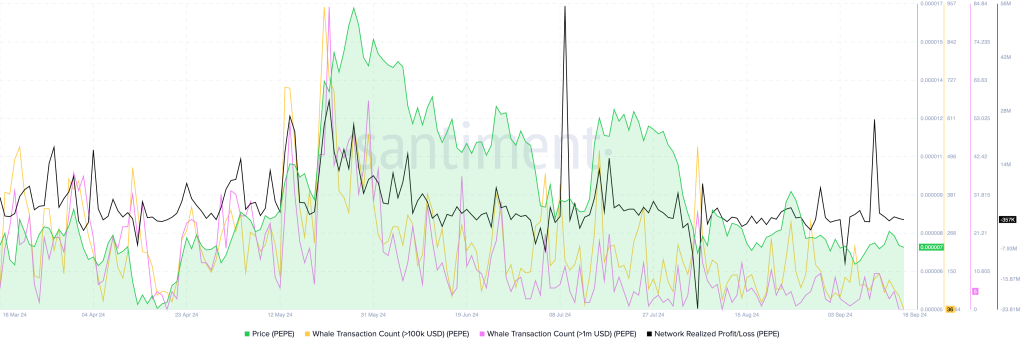

It appears that frog-themed Pepe (PEPE), the third largest meme coin is poised for a price crash following massive profit booking by whales in recent days. According to the crypto intelligence firm Santiment, PEPE whales and traders have realized significant profits of over $30 million in the last six days.

PEPE’s Bearish On-chain Metrics

In cryptocurrency or any market, profit booking is considered a bearish sign and can potentially lead to a price drop in an asset. Aside from profit booking, another potential reason for the upcoming price crash is the lack of interest from traders and investors. According to the data, Whale transaction values from $100,000 or higher have dropped significantly by 70%, from 129 transactions to 36 transactions in the past six days.

Combining this data suggests that investors and whales are losing interest in the frog-themed meme-coin, which may lead to a price drop in the coming days.

Current Price Momentum

At press time, PEPE is trading near $0.0000071 and has experienced a price decline of over 6% in the last 24 hours. During the same period, its trading volume increased by 65%, indicating higher participation from traders.

PEPE Technical Analysis and Upcoming Levels

According to expert technical analysis, PEPE appears bearish as it is trading below the 200 Exponential Moving Average (EMA) on a daily time frame. The 200 EMA is a technical indicator used by traders and investors to determine whether an asset is in an uptrend or downtrend.

On the other hand, PEPE has formed a bearish head and shoulder price action pattern on the daily timeframe, indicating a potential price decline in the coming days. If PEPE closes a daily candle below the $0.00000644 level, there is a high possibility it could fall by 20% to the $0.0000051 level in the coming days.

However, this bearish thesis will only hold if PEPE closes the daily candle below the $0.00000644 level, otherwise, it may fail.