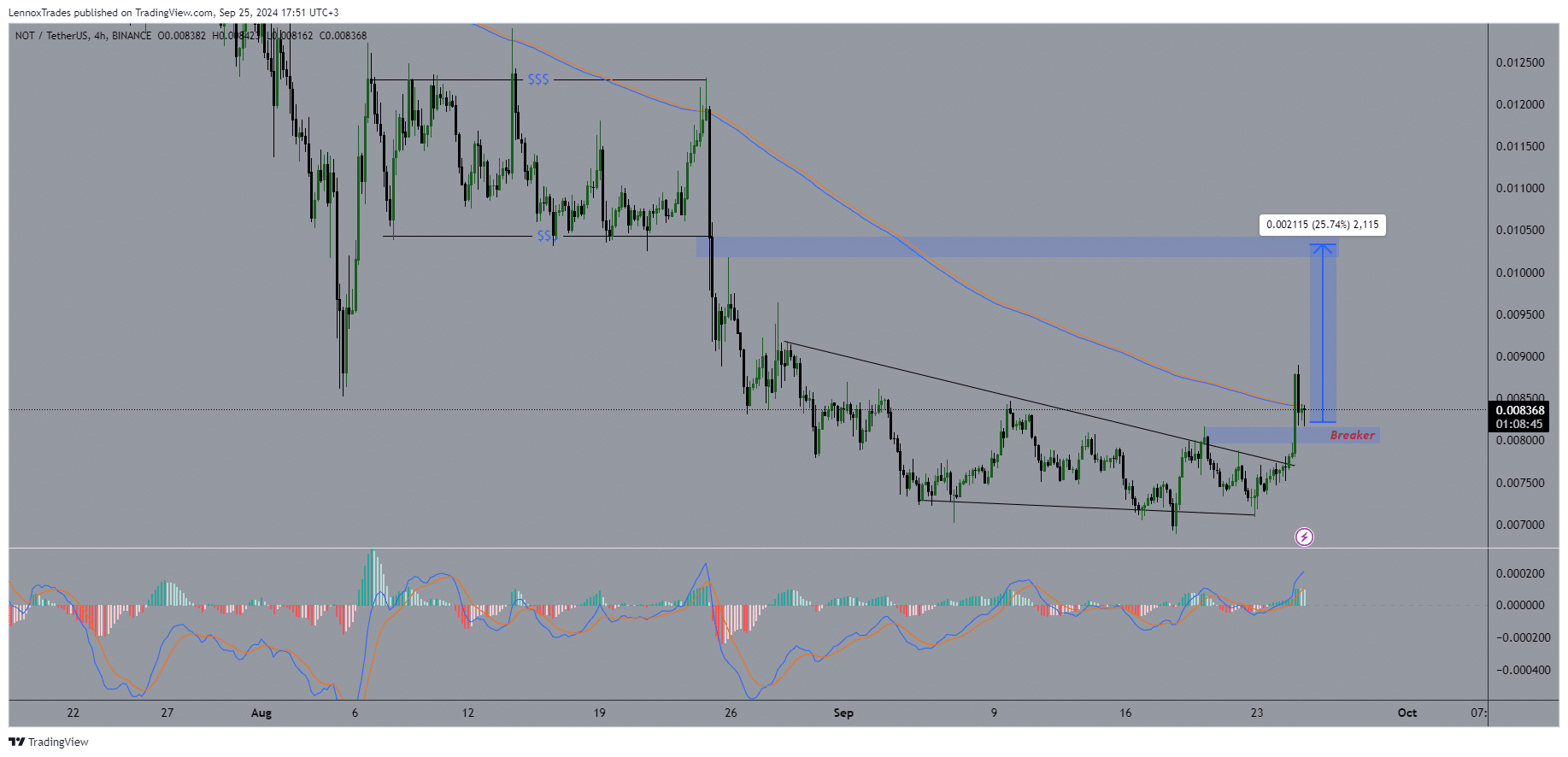

Analyzing the price action of NOT/USDT pair, shows clear signs of bullish momentum. On the 4-hour timeframe, Notcoin recently broke out of a falling wedge pattern, where it had been consolidating for the entire month of August.

This breakout positioned Notcoin among the top gainers. The current price action has now broken out of the triangle pattern and is struggling to stay above the 200 exponential moving average (EMA).

If the price remains above this crucial level, it signals a stronger potential for higher gains. Analysts suggest that Notcoin could see a ROI of over 25% by the end of the week, as the chart signals an urgent need for the price to remain above the breaker level.

Furthermore, earlier in the month, a breakout from a consolidation phase led to 30% gains for short traders, so a similar upward breakout is highly likely.

The MACD (Moving Average Convergence Divergence) indicator also supports this bullish outlook, as the histogram shows strong momentum, and the MACD line has crossed above the signal line, indicating a continued upward trend.

If the NOT/USDT pair fails to stay above the breaker level or the 200 EMA, traders are advised to be cautious when taking long positions.

What NOT’s divergence means?

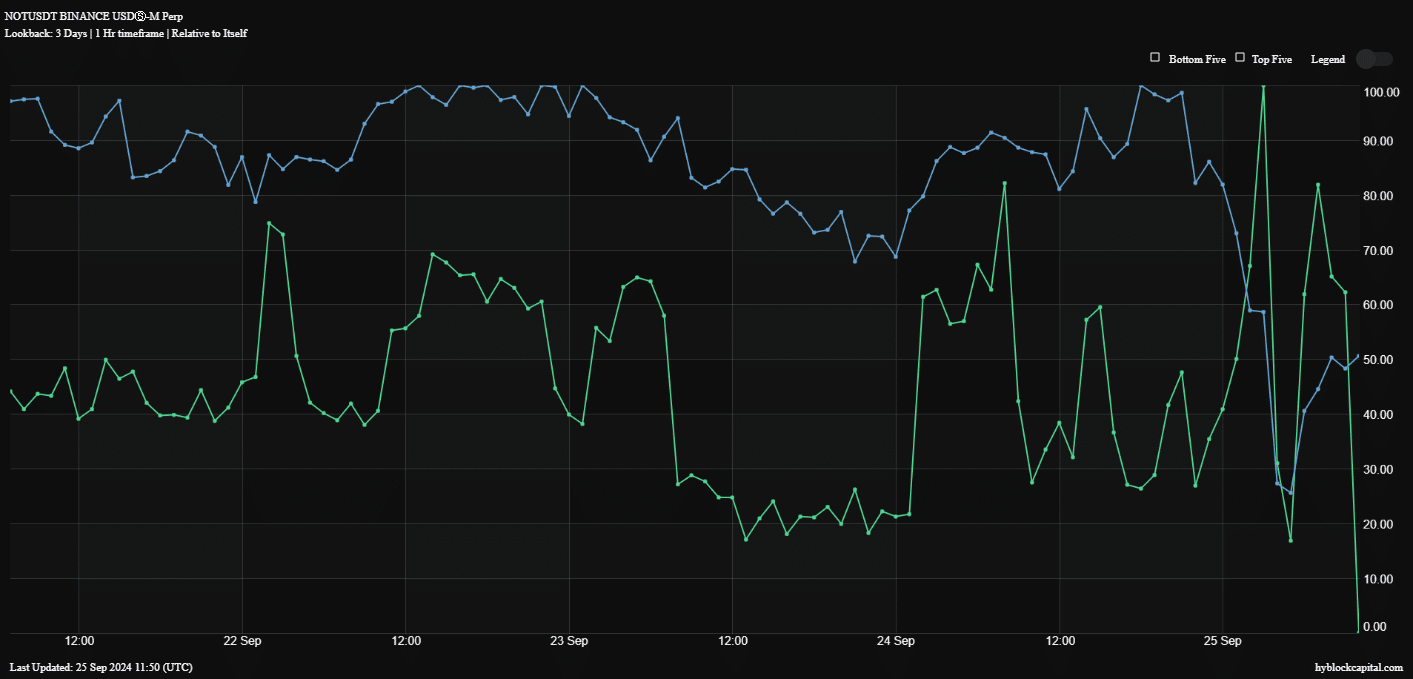

Further analysis of the longs percentage for top trader accounts, combined with the bid-ask ratio, reveals that these metrics are moving in opposite directions, which typically signals divergence.

In most cases, these indicators should either rise or fall together, so this divergence raises questions. Divergence is crucial as it can either indicate a trend reversal or signal that the current trend will continue.

Read Notcoin’s [NOT] Price Prediction 2024–2025

Notcoin’s social sentiment is on the rise

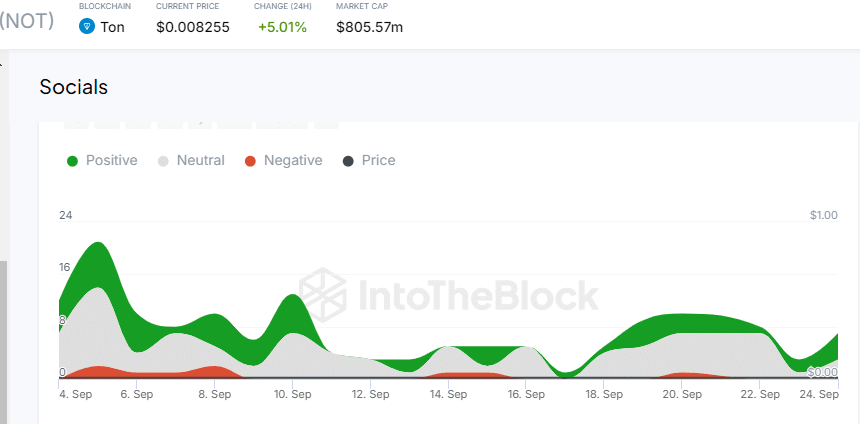

Lastly, Notcoin has been slowly regaining positive social sentiment. Metrics show a rise in mentions, posts, and likes across social platforms, which is crucial for smaller coins like NOT that rely on strong community backing to boost price momentum.

As social activity increases, the chances of Notcoin’s rally continuing grow stronger. This surge in positive sentiment, combined with strong technical indicators, suggests that Notcoin has a higher probability of maintaining its upward momentum in the coming days.