PNUT price has dropped more than 20% in the last 24 hours, following its recent surge after being listed on major exchanges, where it reached $2.28. This sharp decline highlights weakening momentum, as indicators like ADX and RSI suggest that the uptrend is fading.

Despite this, PNUT still has the potential for a strong recovery if buyers return. However, if bearish pressure continues, PNUT could face a significant correction, testing key support levels and potentially losing more ground.

PNUT Current Uptrend Is Fading Away

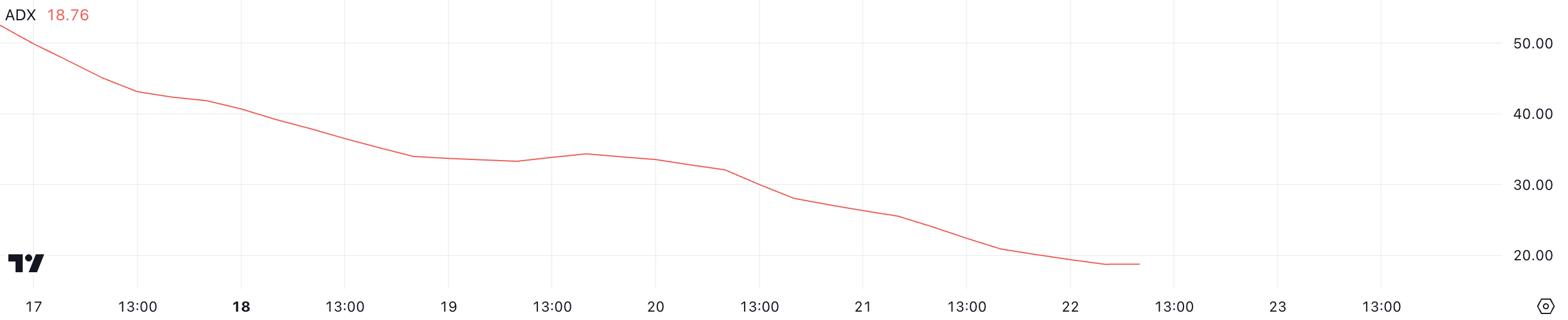

PNUT currently has an ADX of 18.76, significantly down from above 50 just a few days ago. This consistent decline in ADX indicates that the strength of PNUT’s uptrend has been steadily weakening.

Despite still being in an uptrend, the sharp drop in price over the last 24 hours highlights the growing vulnerability of maintaining upward momentum. The ADX suggests a potential reversal could be on the horizon.

The ADX measures the strength of a trend, with values above 25 indicating a strong trend and below 20 indicating a weak or nonexistent trend.

PNUT’s ADX dropping below 20 reflects a weakening trend, even though the current directional movement still leans bullish. If this trend strength continues to deteriorate, PNUT may struggle to sustain its uptrend. That would leave PNUT price vulnerable to a more significant reversal in the near term.

PNUT Is Almost Reaching The Oversold Zone

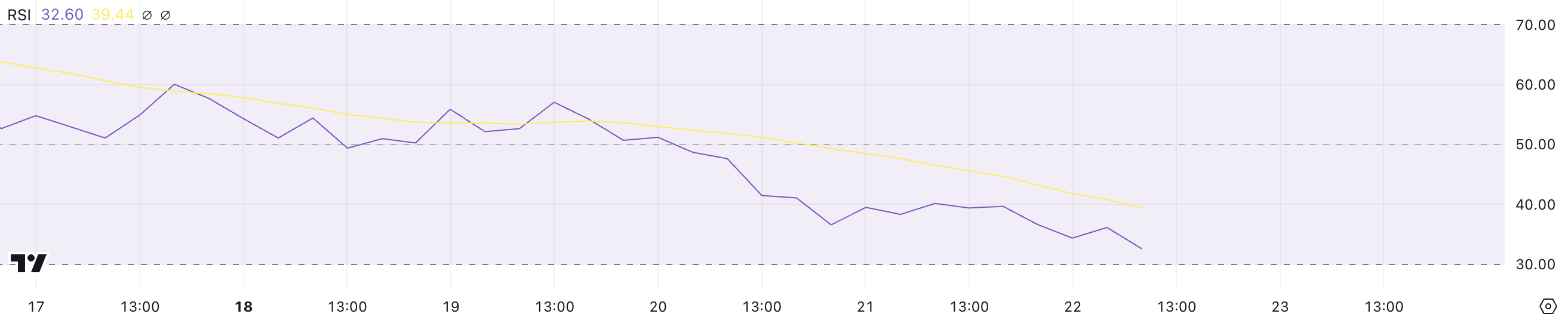

PNUT currently has an RSI of 32.6, marking its lowest level since being listed on Binance.

The Relative Strength Index (RSI) measures the speed and magnitude of price movements, with values above 70 indicating overbought conditions and below 30 signaling oversold levels.

The consistent decline in PNUT’s RSI over the past few days highlights weakening momentum, with the asset now approaching oversold levels.

If the RSI falls below 30, it could signal that PNUT is significantly undervalued in the short term. However, continued bearish sentiment could keep the price under pressure, delaying any recovery.

PNUT Price Prediction: A 72% Correction Ahead?

If PNUT price experiences a reversal and a strong downtrend emerges, it could test the support at $0.749. Should this level fail to hold, the price may drop further to $0.41 and even $0.32, marking a significant potential correction of up to 72%. This would make PNUT be surpassed by other meme coins such as MOG, GOAT, and MEW in terms of market cap.

Such a scenario would indicate increased bearish pressure, with traders potentially continuing to exit positions after the surges following the listing on major exchanges.

On the other hand, if PNUT uptrend regains strength, the price could rise to test the resistances at $1.87 and $2.21.

Breaking through these levels could allow PNUT to retest its previous all-time high of $2.50. That would offer a potential 111% upside and establish PNUT as a top 10 meme coin in the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.