In a notable development for the artificial intelligence (AI) and decentralized finance (DeFi) industries, prominent tech entities SingularityDAO, Cogito Finance, and SelfKey recently announced their decision to merge and form a unified body called ‘Singularity Finance’.

Through this union, the companies aim to devise a layer 2 (L2) solution that can tokenize the burgeoning AI economy as well as facilitate the growth of the real-world asset (RWA) market. Furthermore, the merger brings together the unique strengths of each company, i.e. SingularityDAO’s expertise in decentralized portfolio management, Cogito Finance’s proficiency in bringing tokenized traditional assets on-chain, and SelfKey’s blockchain-based identity system.

With conservative projections indicating that the AI sector could reach a valuation of $407 billion by 2027 — while the RWA sector could achieve a valuation of $4 trillion by 2030 — Singularity Finance is poised to capitalize on this growing demand and potentially have a major impact on the future of digital finance.

Exploring a new, tokenization-driven frontier

Singularity Finance’s approach to tokenizing the AI economy is innovative and comprehensive. It covers three distinct layers of operations: hardware, software, and applications.

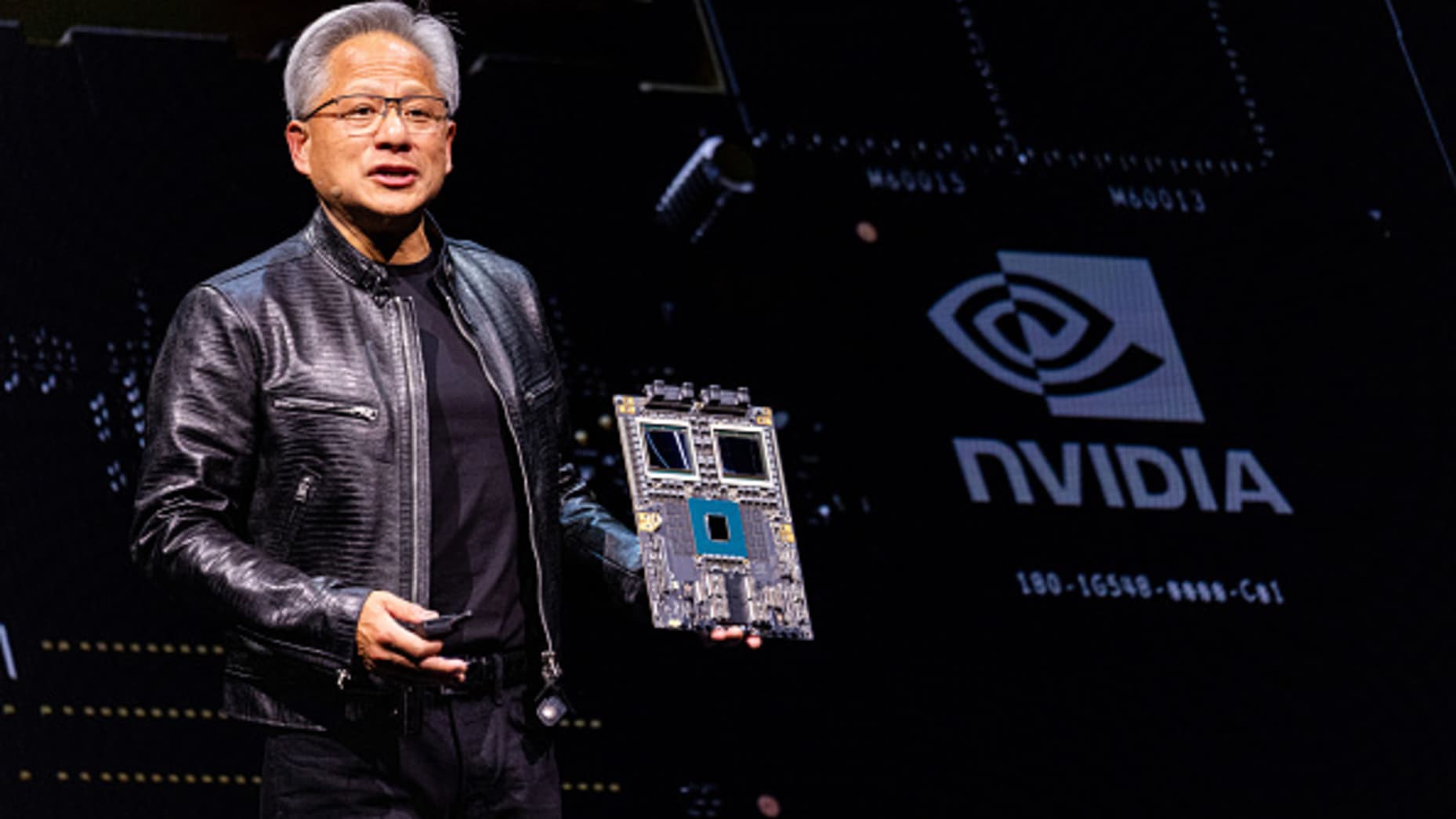

To elaborate, the hardware layer focuses on tokenizing essential components such as semiconductors, GPUs, and data centers, while the software layer addresses the tokenization of elements like data, foundational models, and cloud computing services. In contrast, the application layer explores the tokenization of AI-driven products and services across various industries.

However, before proceeding any further, it would be best to describe what the tokenization process entails. In brief, it is the act of creating a digital representation of real-world assets (RWAs) on the blockchain. This involves issuing tokens that can represent various types of investments — such as real estate, art, or financial instruments — allowing for fractional ownership and easier trading.

The most exciting prospect of Singularity Finance’s ecosystem is the tokenization of GPUs, significantly since the global demand for these gadgets is projected to reach $2 trillion. In essence, data center operators will now be able to tokenize their GPUs, allowing them to raise capital for expansion while providing token holders with a share of the revenue generated from renting out these powerful computing resources to AI software companies.

Lastly, this tokenization framework supports a wide variety of assets across the AI value chain. This includes plans to launch XFUND, a fund focused on investing in publicly traded stocks of tech giants fundamental to the AI stack, providing investors with broad exposure to the burgeoning AI economy.

Building a robust foundation for ‘AI-Fi’

Singularity Finance’s ambitions seem pertinent beyond tokenization alone, with the company looking to create a comprehensive ecosystem that supports the growth and development of ‘AI-Fi.’ In this regard, the platform will feature several native applications designed to address critical challenges in the space and provide value to users.

One such application is the project’s latest multi-strategy vaults, based on SingularityDAO’s existing ‘DynaVaults’ system. These vaults leverage AI and machine learning (ML) to manage risks and optimize portfolios across a spectrum of tokenized assets and strategies.

Similarly, features like an ‘AI-powered risk engine,’ ‘automated execution engine,’ and ‘liquidity management tools’ also ensure that these vaults offer a significant advancement in the management of tokenized real-world assets as compared to existing systems. Lastly, the ecosystem’s AI-driven ‘market-making’ solution uses advanced algorithms to automatically adjust liquidity pools, addressing the challenge of limited or fragmented liquidity often faced by emerging DeFi protocols.

By providing consistent liquidity and tighter spreads, Singularity Finance aims to create a more efficient and equitable marketplace for all of its participants.

A look at the platform’s governance and token utility

Another crucial aspect of the merger is the conversion of each platform’s existing token — i.e., SDAO, CGV, and KEY — and converting them into a singular asset called ‘SFI.’ This offering serves as the governance token for the Singularity Finance platform, allowing holders to vote on important decisions such as protocol upgrades and implementation of strategic initiatives. The token can also be used to pay tokenization fees, provide liquidity, and access premium features.

Furthermore, the Singularity Finance team (led by Dr. Ben Goertzel, Cloris Chen, and Mario Casiraghi) has already outlined an ambitious roadmap for the next two years, with key milestones including the launch of the SFI token, the rollout of the L2 mainnet, and the introduction of various AI-driven financial products and services.

Therefore, as the project evolves and grows, it aims to extend its AI, RWA and identity solutions to additional regulated territories, helping blur the boundaries between AI and DeFi. Not only that, the synergy of these seemingly disparate domains stands to potentially unlock trillions of dollars in tokenized assets — leading to the transformation of today’s global financial systems.

The post Pioneering The Tokenization Of The AI Economy With Singularity Finance appeared first on Zycrypt.