- Smart DEX traders back to accumulating Pepe.

- Pepe’s breakout as global in/out of the money suggested most holders were profitable.

Pepe [PEPE] has been one of the memecoins to watch as the altseason comes closer.

An analysis of the DEX positions for Pepe illustrated fluctuating buy/sell volumes over time, but focuses on a recent spike in buying activity among Smart DEX traders.

They significantly increased their holdings, marked by green bars in early November. In fact this aligns with a surge in the average buying price, suggesting bullish sentiment.

The behavior led to a 48% price increase in the past 7 days as per CoinMarketCap.

Simultaneously, the PEPE/WETH price action identified a downtrend since May but has since broken out of a symmetrical triangle after the recent volume and price spikes.

This surge indicated renewed trader interest, possibly inspired by the accumulation seen on the DEX analysis chart.

The synchronized activity on both charts suggested Smart DEX Traders have strategically accumulated PEPE, anticipating an upward movement.

Such dynamics could set the stage for PEPE to test new highs, given the substantial recent buying and potential for continued demand among informed traders.

Volume weighted average price signals clear breakout

Pepe exhibited a clear bullish breakout through the anchored Volume Weighted Average Price (VWAP) from the ATHs, indicating a significant resistance level that held since May has been breached.

This development suggested an uptrend with the price recently crossing into more bullish territory.

The consistent resistance at the VWAP and the subsequent breakout signified strong buying interest and could lead to sustained upward momentum.

PEPE’s breakthrough of a historically tough resistance level boosts confidence that dips might offer buying opportunities, signaling optimistic market sentiment.

Investors who focus on precise entries now could be strategically positioned for gains, possibly between 3 to 5 times current prices.

This potential for growth appears stronger if the momentum sustains, suggesting a favorable trend in the near term.

Pepe’s global in/out of money

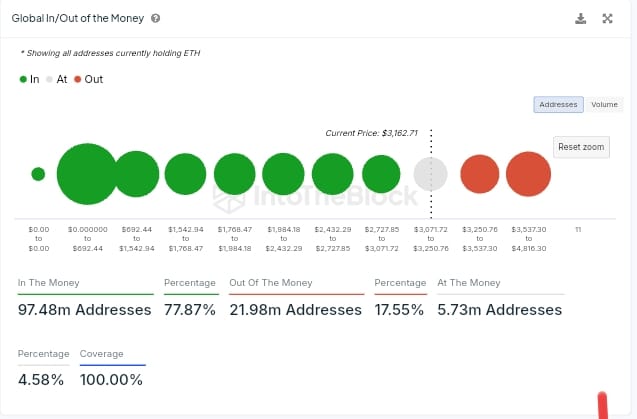

Analysis of the “Global In/Out of the Money” for Pepe provided a powerful perspective on price movements.

At the current price point, a majority of holders—approximately 77.87% or 97.48 million addresses—are ‘in the money,’ meaning their holdings are worth more than the price at which they bought Pepe.

This scenario indicated the floor for PEPE if similar sentiment and distribution patterns hold.

Only 17.55%, or 21.98 million addresses, are ‘out of the money,’ suggesting less potential selling pressure from those who might be waiting to break even or cut losses.

There are 5.73 million ‘at the money’ addresses, a relatively low count, indicating few addresses are near profitability. If PEPE shows similar traits, the high percentage of ‘in the money’ holders could suggest a bullish outlook.

Realistic or not, here’s PEPE market cap in BTC’s terms

This scenario could indicate PEPE might continue experiencing rising prices, driven by optimistic sentiment among profitable holders.

This level of profitability among holders discourages immediate selling and supports price stability as confidence remains high.