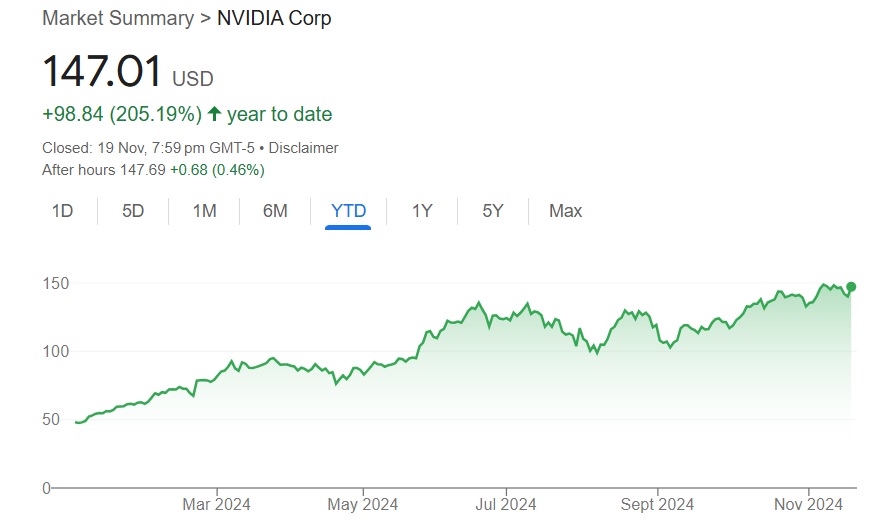

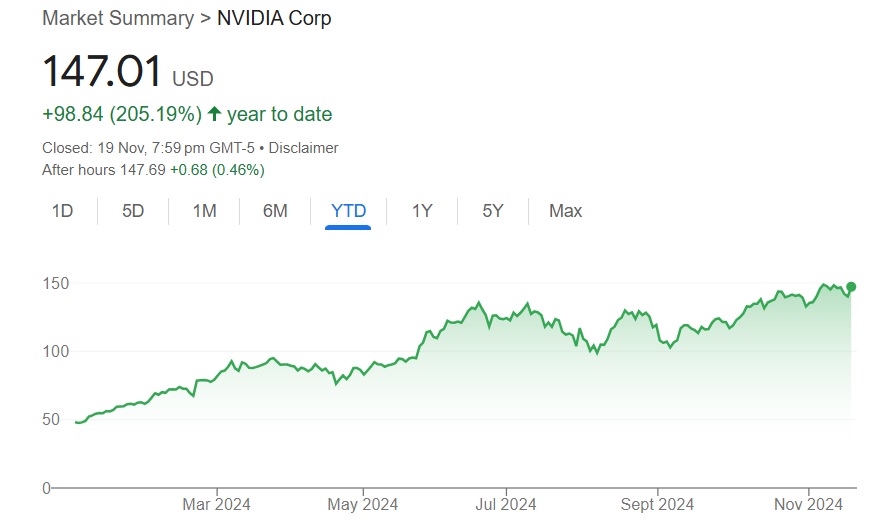

Nvidia surged 205% in 2024 alone and is among the most profitable stocks in the US markets. The year-to-date returns are impressive, as no other leading stock tripled investors’ money in just 11 months. However, analysts predict that the stock could cool down as its price has peaked in the indices.

Also Read: Smart Money Is Watching These 2 Stocks as Trump Wins Presidency

It closed Tuesday’s bell at $147, with a surge of nearly 5% in the charts. The anticipation over Nvidia’s earnings is causing the stock to hit highs in the day’s trade. The earnings call will be held today, November 20, 2024, and is projected to beat all market expectations.

Also Read: Amazon: AMZN Eyeing New Heights in 2025 as Stock Could Surge

Nvidia Bull Trap: A Correction in the Horizon After the Earnings Call

The leading GPU manufacturing firm is projected to generate an EPS of more than 6% and beat all expectations. Nvidia’s price could soar high this week after the earnings call and is forecasted to reach $175 this month. That’s an uptick and return on investment (ROI) of approximately 19% from its current price of $147.

Also Read: Walmart: WMT Sets New All-Time High as Q3 Earnings Overperform

However, institutional investors could initiate a large sell-off as profit bookings take center stage. This development could ignite a domino effect fall, where even retail investors could sell for profits, leading to a price dip. Holding on to Nvidia stock after $175 is risky as it has a higher chances of heading south due to profit bookings.

The global quantitative trading firm Susquehanna Group has predicted that Nvidia could reach $175 next. However, dangers loom in December as the market generally cools down during the Christmas season. Trades turn dim during the holiday season and buying activity decreases. The sell-off and profit bookings mixed with the Christmas season could pull the stock’s price down.

Also Read: Jim Cramer Urges Investors to ‘Buy The Dip’ as Apple (APPL) Slides

Nonetheless, any dip in Nvidia stock is an opportunity to accumulate more. The GPU manufacturers have more upside in the Trump economy and could replicate its previous success again. The long-term prospects look solid and buying the dips is encouraged.