- Polygon – POL – is bleeding with price now at the RSI oversold level of 30.

- Despite the gloom, the protocol has maintained its innovation, suggesting a potential rally ahead.

The price of POL (formerly MATIC), the native digital asset of the Polygon network, recently dropped to new historical lows. This movement comes despite growth in its Total Value Locked (TVL). This mixed sentiment has raised questions about the right time to invest in POL.

Analyzing POL’s Current Trend

During Monday’s trading session, POL’s price dropped to as low as $0.285, the lowest recorded value since the token’s existence. POL’s new historic lows come when most of the top cryptocurrencies strive to reclaim prior highs or establish new ones. At the moment, the token is down 1.09% in the past week to $0.3289, aided by the ongoing rally in the market.

The Relative Strength Index (RSI) indicated that POL’s new record low reached the oversold line below 30. This means POL could see a rebound in its price soon. However, investors should look for metrics besides price performance to determine POL’s next action.

POL’s continuous downside suggests it is one of the least attractive cryptocurrencies this year, which explains the lack of demand. Still, a closer examination of the Polygon ecosystem performance may provide some promise for POL holders.

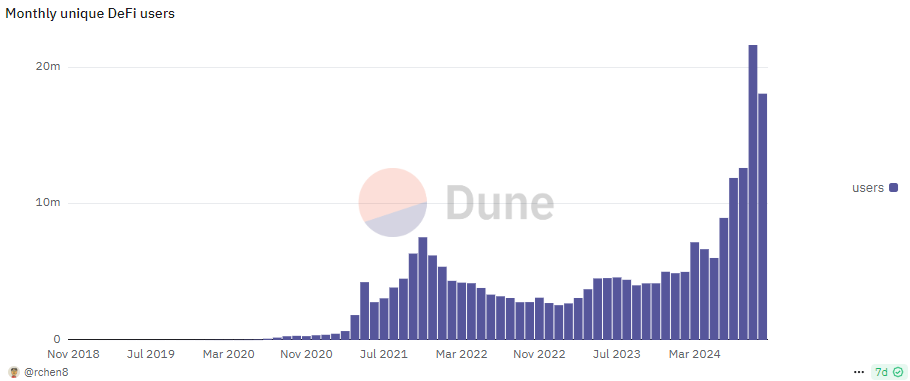

While POL has mostly traded in the red in the last few weeks, the Polygon network grew in other areas. For instance, Polygon’s TVL achieved a net positive growth from $772.4 million in November 2023 to $1.237 billion 12 months later. This suggests the network’s readiness for Decentralized Finance (DeFi) usage. Polygon’s stablecoin market cap also increased from $1.17 billion to $2.08 billion within the same period.

Meanwhile, the number of transactions recorded on the blockchain dropped sharply this year. The number of transactions dropped from over 17 million TXS in November 2023 to 3 million in November 2024. Nonetheless, the November 2023 surge is an isolated event that does not necessarily affect price.

Transaction data has remained steady since then, suggesting network activity is likely not connected to POL demand and price action. This finding is supported by the fact that Polygon did not have negative address growth. On November 4, 2024, the network had just over 379 million unique addresses. The figure has since risen to 470.9 million POL.

Polygon Ecosystem Developments

Polygon is a layer-2 solution for Ethereum, meaning it helps ETH process transactions faster and at lower costs. Polygon’s unique characteristics make it appealing to blockchain users. The blockchain is known for solving one of Ethereum’s biggest problems: high transaction fees. With its strong use case, Polygon is a solid option for long-term investors.

Recently, Polygon has introduced several advancements driving adoption and innovation, making it a key player in the blockchain space. Recently, Polygon integrated ERC-7683 across its core platforms, including Polygon PoS, zkEVM, and the AggLayer. As CNF reported, this integration helps to simplify cross-chain asset transfers and boosts interoperability.

Polygon is also flourishing in the gaming industry. In a CNF article, Ronin, a popular blockchain gaming platform, revealed its intention to develop its ZK-powered Layer 2 solution using Polygon’s CDK.

Furthermore, Polygon continues to expand utility through Real-World Asset (RWA) tokenization. Polygon’s recent improvements and price pattern present one of the greatest chances for investors to buy the token. An analyst claims a rally to the top might result in at least a 400% gain.