- PEPE could soar by 40% to hit the $0.0000133-level if it closes a daily candle above $0.00000974

- PEPE’s Open Interest skyrocketed by 40%, indicating traders’ strong confidence in the memecoin

Following the U.S Presidential Election’s results, the wider cryptocurrency market has registered a notable rally, attracting billions worth of capital in the process. Amid this positive outlook, a crypto whale known for expertise in profiting from memecoins made a huge bet on PEPE.

Whale adds $5 million of PEPE

On 6 November 2024, the whale transaction tracker TheDataNerd revealed that the whale wallet address “0x51C” deposited a significant 5.5 million USDT to Binance to acquire 535.81 billion PEPE worth $5.07 million.

Transaction trackers also noted that before acquiring PEPE, this whale had already made profitable investments in BRETT and TURBO memecoins. In fact, the whale reportedly earned profits of $708k and $952k too, respectively.

In addition to this notable acquisition, PEPE’s large transaction volume jumped by 32.36%. This significant surge in volume can be seen as a sign of participation from whales and investors.

Examining the current scenario and growing interest from whales, PEPE may present a promising opportunity to add to the holdings.

PEPE technical analysis and key levels

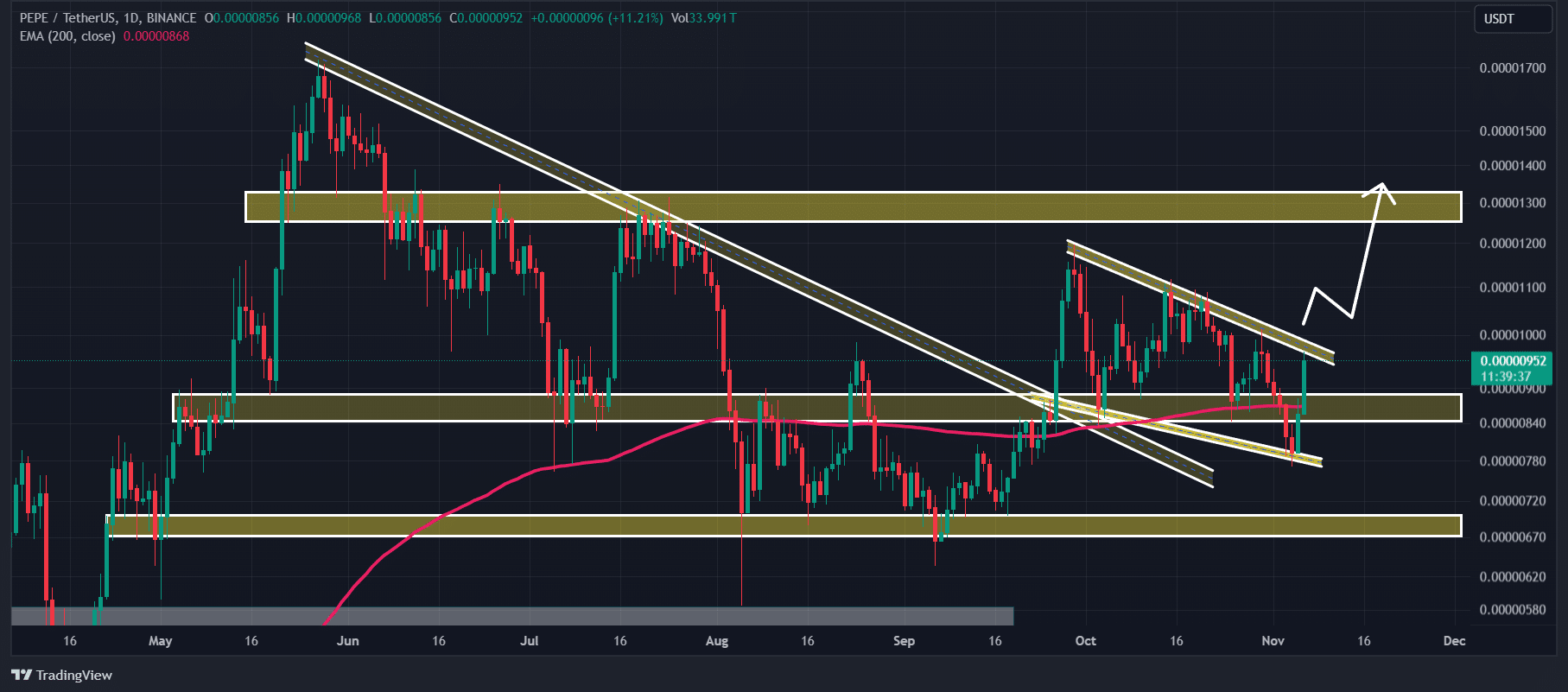

According to AMBCrypto’s technical analysis, PEPE appeared bullish and seemed poised for a notable upside rally. At press time, it had formed a bullish falling wedge price action pattern and seemed to be on the verge of breaking out.

If PEPE’s price soars and closes a daily candle above the $0.00000974-level, there is a strong possibility it could soar by 40% to hit the $0.0000133-level in the coming days.

At the time of writing, the memecoin was trading above the 200 Exponential Moving Average (EMA) on the daily timeframe – Indicating an uptrend.

Bullish on-chain metrics

Besides this technical analysis, on-chain metrics further supported PEPE’s positive outlook.

At the time of writing, the strong liquidation levels were at $0.00000905 on the lower side and the $0.00000979 level on the upper side. Traders seemed to be over-leveraged at these levels, according to the on-chain analytics firm Coinglass.

Additionally, PEPE’s Open Interest skyrocketed by 40%. Taken together with the uptrends in on-chain data, the formation of new positions indicated strong confidence in the memecoin’s fortunes.