The US stock market is currently trading in a stabilized zone with slightly volatile upticks due to recent geopolitical changes and the war between Iran and Israel. However, the sentiment seems stable for now, with developments being reported in the field of corporations worldwide.

IT giant Nvidia recently hired Accenture for a holistic AI-embedded approach, which may change Nvidia’s share price in the future. Here’s how.

Also Read: Pepe and Dogwifhat (WIF) Price Prediction For The Weekend?

Nvidia X Accenture: What’s It About?

Nvidia, the leading IT giant, is keen on exploring AI. The firm has roped in Accenture to explore this buzzing realm. Last week, Nvidia unveiled its new corporate segment, dubbed the Nvidia Business Group. The segment is poised to help the IT giant streamline AI-centric endeavors and help other enterprises make the most of the new AI realm.

Per Accenture, its AI refinery platform will play a pivotal role in supporting companies in launching their custom AI agents. This will include the firm utilizing Nvidia’s AI stack, which comprises Nvidia AI Foundry, AI Enterprise, and Omniverse to do the job.

“With this marquee partnership formed to boost corporate adoption of AI, we believe this speaks to the next enterprise phase in the AI Revolution with the 2nd/3rd/4th derivatives playing out across the tech world,” Ives went on to say. “AI starts with the Godfather of AI Jensen and Nvidia but the ramifications for broader tech are essentially a 4th Industrial Revolution now being built out across semis, software, infrastructure, internet, and smartphones over the next 12 to 18 months.”

Also Read: Dogecoin: Analyst Predicts 60% Rally For DOGE

Wall Street Analyst Echo Strong Buy Call For NVDA: $200 Incoming?

As per TipRanks, Nvidia’s aggressive AI endeavors with its newly launched segment may usher in new price prospects for its share price. The segment will help other firms design their AI agents and managers, which may prove to be a lucrative use case for firms around the world to explore.

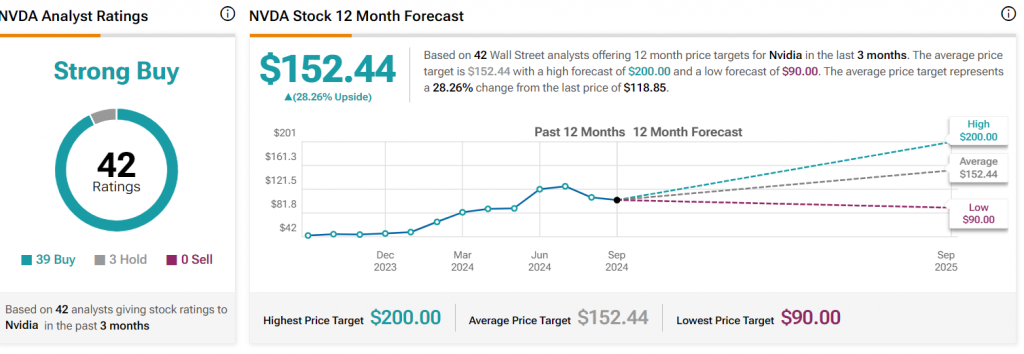

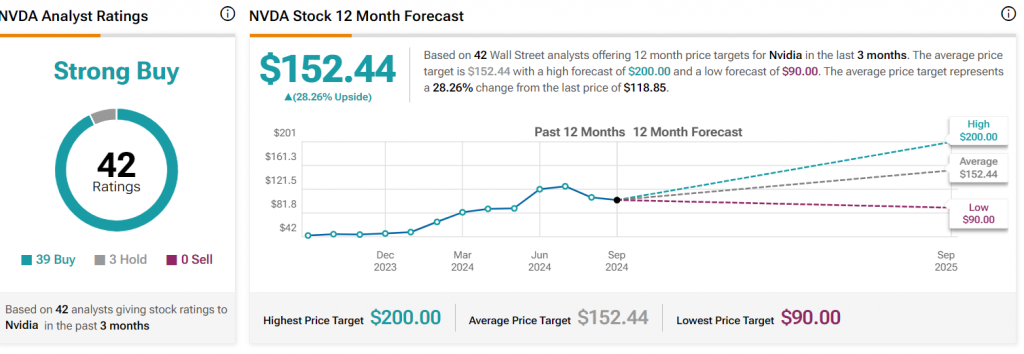

Per TipRanks, Nvidia’s share price targets $152 as its primary share value. But if positive market changes support, its share can reach a high of $200 in the next 12 months. Nearly 39 Wall Street analysts have shared a buy call for Nvidia’s share, stating how it may become a lucrative asset to hold in the near future.

“Based on 42 Wall Street analysts offering 12 month price targets for Nvidia in the last 3 months. The average price target is $152.44 with a high forecast of $200.00 and a low forecast of $90.00. The average price target represents a 28.26% change from the last price of $118.85.

Also Read: Breaking: SEC Appeals XRP Victory – Ripple CEO Fires Back!