- PEPE’s near-term trajectory will depend heavily on its ability to hold the $0.000018-$0.00002 support zone

- The memecoin’s derivates data highlighted mixed sentiment with a slight edge for bulls

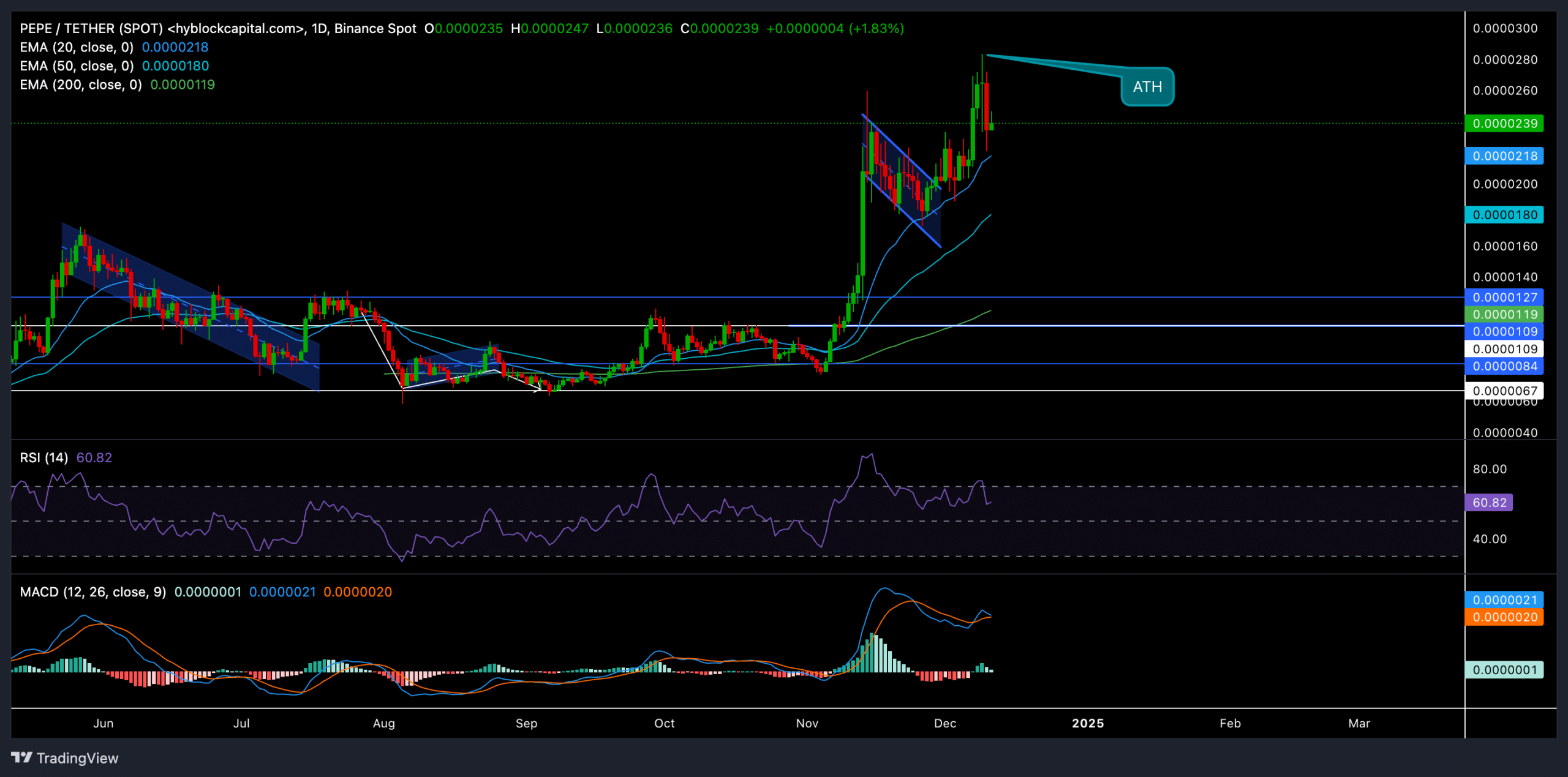

PEPE recently saw an exponential rally of over 250%, hitting a new all-time high (ATH) of $0.0000284 on 9 December. This explosive growth coincided with the broader memecoin supercycle and Bitcoin’s sustained bullish sentiment on the charts.

At press time, PEPE was trading at $0.0000239, with its 20-day EMA providing strong support to the recent correction. A consistent rebound from this level could propel the price into a price discovery phase, potentially finding a newer ATH.

Critical levels to keep an eye on

Since its ATH, PEPE has oscillated between $0.000018 and $0.0000247, signaling more market indecision.

The key levels to watch out for are –

Support: The $0.000018-$0.00002 range, aligned with the 20-day EMA, is a critical support zone for buyers. A dip below this range could invalidate the prevailing bullish trend, exposing the token to downside risks towards $0.000015.

Resistance: A decisive close above the $0.000025 resistance could set the stage for buyers to push towards the $0.0000284 ATH. Breaching this level could open doors to an extended uptrend towards $0.00003.

Technical indicators suggested cautious optimism. The RSI, at press time, was hovering near 61 – A sign of moderate bullish momentum. While it seemed to be far from overbought territory, the possibility of a consolidation phase near these press time levels cannot be ruled out.

The MACD was also yet to see a full bearish crossover, hinting at potential near-term pressure on sellers. However, traders should wait for the Signal line to stabilize before predicting a trend reversal.

Derivatives data revealed THIS

Here, it’s worth noting that the trading volume dropped by around 48.93% over the past day, signaling reduced market activity after the most-recent rally.

Open Interest showed a slight 0.38% uptick, indicating cautious trader participation. The overall long/short ratio was slightly below 1 to depict a rather neutral trend. However, the ratio on OKX confirmed a strong bullish edge as it was well above 3.

The 24-hour liquidations amounted to $8.74M in total, with $6.07M in long liquidations and $2.68M in shorts. The larger long liquidations suggested that the recent price correction caught over-leveraged long traders off-guard.

Bitcoin’s continued bullish momentum could further catalyze a sustained rally for the memecoin. However, traders should remain cautious because PEPE’s high volatility could lead to sharp reversals.