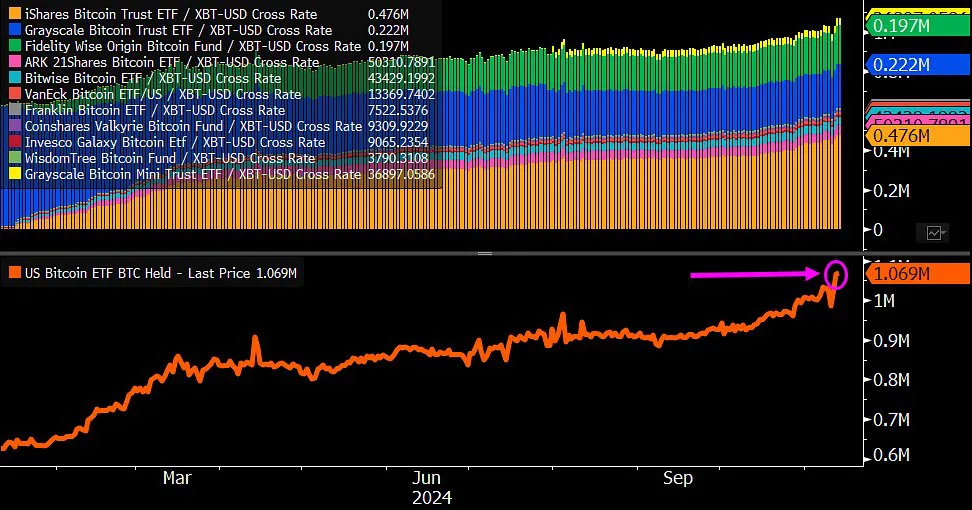

Veteran trader Peter Brandt has noted that Bitcoin recently broke out of a triangle pattern, highlighting a bullish prospect with a target above $97,000.

Despite experiencing a notable price dip below the $68,500 mark, Bitcoin’s broader bullish structure, which has been forming since September, remains intact. In a recent analysis, Brandt identified potential targets for Bitcoin as the market progresses.

For context, between March and September 2024, Bitcoin’s price chart revealed an inverted triangle pattern characterized by converging trendlines of lower highs and higher lows. This often indicates consolidation before a breakout.

Bitcoin Breaks Out

Remarkably, a market chart shared by Brandt shows that Bitcoin recently broke out of this triangle pattern precisely last week when Bitcoin surpassed $73,500. This move above the upper trendline resistance suggests a significant bullish shift.

Following this breakout, Bitcoin signals a potential upward trend, with a target price of $97,056, according to Brandt. However, the seasoned analyst emphasized that specific criteria must be met to validate a breakout.

@Crypto_TownHall

Current Bitcoin Chart pic.twitter.com/afuohAWbVF— Peter Brandt (@PeterLBrandt) November 1, 2024

Criteria for Confirming Breakouts

Brandt has pointed out that not all breaches of trendlines qualify as genuine breakouts. According to his analysis, price action must satisfy defined conditions. Specifically, on the daily chart, Bitcoin’s price must close above $76,000 to confirm the breakout above the March high.

Brandt noted that this confirmation should occur at midnight on Sunday to validate the move. However, on Sunday, November 3, Bitcoin did not achieve a daily close above $76,000, as required to confirm the breakout above the March high. Instead, Bitcoin’s price experienced a slight decline, closing at $68,741 after it had dipped to $67,482.

Meanwhile, Brandt noted that diagonal patterns with slanted boundary lines can be tricky to trade, as slight touches to the boundary lines do not automatically constitute breakouts. While Bitcoin’s recent breakout is promising, Brandt observed that additional effort is required to maintain bullish momentum.

Brandt Bitcoin Price Targets from Previous Analyses

In his previous market assessments, Brandt outlined three distinct price targets for Bitcoin based on various analytical approaches. He first noted a target of $94,000, stemming from an inverted expanding triangle pattern analyzed on a semi-logarithmic scale.

Initially perceived as bearish, this pattern has shifted to present a bullish outlook. The $94,000 projection is derived by measuring the triangle’s height and applying it from the breakout level. If Bitcoin holds above $70,000, this price could serve as a new support zone.

The second, more ambitious target is $230,000. This was calculated by projecting price movements from the low in November 2022 to the high in March 2024 and then applying that range starting from August 2024.

Although this outlook is considered more aspirational, Brandt highlighted that focusing on one target at a time is best. His third target is $160,000, based on the recurring cycle symmetry in Bitcoin’s historical market patterns.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.